The Anti-Savings Model – Offer 0.1% APY on Savings Accounts and Charge 15% on Credit Cards. A System Designed to Punish Savers and Encourage Extravagant Spending via Usury.

- 8 Comment

U.S. Banks have a solid incentive, dipped in gold, to keep people in a perpetual state of paying rent on debt while not saving a shiny penny. In fact, their ideal state of financial equilibrium for Americans would be one in which people spent every single penny from their earnings reaching the end of the month like a pauper showing snake eyes in their savings account. This unfortunate banking structure has also been fostered by decades of government banking welfare for an entrenched corporatacracy. Now it is no responsibility of the government or banks on how people choose to manage (or mismanage) their money but when taxpayer money is used to subsidize the banking structure it is important to setup a system that is both fair and beneficial to the overall economy. That should be a minimum requirement. Today’s current system is designed to penalize savings and creates perverse incentives.

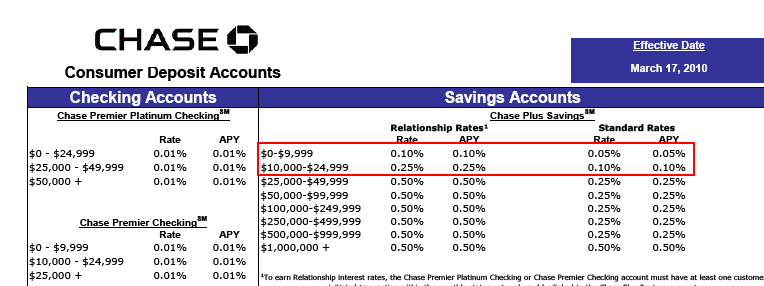

Let us first look at how absurd current savings rates are:

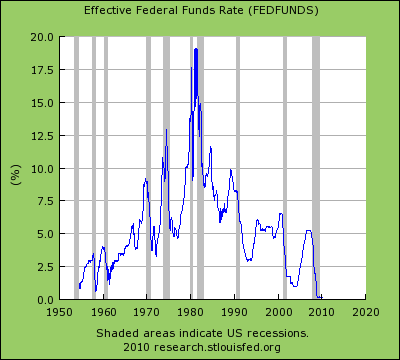

This rate is so low, that if you had $10,000 in a Chase standard savings account, after one year you would earn a whopping $10 or enough to buy two Big Macs or one movie ticket. What incentive is there to put your money in a bank account? They used to say people enjoyed watching their money grow but at this rate you’ll have better luck watching your lawn grow. Much of this low rate environment has been created by the Federal Reserve pushing the Fed funds rate to zero:

What incentive is there for saving any money for the typical family in the U.S.? And interest rates do make a big difference. Take for example the rule of 72. This is a quick rule where you divide a stated interest rate to see how long it will take to double your initial money. This actually highlights how important it is to get a solid rate:

72/15 = 4.8 years at 15% to double

72/10 = 7.2 years at 10% to double

72/5 = 14.4 years at 5% to double

72/.1 = 720 years to double

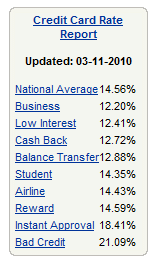

Right now, most of the too big to fail banks are offering that .1% annual interest rate. At the same time, they are charging astronomical rates on credit cards and other loans making up a margin that would embarrass even your local loan shark:

The current national average interest rate for credit cards is 14.56 percent yet they are offering clients who want to save 0.1% or even lower on their savings account. In business lingo this is what you call the margin and it is gigantic. This is why the banking system is fundamentally flawed. They borrow taxpayer money for cheap, take client money for cheap, and lend it out at usury rates. Not only does it encourage massive consumption but it creates a large part of our economy that is simply dedicated to paying rent above and beyond the face value of the product.  And many people only pay that minimum interest rate. As we have seen above, only paying the minimum with a 15% interest rate will double the cost of the item in 4.8 years. That flat screen TV no longer costs just $1,000 but $2,000 over many years and high amounts of interest.

And the problem with savings at least in our current banking model is that these same banks are also the biggest credit card pushers:

U.S. general purpose credit card market share in 2008 based on outstandings

(Note: 2007 ranking in parentheses)

1. JPMorgan Chase – 21.22% (17.74%)

2. Bank of America – 19.25% (19.36%)

3. Citi – 12.35% (13.03%)

4. American Express – 10.19% (11.40%)

5. Capital One – 6.95% (6.95%)

6. Discover – 5.75% (5.65%)

7. Wells Fargo – 4.21% (3.07%)

8. HSBC – 3.47% (3.65%)

9. U.S. Bank – 2.14% (1.84%)

10. USAA Savings – 2.02% (2.01%)Source: Creditcards.com

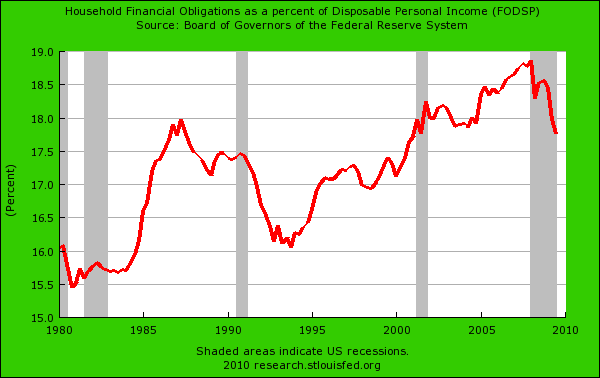

There is no incentive to offer a competitive savings account from the banks perspective because they can milk their clients on interest and other fees. What other choice do people have? At the same time, any bad loans that go sour will be bailed out by the taxpayers. This is the most incestuous and corrupt banking system in the history of the U.S. What real use is being provided? We need banks but not operating under this structure. Banks right now are operating like feudal lords smacking their peasants around for their interest payments. Ironically a part of GDP comes from this servicing of debt:

