Why Budget Deficits Matter: Government at a $1.26 Trillion Budget Deficit for the 2009 Fiscal Year. Three Times as Large as Last Year and we still have Two More Months of Data.

- 3 Comment

The notion that deficits do not matter is a widely held and deeply ingrained economic philosophy. This line of thought took a stronghold in the 1980s and has seemed to stick to our ever-growing dismay. Yet budget deficits do matter if we are looking at an economic horizon that is longer than one fiscal year. You need to put this into context of your own household. If you as an average American spend more than you make, it will eventually catch up to you. In a more distant past, the American consumer did not have access to debt as they do now. So they in effect had the ability to run localized deficits. Americans took this notion of spending more than you earn to heart. Many bought homes, cars, entertainment systems, and other consumer goods that simply did not jive with their income. This can last for a few years but eventually it will catch up. Now we are seeing the housing bubble burst and bankruptcies soaring.

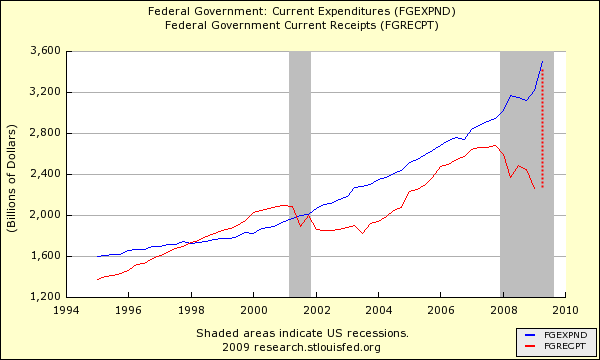

Now I want to bring this to a more micro level because similar rules apply to larger systems. Many Americans have had their access to credit cutoff. The U.S. Government for many years has been relying on cheap money fuel from foreigners to keep our deficit engines going. This will only work if we can eventually get the revenue side of the equation up. Otherwise, foreigners will do what many credit card companies are doing to consumers and that is pulling away that easy debt. It probably helps to see the actual cash flow sheet of the United States:

This chart is so important because it strikes at the root of our current dilemma in that we are spending more than we are bringing in. So what would this ratio look like if we apply it to an easier example? Let us use a simple example to understand this ratio. This is like the $50,000 American household spending $80,000 a year. How long can that go forward? Sure you can have the artifacts of wealth like a leased Lexus and a new McMansion giving the appearance of wealth but once the access to credit runs out, it is a sudden freefall. People quickly realize who owns the underlying asset when they are unable to make the debt payment.

For Q2 of 2009 the government spent on a seasonally adjusted annual rate $3.5 trillion. In Q1 of 2009 (the latest point on the chart) the government brought in $2.2 trillion in tax revenues. We have never run such deep deficits so we are in uncharted territory here.

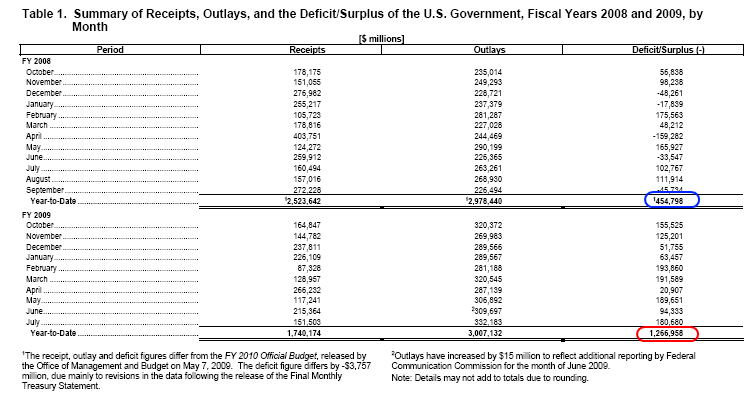

It will help to look at the monthly data since we still have two more months left for this historic fiscal year:

For the 2008 fiscal year, we ran a $454 billion budget deficit. That is deep but nothing compared to our current deficit. This fiscal year we are running a $1.26 trillion budget deficit and we still have two more months of data. Keep in mind the recent improvement in GDP is largely due to massive amounts of government spending, bailouts, and taxpayer subsidies. The so-called recovery didn’t occur naturally. Now we all understand that the government has been spending to support the economy. Yet one factor that is being largely ignored is the revenue side of the equation. The 2008 fiscal year saw $2.5 trillion in tax receipts and this year we have seen only $1.74 trillion. Depending on the next two months, we are looking at a $600 to $700 billion short fall in income from last year. Keep in mind that 2008 was already a battered year so this is significant.

Moreover, this is not something that only applies to tough times like this extraordinarily painful recession. In Q1 of 2007, our highest tax revenue quarter we brought in $2.66 trillion on a seasonally adjusted annual basis.  Even during this supposedly good quarter, we managed to spend $2.88 trillion on a seasonally adjusted annual rate. This stems from the pervasive mentality that deficits simply do not matter. If they do not matter during good times or bad times then we have to conclude that the entire policy is based on believing that deficit spending is okay under any circumstance. This has been going on for 30 years.

