The stalling of the California housing market – California Foreclosure Prevention Act has institutionalized a drawn out foreclosure process. 470,000 MLS listed and distressed homes in the state. California construction industry employing the same number of workers as it did in the early 1990s.

- 1 Comment

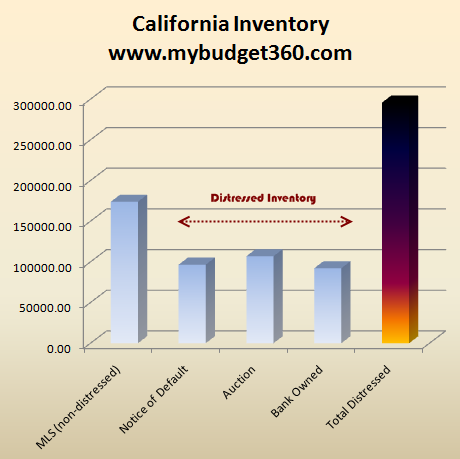

The state of California continues to grapple with the collapse of the enormous housing bubble. The Governor earlier in the week called for a special emergency session to deal with a $6 billion deficit that emerged just weeks after the state budget was signed and the ink dried. States with a large dependence on the housing market are suffering with larger issues since much of their economy was reliant on the volatile housing market. This came in the form of construction employment, property taxes, jobs in the finance industry, and home spending typically through home loans. In California, 470,000 homes are potential for sale properties with MLS inventory, homes with notice of defaults, those scheduled for auction, and properties that are bank owned. The public can only view and can only put in a bid on roughly 170,000 homes but the large amount of problem housing will keep the state budget in limbo for years to come unfortunately. To understand the California housing market, the biggest and most expensive in some areas, we need to first see the total potential inventory.

Below is data gathered as of November 12, 2010:

Source:Â MLS, foreclosure records

This is a good way of measuring the health of the overall housing market. If we take notice of defaults (NODs), these are homes with at least three months of non-payment and many more in some cases. Yet this was extended out by 90 days thanks to the California Foreclosure Prevention Act (CFPA):

“(CA.gov) The CFPA extends the foreclosure process by 90 days unless a lender or mortgage loan servicer obtains an exemption from the 90 day stay. The lender or mortgage loan servicer applies for the exemption with a state department. If the lender or mortgage servicer demonstrates to the state department that it has a comprehensive loan modification program offered to borrowers, and designed to keep them in their homes, the lender or mortgage loan servicer is exempt from the 90 day delay of foreclosure. The law is designed to encourage more loan modifications that keep borrowers in their homes.â€

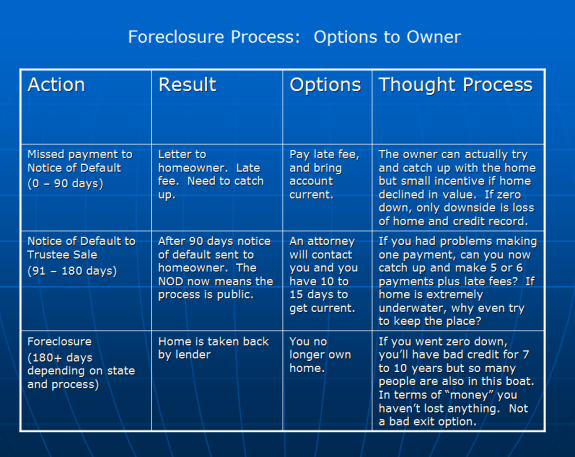

The above was signed into law in February of 2009 and has done very little except formalized the ever lengthening foreclosure process. So the nearly 100,000 current NODs in California are likely to have many months of non-payment and are likely to end up as foreclosures in a few months. Next we have roughly 106,000 homes scheduled for auction. These are deeper in the foreclosure process. To give you a sense, this is how the typical foreclosure process looks like:

Keep in mind the above chart is assuming a typical process but the current market is anything but. We have loan modifications, the foreclosure process being drawn out by legislation, and banks simply ignoring non-payments. The bottom line is that California has an enormous backlog of homes and foreclosures sell for much less than non-distressed property. This will be the albatross on price appreciation for years to come. 35 percent of last month’s home sales in California were foreclosure re-sales.

