U.S. home prices will resume price decline after year of banking and government intermission. Multiple signs point to another year of slow home price growth and U.S. home values over priced by 20 percent.

- 5 Comment

Home sales follow very seasonal patterns. Yet much of this natural mechanism was stunted by banks delaying foreclosures and the government artificially stimulating home sales. Now that much of the stimulus has been exhausted, it is clear that home prices are correcting once again. It is hard for many to imagine that home prices can go lower especially after a vicious correction. Yet we have become conditioned to the notion of expensive home values by years of targeted propaganda. Home prices in many regions like California are still inflated even after significant price corrections. The upcoming decade will prove to be a weak one for home prices yet economists are once again making absurd long-term predictions regarding prices.

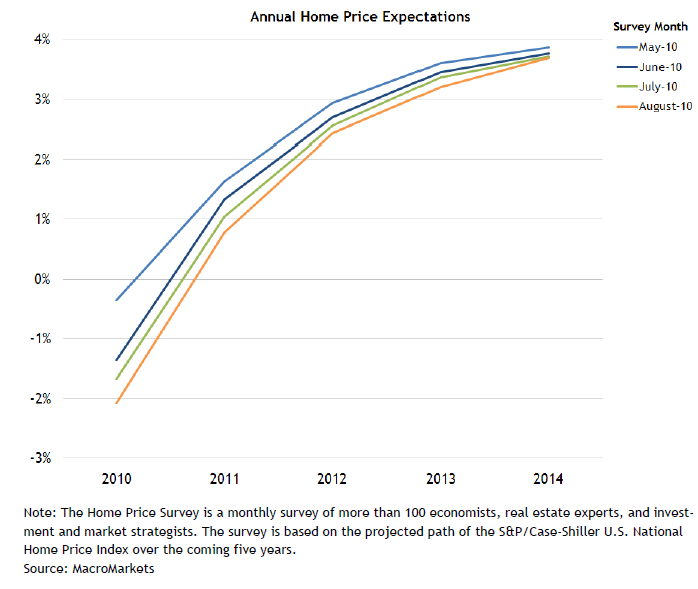

Take a look at a recent survey of 100 economists:

Just look at how the survey has shifted over each month of data. In the earliest survey in May, most expected no housing price declines for the year. Of course, we now know that homes will most definitely end the year with price declines. For 2011 the economists expect prices to increase and it steadily paces upwards deep into 2014. Why should we even believe a group that could not see the housing bubble coming? We are to believe that this group has an idea of the actual appreciation rate for housing in 2014? You might as well call the psychic hotline and ask her about this. Even over a four-month period, economists couldn’t get this year correct!

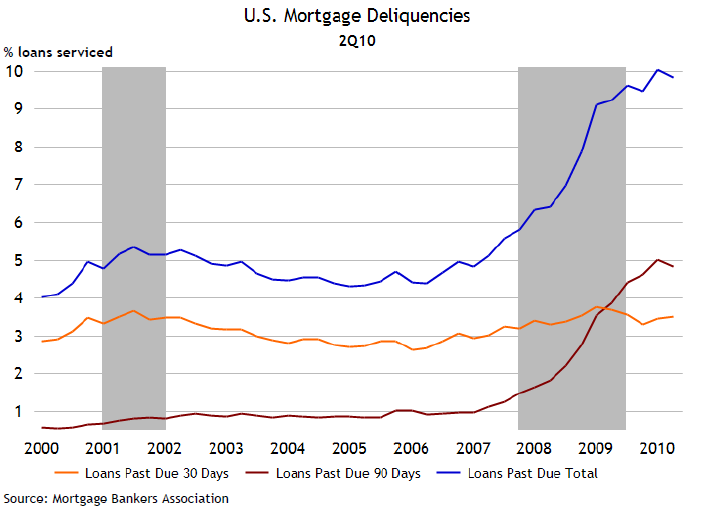

Yet if we look carefully at the data, it is clear that we are in for a long haul with housing. First and foremost, the middle class has been dismantled from every angle. Incomes have remained stagnant for well over a decade and artifacts of middle class living like healthcare and college seem to get more and more expensive by the day. What does this mean? More money is consumed by other items besides housing with a smaller amount of disposable income. Housing is still a necessity but it is easily substituted in the market. If you can’t buy, you can rent. So prices need to fall to meet the ability of what Americans can pay. Sure banks wish they could get top dollar for foreclosed homes but that isn’t what the market can sustain. Just look at the number of troubled mortgages in the U.S.:

None of us (short of those who lived through the Great Depression) have seen something like the above. Each past due mortgage is a story of the deep recession. A job that has been downsized, an illness that has eaten up a larger portion of savings, or simply the inability to continue paying on a toxic mortgage are all stories playing out each and every day. The above chart shows that we are still near the peak and with the employment market still weak, why are we to expect any sudden change in the trend? The secret to the recovery isn’t so shocking and once we start adding a sizeable amount of private sector jobs (300,000+ per month) then we can issue predictions of home prices rising. Until then, it is merely parlor game speculation to say home prices will go up in 2014.

