Stock Market Dollar Store: U.S. Dollar Down 12.5 Percent and S&P 500 Up 50 Percent since March. How the U.S. Treasury and Federal Reserve Juice the Stock Market.

- 4 Comment

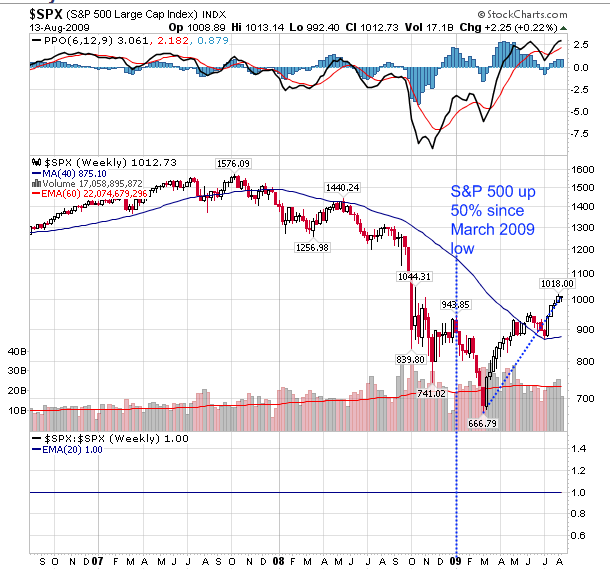

Americans have missed one serious correction since the manic stock market took off in March. Since that time the value of the U.S. dollar, the bedrock of our economic system has fallen a stunning 12.5 percent. Currencies should not fluctuate this much especially the world’s reserve currency. Back in December, I talked about how the U.S. Treasury and Federal Reserve were determined to destroy the dollar for the sake of bailing out our massive debt. The plan in the short run has created a stunning stock market rally that has set the S&P 500 on fire to a 50 percent rally. In a recession this profound, you don’t typically turn things around in two years (the recession started officially in December of 2007). Yet this appears to be more of a bear market rally since the unemployment picture will remain bleak for months to come.

It is interesting how little coverage the tanking dollar is receiving. Maybe people are just happy that their stocks are running back up even though P/E ratios are extremely expensive. Yet the correlation between the dollar going under and stocks rallying is undeniable:

Now you might ask, why at the peak of the panic did the U.S. dollar reach a 3-year high? You have to remember that for almost a year, the notion of decoupling was making the rounds across investment communities. This idea was based on the premise that the U.S. was going to have a silo like decline while nations around the world somehow prospered with the biggest economy going under. This had as much merit as believing subprime loans would be a contained issue. So in late 2008, the idea was put to rest and people started rushing to safety especially with the implosion of banks like Lehman Brothers and the virtual nationalization of Fannie Mae and Freddie Mac. In March, investors had enough and the U.S. dollar still reigned supreme as a safe haven.

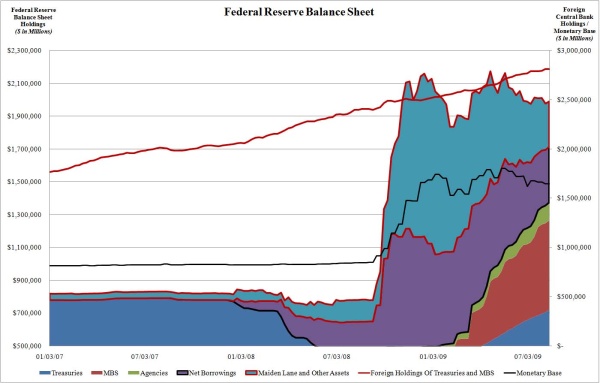

Since that time, the U.S. Treasury and Federal Reserve have done everything possible to crush the dollar rally including committing to buy $1.25 trillion in various forms of debt much of it in the form of mortgages and going with quantitative easing. What happened after this?