So let us set aside saving anything for the moment, many Americans are only having enough to service the current debt they have. And if they try to save, they get rates that are equivalent to stuffing money into the mattress. The only option that even comes close to competing with credit card rates is the stock market but that is one giant casino.

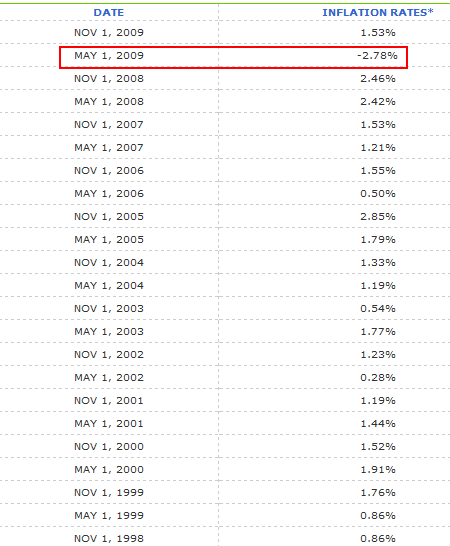

Or take a look at I-Bonds from the U.S. Treasury. These seemed to be a safe place but not so:

Since I-Bonds started, they were meant to pay savers a guaranteed amount bi-annually based on current inflation rates. The bond would never go below zero percent even in a moment of deflation. Now, no one ever expected this to hit when it started in 1998 but we hit that in May of 2009 when we did experience deflation. So for six months, I-Bond holders were receiving 0.00%. These are the ways the system punish savers even who are looking for “safe†5 percent returns.

There is a reason why banks are making billions of dollars even in this economy with record unemployment. They are the new landlords of the nation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

8 Comments on this post

Trackbacks

-

Missing Point said:

I think you are missing the point.

In a deflationary environment keeping your principal is great. When you are earning 6% or 15% in a bank account that means inflation is going strong and your likely just staying even.

If we continue to see deflation banks may start charging for us to use there services instead of offering it for free and paying us interest. Japanese banks have been charging for years because of there deflationary problems.

March 17th, 2010 at 10:03 pm -

3rd_worlder said:

You forgot to mention discount stock brokers. Fidelity, for example offers 4 1/2% interest for just parking money, plus any investment imaginable under the sun. Others that offer similar services are Scott Trade, E-Trade, Ameritrade, just to name a few.

March 18th, 2010 at 2:58 am -

mmmmm said:

even with such great profits for the banks why are the share prices like 80 percent down but up 60 percebt from the bottom…, note a 60 percent growth that is not being counted as overheated enough to raise interest rates, note that investing with government has lost purchace power for many, many years admidst their mandate to balance the value of the dollar…………..no change in sight in this manipulations..

March 18th, 2010 at 8:37 am -

TobyBo said:

Some I-Bond holders could have made a return after the “deflation” rate was combined with the base rate.There were I-Bonds issued with a positive 3.60% base rate that would “overpower” the negative 2.78% deflation rate-woot!

America will not default on external debt but will default on internal debt like social security and savings bonds.Obama is dancing on the deck of the pirate ship in his ballet slippers while around him pirate mayhem continues.

March 18th, 2010 at 4:38 pm -

TobyBo said:

The deflation rate is semiannual while the base rate is annual so my math was wrong.The average guy is a zero to the elites so why not make that figure exact to two decimal places.

March 18th, 2010 at 5:18 pm -

maguro said:

MyBudget,

Preserving wealth is one thing, but the bigger problem is avoiding a return to feudalism. That’s what the economic royalists want, and who can blame them? If the masses can’t stand up for themselves, don’t they deserve what they get?

3rd World,

How safe is money at a broker?

MissingPoint,

Here in Japan, I haven’t heard of anyone paying to put money in the bank. It’s certainly the case that you get nothing on your money, but people would just keep their money as cash if they had to pay to put it in the bank. Large sums of cash are still fairly normal here.

You are also ignoring the spread. If deflation is so strong, why have the banks been charging rates that were considered criminal in the Western world until recently?

March 18th, 2010 at 7:10 pm -

money_market said:

3rd_worlder, the Fidelity Money Market fund current 7 day yield is 0.01%. A few years ago you could have gotten 4.5%, but not now.

March 19th, 2010 at 8:25 pm -

Bleep said:

Rational investors (and there still are a few) will refuse to pay 22% interest. Over time, the rates the big banks can demand will drop. The banks are currently charging these rates to alter their balance sheets and return to a low risk environment.

March 20th, 2010 at 6:37 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!