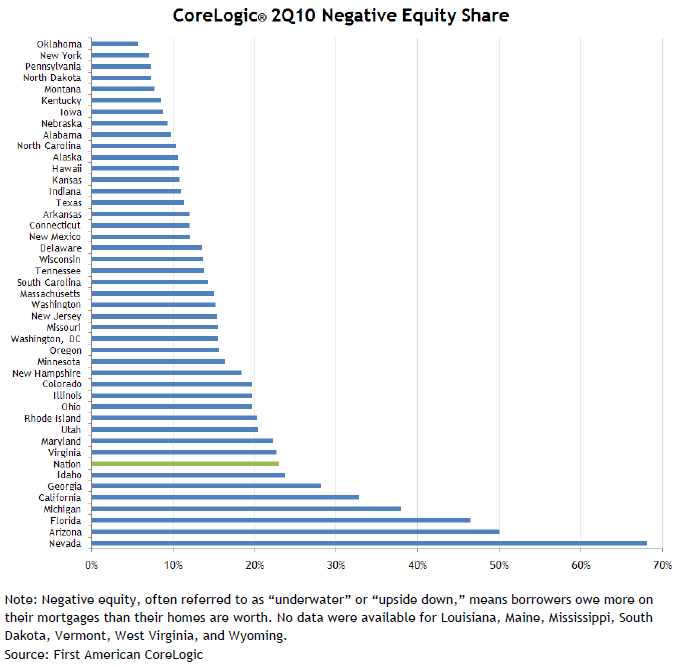

Why else do we expect home prices to fall in the upcoming year? We already know that negative equity is the number one reason in predicting foreclosure. And the amount of negative equity mortgages is still incredible:

Places like Nevada have nearly 70 percent of all mortgage holders underwater! Arizona is up to 50 percent and 1 out of 3 mortgage holders in California owes more than their home is worth. In other words, they have a giant incentive to strategically default. Many in these states have no intention of allocating 70 to 80 percent of their income to some toxic mortgage on a property that is worth half the peak value. The amount of shadow inventory on the bank balance sheet is growing larger and larger by the day. Banks were hoping that by now, three years into the greatest banking bailout and wealth transfer in history, home prices would be back up. Yet that hasn’t happened for average Americans. Homes that hit the market will command lower prices to justify the economic realities faced by Americans.

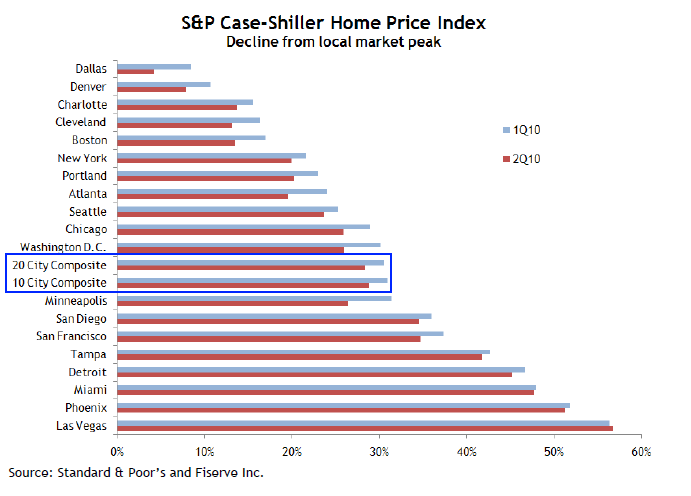

Many adhere to the theory that prices have corrected so deep and so fast that they must bounce back like a rubber ball hitting the ground. Yet when bubbles pop, there is no reason for this to happen. Take a look at price declines in major areas:

Nationwide home prices are off by 30 percent from their peak. How big is this? Since the Great Depression we hadn’t seen one year of nominal price declines in real estate. You can see the damage in other areas as well. But prices are still too high even after this correction because the magnitude of the bubble was incredible. Take for example a home in California and walk through this hypothetical case:

1998:Â home sells for $190,000

2002:Â home sells for $250,000Â Â Â Â Â Â Â Â Â Â +31%

2005:Â home sells for $400,000Â Â Â Â Â Â Â Â Â Â +60%

2007:Â home sells for $650,000Â Â Â Â Â Â Â Â Â Â +38%

2010:Â home sells for $350,000Â Â Â Â Â Â Â Â Â Â -46%

Most of the time people just look at the last sales reference point. It is an incredible fall from $650,000 to $350,000. But look where it came from. Prices are still close to double what they were in 1998 yet incomes over this time remained largely stagnant. If we account for inflation, we are looking at a 35 percent increase yet the current price is much higher. The current sales price is still too high even adjusting for inflation. In other words, prices in many places are still in bubbles.