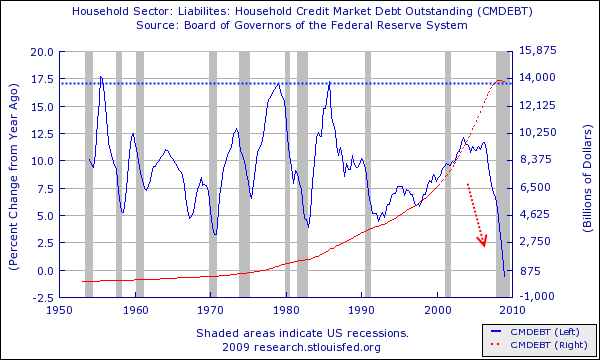

The stock market took off while the U.S. dollar continued a steady decline. And of course this would only be logical because why would foreigners want to purchase debt that is inherently following a policy of inflation by its issuer? U.S. items have become cheaper on a global stage. For those setting this policy, it makes a lot of sense because they are trying to inject inflation and slowly grow ourselves out of trillions in debt. U.S. households are still mired in massive amounts of debt:

Now one thing is certain and that is American households are cutting back on debt. Much of this is happening because of a forced austerity but many are simply choosing to spend less by choice. And given that most of our borrowing comes from foreigners who hold enormous amounts of our debt, a declining dollar makes the amount we have to pay back that much cheaper. Now rightfully so, foreigners really do not like this kind of arrangement so the U.S. Treasury and Federal Reserve have to walk this trillion dollar debt tightrope. Their solution? Juice the stock market and make saving your money as unattractive as possible for domestic consumers. Cash for clunkers. Massive tax rebates for buying homes. All these are steroids for consumption and over consumption ironically is what led us into this financial crisis.

So should you worry? You may be thinking that it would be great if you can simply inflate all your debts away. That is assuming that the U.S. Treasury and Federal Reserve actually succeed in their objective. Keep in mind, never in the history of our country has the Fed loaded up their books with so much questionable debt:

Source:Â Zero Hedge

This is unprecedented but the gist of all this is that we can somehow engineer ourselves out of this mess with targeted inflation. Given the size of the housing and credit bubble it is hard to see how this is even possible. The average American household is not able to balance this out given the number of rising bankruptcies and record high foreclosures.

The more troubling sign is how our currency is being sacrificed for easy finance for the banking industry. Many banks are now staying solvent even with bad loans on their books because they are now able to raise money in the open casino (stock market) by suspending belief with massaged mark to surreal accounting methods.

The S&P 500 is not up because of earnings. It is up because of the systematic destruction of the U.S. dollar and massive subsidies to failed banking institutions. We still have major issues including $3 trillion in commercial real estate yet this rally has the wind blowing on its back. Yet this is a stock bubble engineered by the juice of the U.S. Treasury and Federal Reserve. Those who use steroids usually have it catch up on them.

4 Comments on this post

Trackbacks

-

Mark Tomlinson said:

Good article.

August 14th, 2009 at 10:47 am -

Wendall Dennis said:

Greetings. I enjoyed the article. I, a seventy five years old retired carpenter; having lived in the real world of trading my time for my living for about sixty of those years, I didn’t need the graphs. First A question, then a commentary.

If the United States is a “Christian” nation, as is widely claimed, why was the quicksand of debt chosen as the foundation of its government? Per Luke 6: verses 48/49, the foundation is the most critical component of any structure: Quote:

Chapter 6 verse 48: He is like a man building a house, who dug and went deep, and laid a foundation on the rock. When a flood arose, the stream broke against that house, and could not shake it, because it was founded on the rock.

Chapter 6 verse 49: Â But, like a man who built a house on the earth without a foundation, against which the stream broke, and immediately it fell, and the ruin of that house was great.” The Answer To The Question Is: They Didn’t !

Though this debt based system was considered and rejected at the close of the Revolution, one failed attempt followed another, until, with the passage of the Federal Reserve legislation in 1913, the bankers succeeded in altering the original foundation.

At that time, Great Britain’s royal system was instituted, with the goal of, over time, securing title to all wealth, whether individually or collectively owned. Income, occupation, and business taxes, in conjunction with debt based “money,†has since, either confiscated, or encumbered our wealth, as it is created.

To our detriment, the harder and more efficiently we work, the more expeditiously the plan progresses. We are literally forging the shackles with which we are bound; the current bailout completes the process.