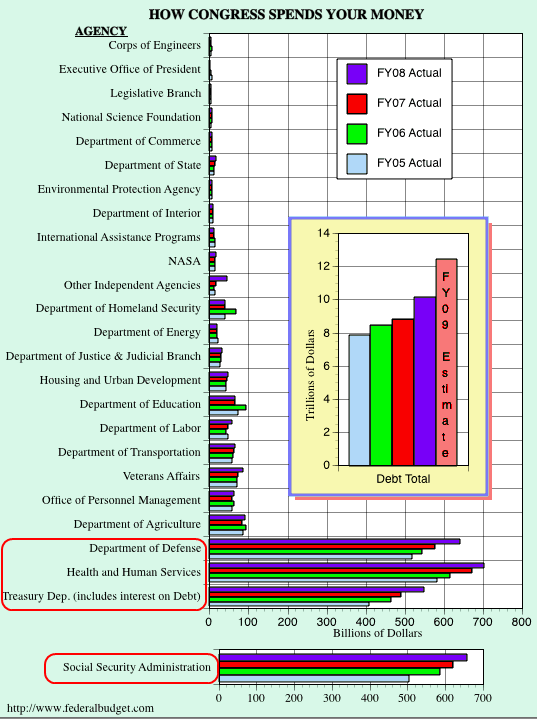

The U.S. Treasury and Federal Reserve are spending as if nothing has changed during this recession. Let us look at where all the money is going:

For all the talk about certain agencies, there are four major expenses here:

(1)Â Department of Defense

(2)Â Health and Human Services

(3)Â Treasury Department

(4)Â Social Security

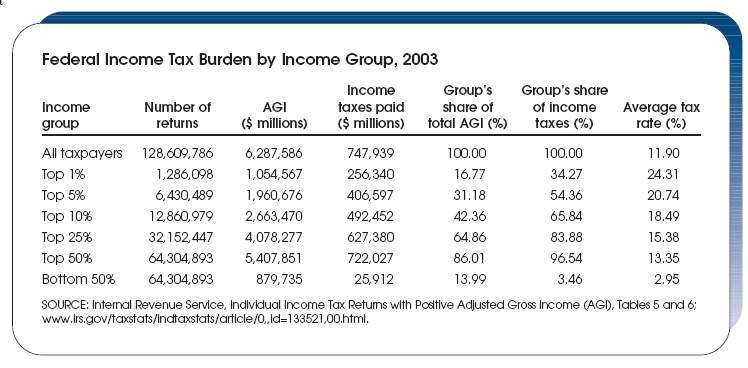

And the cost for each is increasing. The only one we seem to be talking about is healthcare but the dialogue is being sidetracked. The other three seem to be off limits or a third rail of politics. Yet anyone looking at this chart realizes this is unsustainable unless one thing happens. Revenues increase. How can we increase revenues? There are a couple of ways. The economy improves and incomes pick up naturally or we raise taxes. Yet that may not help. Let us look at the tax structure:

Source:Â Federal Reserve, St. Louis

The top 10 percent of taxpayers already pay 54 percent of income taxes. Drop down to the top 25, and you have 83 percent of all taxes. This is a question that we need to seriously explore. In terms of the economy improving, most are hoping that it does improve with job losses abating and growth occurring. That has not been happening. The economy will improve when it finds an equilibrium. The root of our problem dealt with spending more than we earned. Yet here we are offering people money to purchase cars. Why give tax rebates for people to purchase homes subsidizing their purchase on the backs of non-homeowners? I think many can understand spending money on modernizing roads or building new schools but rebates for cars? Yet increasing taxes is something that probably will occur and with such massive deficits, this is something that will be on the table. The question is, will this help the overall economy?

The U.S. Treasury and the Federal Reserve are going to realize in the next few years that deficits do matter. Publicly our officials keep saying that they do care about deficits and the world seems okay with this for now. Yet the massive bet here is that the income side of the equation will improve. But, what if it doesn’t?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Expat said:

“The top 10 percent of taxpayers already pay 54 percent of income taxes. Drop down to the top 25, and you have 83 percent of all taxes. This is a question that we need to seriously explore.”

Yes, let’s explore that. Income distribution has hit record “unfairness” levels in America, the kind usually seen in tin-pot Third World dictatorships the US so loves propping up. The middle class is being eviscerated. And the poor, well, they are still poor.

If the top 25% of income earners are paying 83% of taxes it is because they are earning at least that much of the wealth, if not more. I am a wealthy, retired trader but I am sickened by seeing hedge fund billionaires paying 20% tax while taking home literally billions in pay.

The US is not a socialist country, though there are many socialist programs in place which even rich, right-wing Americans would not touch (think CIA, FBI, DHS, Military, ATC, police, fire departments, border patrol, etc.). They simply decide they don’t like things which they don’t use like social security, Medicare, public schools, and public health services.

But if the American ideal is to have 10% of the population controlling 95% of the wealth, then the rich better buy guns and armed guards because most Americans don’t want this. As ignorant, stupid, xenophobic, and greedy as Americans may be, they also have a certain sense of fairness and equality.

Your insinuations are distasteful to me, but I suppose you are rich and don’t give a f%$*

August 17th, 2009 at 10:00 am -

Webe Scrude said:

we’re scrued, blued and tatooed. ended as a republic. crashing as an out of control, rogue dictatorship bent on endless war mongering and killing.

August 17th, 2009 at 2:15 pm -

Lost-in-North-Dakota said:

I have no argument with the table presented, that the top 10% of earners pay over 50% of the income taxes. However, it only tells part of the story. Middle-income people pay tons of federal taxes, via “payroll” taxes. A more complete story would be told if the table presented all FEDERAL taxes paid, not just the income tax. The people who are taxed most heavily are the middle class to upper-middle class self-employed. They pay a lot in income taxes, and payroll type taxes.

August 20th, 2009 at 4:03 am