The American Dream no longer involves owning a home: Record number of young living at home and rents increase while income falls.

- 0 Comments

Inflation is an insidious money grabber. When incomes are stagnant or falling, any tiny amount of inflation is tantamount to a wage a cut. The largest expense for Americans is housing payments. This can be in the form of rent paid to a landlord or mortgages paid to a bank. Either way, money is getting funneled out for shelter. While incomes have been stagnant, rents have been soaring and the number of households renting has surged thanks to banks crowding out regular families in the single family home market. Wall Street has been chasing yield and thanks to generous bailout policies, the American public is subsidizing this low rate environment on the backs of this debt fueled low wage recovery. Many Americans are now sour to the notion of owning a home. How many young adults lost their homes or saw their parents struggle to make the monthly mortgage payment? The mindless banter of “housing never goes down†is now lost on this current generation. What is interesting is that home values have gone up, rents have gone up, but the overall homeownership rate has fallen in line with incomes. And of course, rents are being jacked up while incomes flutter.

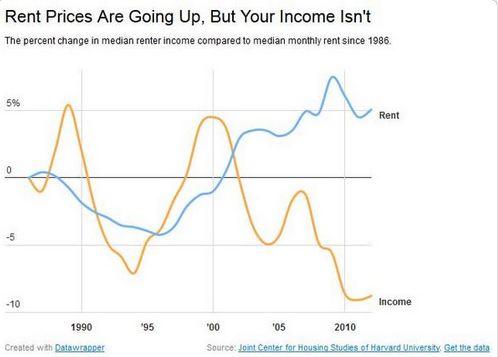

Rent vs income

With millions of additional Americans now becoming renters, more money is now being siphoned off each month into the coffers of large property holders in Wall Street and hedge funds. And of course, rents are being pushed up because even with low interest rates, cash strapped Americans are unable to purchase homes. Half of this country is one paycheck away from being broke. Let that sink into your head.

So take a look at this troubling trend:

Rents are up and income is down. All this means is more money is being allocated to housing. Not exactly a good thing for an economy driven by consumption. It also doesn’t come as a surprise that there is a boom in subprime auto loans since car sellers have ran out of qualified buyers and are now going after those with low incomes and substandard credit. I’m sure that’ll turn out just fine.

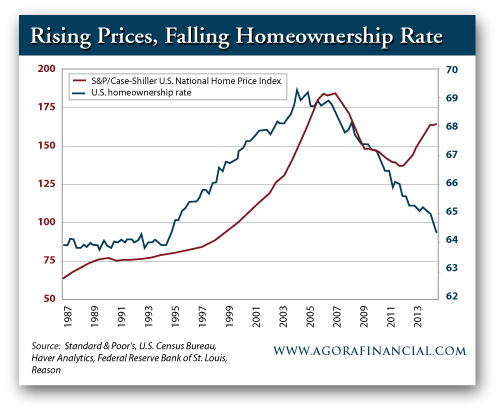

Home prices are up but this is largely due to Wall Street jumping into the market, banks rewriting accounting rules, and basically Americans having less money once inflation has eroded their paycheck. The trend is clear:

Since 1987 home prices tracked the homeownership rate. As the rate started to fall with the bust you also saw the rate trend lower. But then in 2009 to 2010 as big money jumped in you will notice prices surged up yet the rate of homeownership continued lower. This broke with the long-term trend. Why? Because big banks were buying up blocks of properties instead of regular American families. One corporation can buy hundreds of properties.

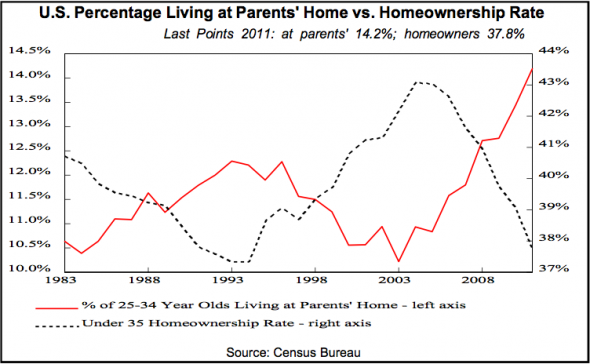

Your typical jump in homeownership comes from young families buying. As you may know, many young Americans are deep in college debt and already carry a mini-mortgage. In fact, so many are too broke to even afford a rental and are living at home:

All this means is that when the time comes, this will add more pressure to rents. Also, many large investors are going to find out when the next recession hits that there is only so much rent you can squeeze out of someone with no income. They have bought at a time of artificial supply and accounting chicanery. There is no faking a lost income due to the economy contracting or wages being eroded by inflation.

A recent How Housing Matter Survey found that 43 percent of Americans no longer feel housing is a good long-term investment. Compare this to nearly 100 percent before the housing bubble popped and you realize that many Americans now have a new idea of what amounts to the American Dream.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â