While our “leaders†are visualizing the restructure of irredeemable debt, I am realistically acknowledging an unsustainable world created by sacrificing our future, on the alter of manufactured reality, institutionalized debt, and calculatingly induced, mass stupidity. Sprawling suburbs, composed of houses so large that the occupants can no longer afford to either heat or cool them, (even if they could pay for them) and located at a distance precluding the expense of a daily commute.

An increasing number of people are finally acknowledging the Federal Reserve to be the most lavish and successful Ponzie scam the world has ever seen.

While screaming for its abolishment, apparently few, if any, appear cognizant of the fact that our manufacturing industry, our wealth producer, has been totally supplanted by the law & currency manipulation industry, wealth consumer, extraordinaire.

“If You Don’t Work You Don’t Eat,” Â This, the pronouncement of Captain John Smith, in 1607 saved the Jamestown Colony from starvation. Four hundred years ago, virtually all work existed at the productive level, thus, specifics were unneeded. Not so today: although productive is assumed, the facts are, work now exists in three categories: productive, non-productive & counter productive.

The New York City, and the Washington DC, law and currency manipulation “work” force as well, are of the counter productive variety! Self preservation is the “Feds” sole mission; the obligation, and sole purpose of the Law & Currency Manipulation workforce, is feeding its ravenous apatite!An industry numbering in the multi-millions of employees, indeed skyscrapers crammed with computers and people, all dedicated to keeping the records of what is increasingly being recognized as a centuries old, now world wide criminal empire. An empire encompassing every phase of criminality known to man, from extortion to murder, (war) while masquerading as lawful government!

While the foundations of the skyscrapers housing the human and technological machinery is grounded on bedrock, the foundation of the structure upon which our very lives are dependent, is “grounded†on the quicksand of lies, mystery, obfuscation, coercion, and death & suffering beyond measure.

Most everything produced by either, is relatively detrimental to my well being, and that of multi-millions of other Americans.  A point in fact, if either of these “work forces†vanished tomorrow, the nation as a whole, would benefit from their absence.

Thanks to the success of their “work†at destroying our domestic industry, our wages are stagnant, or non existent; our youth have not been instructed in productive work, nor even its necessity, and we are now totally dependent upon the under compensated labor of millions of foreign citizenry, for our very survival.

The worth of the Federal Reserve Note has steadily declined since the 1960‘s. Since the beginning of the 21st century, that decline has accelerated markedly, the inflation created by the proposed bailout, totally destroys the remaining perception of its value. This predicament launches a real crisis.

Accepted data reveals the average journey of every meal enjoyed by the residents of, or visitors to NYC, and many other eastern cities, including DC, to be 1500 miles. When the dethroned US dollar, no longer trades for oil, and either the lack of, or cost of fuel idles the trucks now transporting the food in, and the waste out, neither NYC, DC nor the many other currently “bustling†cities, are going to be very pleasant places to either live or visit.

Our profit based criminal justice “system;†government imposed insurance and taxation “enterprises,†and a “financial†(read loan) industry composed of six hundred trillion dollars of debt derivatives, or, is that depravities, constitute a very small example of “businesses,†supporting an army of well paid lawyers, all devoted to the servicing of the “Fed.â€

Justice cost money, how much can you afford,“ personifies our mercantile legal system. This monopolistic replacement for our system of common law, is comprised of a nest of lawyers, (government “ordained†priest of the system) with the duty of both writing and interpreting the “law,†thus, symbiotically preying on those citizens requiring rescue, from their manufactured “need.â€

As supported by history, extending into the mist of antiquity: At the point that a governments survival has evolved to the plunder stage, the cost of acquisition, soon exceeds the value it returns; the government/nation dies in bankruptcy.

Thank you for your work, and thoughts.

Wendall Dennis

August 15th, 2009 at 10:12 am -

Greg said:

It is fantastic to see someone understand what is really going on behind the scenes.

Enlightning and interesting read. Thanks!

August 22nd, 2009 at 2:47 am -

Yohanan said:

So, it now takes two dollars to equal one dollar, but since you have more dollars you just feel good inside. And, the stock market is up only because it reflects the fact that it takes twice as many dollars to equal one; meaning the “real-purchasing-value” of today’s dollar is worth about half of last year’s dollar, WOW!. And, the “proof” is in the value of gold’s rise, check it out.

January 3rd, 2010 at 8:55 am