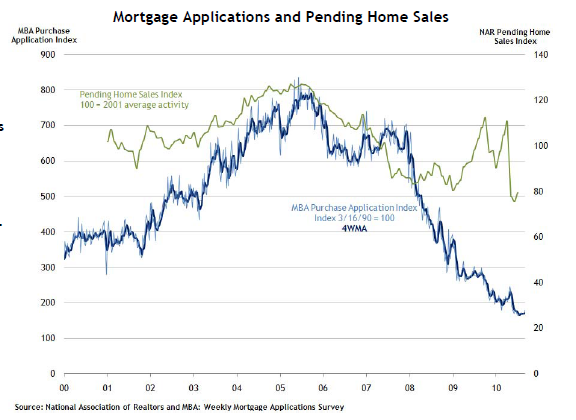

And the public is dealing with bigger issues like looking for work and holding on tight to jobs. That is why if we look at current indicators of home action they are falling off cliffs:

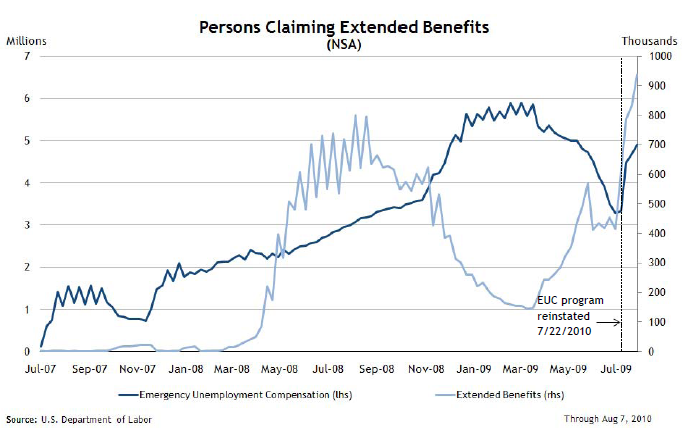

Pending home sales have fallen off the cliff after the banking and government sugar high has worn off. Mortgage applications are near all time lows. Why? Because people are not going to make the biggest financial decision of their lives in the weakest economy in a generation! That is what banks and the political system fail to grasp. Trying to keep home prices inflated has been an absolute catastrophe from a policy standpoint but has also cost the taxpayer an inordinate amount of money. If you want to see where things stand just look at emergency unemployment benefits:

4.9 million Americans are receiving emergency unemployment benefits. These are benefits that are paid out once the normal unemployment coverage expires. All in all you have over 10 million Americans receiving UI. How can one look at the above chart and expect home prices to go up? The median household income of Americans is now under $50,000. Adhering to tried ratios over decades of more stable housing days, it would look like home prices should be hovering around $150,000. The current median home price nationally is approximately $180,000 or 20 percent too high. If we look at niche markets in California you will find some areas that are still over priced by 50 percent based on local income metrics. In other words, expect to read about falling home prices over the next year in the mainstream media.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Real estate prices decline said:

Its long road ahead when it comes to stabilizing real estate markets. All over the world, housing prices have fallen. The number of buyers have gone down. Interest rates have increased. Foreclosures are on high. So these are the variables that first needs to be settled. Only then we can see real estate prices going up.

September 20th, 2010 at 2:12 am -

john of sparta said:

real estate is not just housing.

it’s raw or developed land and commercial real estate.

commercial is the key. it’s the ‘leading indicator’.

based on local figures…this is a snowball rolling downhill.

bottom line: if you can sell now, sell now. for whatever.September 20th, 2010 at 6:32 pm -

SkyHigh said:

I saw a house in a California coastal town the other day for $438,000. I thought it was cheap! It’s an old but clean 2 bedroom, 1 bathroom house with a very small office “which could be used as an extra bedroom.” The prices in this shit-hole town are still way too high!!! $438-K for a older, small house! But it’s clean, so I said “Oooohhh.” I’m sure that 6 years ago, it would have sold for $800-K or more. You can’t buy dog-doo in this town for under

$400-K. Things are still WAY OVERPRICED, however prices are falling SLOWLY. Patience is a virtue in this market in overpriced towns like this.And to think that today Obama and the National Bureau of Economic Research declared the recession to be over as of June, 2009. Hot-damn, who’s fooling who? Do these saps think we Americans are just a bunch of complete morons and retards? Apparently they do. Tell the millions of Americans who have lost their homes and their jobs that the recession is over! Who are the real idiots?

September 21st, 2010 at 2:35 am -

Curt said:

Very good read but when you make a comparison to 1998 levels and “what people can afford” you must also take into account the fact that interest rates are much, much lower, so what people can afford should be higher than simply the 1998 level plus inflation.

September 21st, 2010 at 7:47 am -

Acatt said:

Great data…if you like to de-emphasize the local nature of markets. While the numbers may be valid from a general national standpoint their validity unwinds as you begin to break out Regional Data, then break out State data, then break out County data, then break out City data, then break out neighborhood data. Markets are local. Period.

Numbers like these would be akin to asking Willard Scott to draft up a weather report based on combining all national data. Raining + Sunny divided by two doesn’t average out to anything coherent and neither does this report for anyone looking to buy or sell real estate.

It’s the validity of these same figures that played an active role in getting consumers into the mess they’re in now.

Here’s the facts:

Every market is unique.

Interest Rates are very appealing & good and responsible financing is available.

Many markets offer buyers and sellers great opportunities.

Many markets will continue to be troubled and distressed (no different than markets that actually struggled during the boom years).

Buyers and sellers need to educate themselves about the local factors that determine their market.September 21st, 2010 at 12:12 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!