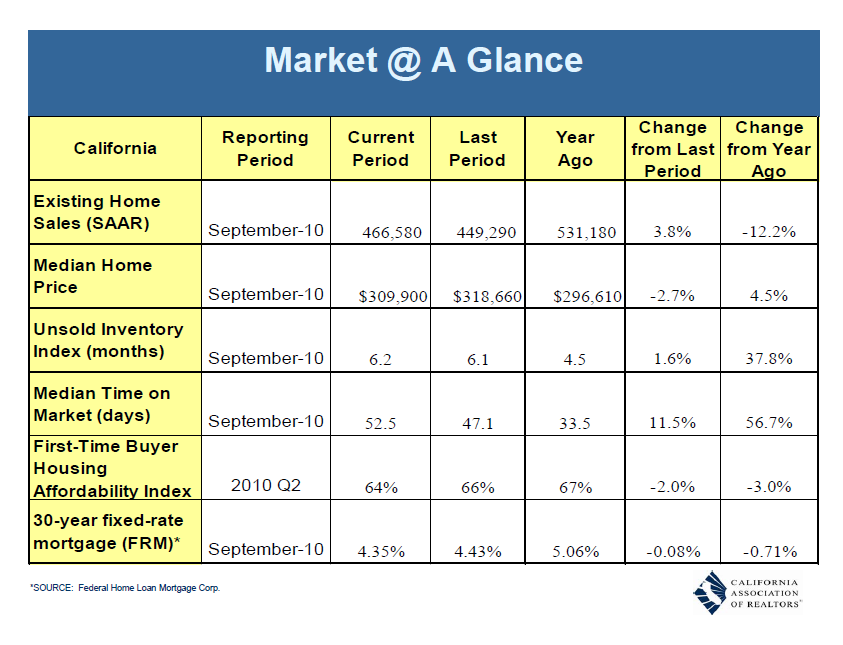

Let us look at the current California data according to the California Association of Realtors:

Now some will say that if California has roughly 470,000 homes through the MLS and distressed shadow homes, then the state has roughly one year of inventory. However, the above doesn’t account for home that come online each month. It also doesn’t factor in that homes are going into foreclosure as we speak adding more future inventory. The short-term trend however shows home sales dropping and the median price moving lower. You’ll also notice that the time on the market has increased from 33 days on the market to 52 days showing that buyers are more reluctant to buy even though mortgage rates are lower.

The above data misses the shorter term changes since it uses seasonal figures but the market right now is anything but seasonal. The numbers are distorted by the federal home buyer tax credit but also a state initiated tax credit. Those are gone now. Last month 33,176 homes sold in the state. Keep in mind the CAR data shows 6 months of inventory but only looks at MLS data. If we look at MLS and distressed data the market has roughly 14 months of inventory with the bulk being made up of by distressed properties.

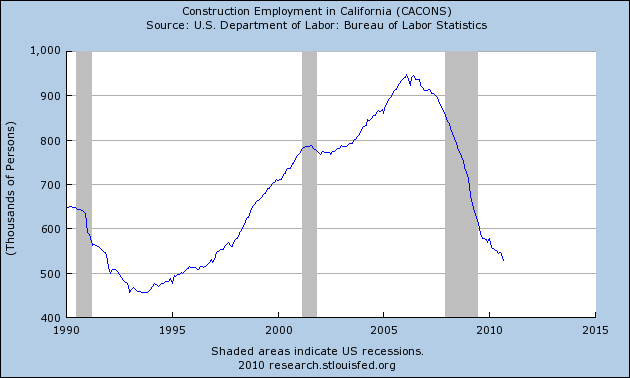

It is an interesting trend but California depends heavily on housing. If we look at the construction industry in the state it is in shambles:

Certainly no recovery here. The construction industry is now employing as many people as it did in the early 1990s yet the state population has grown by millions since that time. These are potential home buyers here so where will the demand come from to soak up the remaining excess inventory? Hard to say but until that time prices will continue to move lower to work with the current state economy. Many states including Nevada are facing similar challenges.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Don said:

It looks like all those predictions made years ago of California falling into the ocean finally happened. Just not the way we expected.

November 13th, 2010 at 6:42 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!