U.S. Treasury Summary of Receipts and Outlays for the U.S. Government: If Your Budget Looked Like this, You would be out on the Street.

- 3 Comment

It comes as no surprise that the U.S. government spends more than it takes in. We all know this. But what are the funding sources for the U.S. government? Meaning, who cuts their monthly pay? It is easy to get caught up in the talk of large numbers but you have to think of the budget of our country as you would any other budget. Most Americans are trying to make it buy with wages that are stagnant while the government spends as if it has a no-limit American Express card.

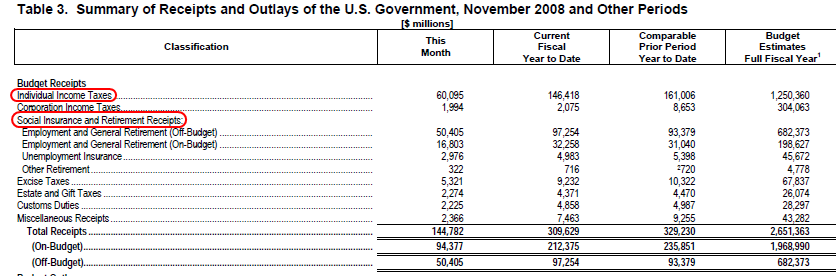

Most people derive their largest income from their job. For example if you are an artist, when you get paid you can assume your “job” is creating art. Well if we look at where the U.S. government gets their money from, we can assume their job is to tax us. The two biggest sources of income for the U.S. government are individual income taxes and social insurance/retirement receipts:

*Click for a sharper image

First a couple of clarifications. The corporate income tax is a small amount toward the tax collections of the U.S government yet most of the bailout money is going to large corporations. Corporations aren’t the only places that hire people and many small business run under sole proprietorships or limited liability partnerships. The largest revenue comes from individual income taxes and social insurance (i.e, Social Security and Medicare). These two sources make up over 80 percent of all taxes to our government.

I want to draw your attention to our current fiscal year collections and those from last year. Individual income taxes are off by 9 percent and corporate income taxes are off by a stunning 76 percent. Now, given that the individual income tax is the largest income source, 9 percent is enormous. This is significant because the budget estimate for the fiscal year is expecting $1.25 trillion to come in from individual income taxes. Should the 9 percent rate hold, that is a short fall of $112 billion in revenues.

Corporate taxes are already off by $6 billion from the same period a year ago. These are big changes and are partly to blame for the devastating depth of the current recession.

