Where should you put Your Money? Investing in a Recessionary Environment.

- 1 Comment

In two days, the market relinquished all weekly gains and looking at market fundamentals there really is very little doubt as to why this occurred. This past week, the two large mortgage behemoths Fannie Mae and Freddie Mac announced record quarterly losses. We also got a report that the housing market dropped at its fastest rate in 2007 from anything that we have on record. But there are areas that are on a massive tear and will continue going up because of inherent imbalances in our economy. In Investing in Foreign Currencies: Recession Proof Investing we discussed various ways you could protect your portfolio from recessionary forces.

First, we need to highlight what our forecast is for 2008.

- Continued Housing Weakness

- Credit Market Distress

- Commodity Prices Increasing

- Dollar Declining

- Yen Unwinding

- Higher Unemployment

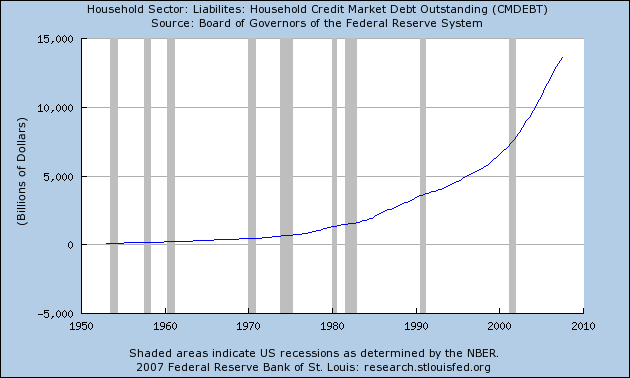

The reason for this forecast is the insurmountable debt that we carry as a nation. If you want to look at household credit market debt outstanding, just take a look at the below chart:

The problem with the above goes in two ways. First, with the massive deflation in housing many people are now finding that their mortgage is worth more than what they initially paid for their home. What we are now seeing is an epidemic of people simply walking away from their homes. What this does in effect, is a destruction of money which is deflationary. Think about it for a minute. Someone somewhere has on their books a home that is valued at $300,000 and a corresponding mortgage for $300,000. Now let us assume the home is now “worth” $250,000, does the mortgage adjust instantaneously? Of course not. And as we all know, many people were using home equity lines to fuel the consumer economy and this is no longer an option.

Now what does this mean for our economy? First, it means the Fed is going to probably go toward a zero interest rate policy and with each cut, you will see gold and oil surging higher. We also have seen the Japanese Yen surging this year with the currency unwinding. It only makes sense since the Japanese are one of our biggest creditors and our debt is growing more and more devalued as the year progresses.

There is a great piece over at Econobrowser by Professor Jim Hamilton:

*chart source: Econobrowser

Incredibly, nearly every major commodity class is not only rising, but surging at unbelievable rates. If the Fed continues to cut rates which seems very likely, you can expect to see foreign currencies rise and commodities explode. Invest accordingly.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

[…] Investing in a Recessionary … Published in February 29th, 2008 Posted by in Uncategorized Where should you put Your Money? Investing in a Recessionary … Now let us assume the home is now “worth†$250000, does the mortgage adjust instantaneously? Of […]