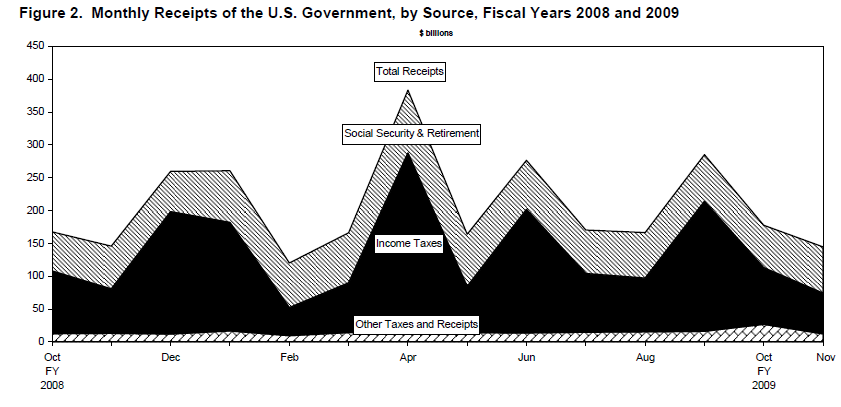

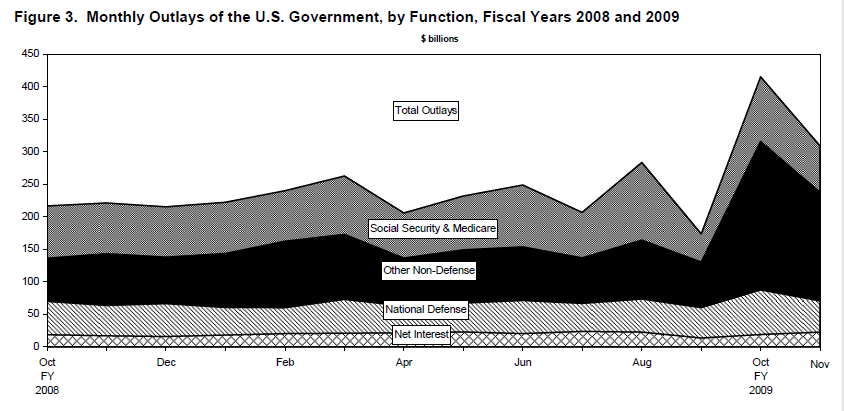

To get a better overall picture of how the U.S. government spends its money, let us look at two charts:

It doesn’t take much to realize we are running a deficit each month here. Our biggest expenses are Social Security and Medicare yet these two areas are hardly on the radar of any politician. How can the biggest expense item of our budget not be looked at? This isn’t to say that the programs are useless or not needed, in fact certain key components are needed and necessary. Yet it is stunning that we are not examining this area much closer.

If your monthly income was $4,000 and you spent $2,000 a month on clothing and were struggling, someone may look at your budget and say, “cut down on the clothes.” The way our government works, we look at the biggest line item expense and we say, “how can we avoid talking about this?”

The day of reckoning will happen and we need to address this enormous problem. No one has seriously tackled the entitlement bubble but what use is it to clean up the mess of our current economy only to dive into another problem which will occur with these massive entitlements? The system needs to be reformed. Ideas need to be discussed. So much wealth has been destroyed in the last year and unemployment is skyrocketing that we know tax receipts will only decrease. After all, if you aren’t working you are not paying income tax. In fact, the opposite may be the case if you are drawing on unemployment insurance. The system is being pulled in multiple ways yet we need to confront this issue head on. Pretending it is not there does nothing. We did that with the housing bubble which was built over multiple decades and look how that has turned out.

Nothing points out our current problems more than the trade balance:

Consistently we have been spending more than we earn since the early 1990s. The only reason we have this capability is because of the value and reputation of the U.S. Dollar. But ask yourself this; with Ben Bernanke and Henry Paulson systematically hoping to destroy the U.S. Dollar, what do you think our foreign trade partners are going to think about exchanging actual goods for a dollar that is worth less and less?

This game can’t go on forever. If the time to address this isn’t now, then when? We either get our ducks in a row or this current severe economic recession will turn into a major depression. It is that painfully simple. A household that does this will lose their home in foreclosure, get their luxury car repossessed, and will have to pawn off their jewelry. Yet the U.S. government thinks the rules that apply to average Americans don’t apply to it. We do not want to be in that position in a few years but given our current path, our government leaders are simply fiddling while Rome burns.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Doug said:

that is why this downturn will last for a long time no one is fixing the real problems facing us today, just more bandaids, smoke, and mirrors

December 24th, 2008 at 10:18 am -

Etienne De La Boetie said:

This whole thing is going to go “Mad Max” in 2-24 months… Remember who did this to you: The Federal Reserve, The Banks and Private Owners of the Fed, and their puppets in govt… and they did it to you on purpose because the information revolution was starting to eat away at their control of the media.

Fight Them! Google: The Appleseed Project

December 24th, 2008 at 11:24 am -

Ed said:

I agree with both the comments above. The US economy is filled with cancer in the form of large financial institutions. You cannot put a band-aid on a patient with cancer and hope for the best. Technically, the big banks are insolvent in the US. They have lent out way more in the form of risky loans and investments than the actual deposits they have from all sources.

November 23rd, 2009 at 5:33 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!