Zillow: Concentric Circles of Pain. Examining how the Epi-Center of Housing is Collapsing and the Future of Real Estate Tools.

- 8 Comment

Zillow once again is showing why it is two steps ahead of those in the housing industry. First, they manage to aggregate an incredible amount of data including tax records and previous sales prices all in one simple to use website. That is the primary function that set things off. Zillow integrates modern mapping technology, real estate tax records, previous sale information, and puts it all under one simple to use search site.

Next, they started offering sellers the opportunity to sell their homes directly on the site. This to a certain extent allowed sellers to become “appraiser/agent” and shifted the power of knowledge into their hands. Of course, this is a direct threat to those in the industry because of the nature of how things work in real estate and the fee structure. Those most threatened are also those that get the biggest pie in the real estate transaction.

Then recently Zillow went after the mortgage quote market by doing something completely novel, allowing the potential borrower to anonymously request quotes making lenders compete for borrowers. You would think this model existed previously but it did not. Places like LendingTree which provide a similar function require potential borrowers to disclose detailed information (i.e., address, income, etc) before receiving any quotes. The power was still with the lenders. In this case, the power has shifted to borrowers since you do not disclose any of your information except basics on your income (self reported), property location, price, and budget information. These are self reported and any lender worth your time will spend two minutes looking at your data to give you a rough estimate.

When Zillow first came on the scene, not many people thought it would last. First, proprietary information like the MLS gave power to a select group of people. This is a problem in real estate where previous sales data and recent comps make all the difference of how to value a property. Yet sites like Zillow shifted a lot of the power to buyers. Now, you can quickly enter the property into the system and see tax information and previous sales data. Why is this crucial? Well imagine buying a home that sold in 2005 for $500,000. The current market median price is $400,000. With this knowledge, the seller needs to justify at least to you why the home is worth that $100,000 more. Maybe it has major upgrades or special features. You can see how this becomes power.

Zillow has gained a competitive edge now given the current housing market. People are now looking carefully at their real estate purchases. People like free information and they have voted with the traffic now seen on the site. Think of how Google trounced Yahoo! over the throne of internet search engine king. Yahoo! wasn’t too clear on their ranking algorithm, sometimes placing top ad payers higher, or even some erroneous pages that had “real estate” written ten thousand times on a Geocities page. I’m sure many of you remember that. Yet Google’s PageRank technology changed that. They figured that pages should be ranked by other websites linking to you. If a very popular site like CNN linked to you, your PageRank would jump proportionally to the power of the linker. If you had a blogger with 1 hit per day linking to you, it did nothing in terms of your ranking power. This idea of letting the market determine what is popular sent Google to the number 1 search engine on the net and they have the simplest homepage that hasn’t changed much since day one. Free, accurate, and easy.

Yet make no mistake, this is not a free lunch. Just like Google, they figured out a way to leverage their enormous traffic with Adwords. People realize that everyone needs to make a living. Google figured out a way to place ads (like the one’s on this site and others) that contextually match the content. So for example, that is why you see many financial ads on this site. People have come to expect that business, blogs, news, and other sites will have ads. I think Zillow is trying to figure out how to leverage this traffic.

They are also showing a new method of examining real estate. For example, they recently provided some concentric circles showing how housing prices change from urban hubs. Take a look at this novel way of looking at real estate with Los Angeles:

*Source: Zillow.com

As you can see from the above image, as you head out from the center of the county, prices start decreasing. The farther out you go the more pricing pressure you see. This is particularly telling for the Southern California housing market. I wrote an article discussing the pricing pressure that fuel was having on counties in the Inland Empire. Many bought out in these areas because it was too expensive to live in the city and still wanted to own a home. So income wise, they have less of a cushion to combat higher fuel prices unlike those nearer to the city who probably don’t use as much. An odd catch-22 here.

Without a doubt, even the center of the hub is feeling pain. No one is immune here in California.

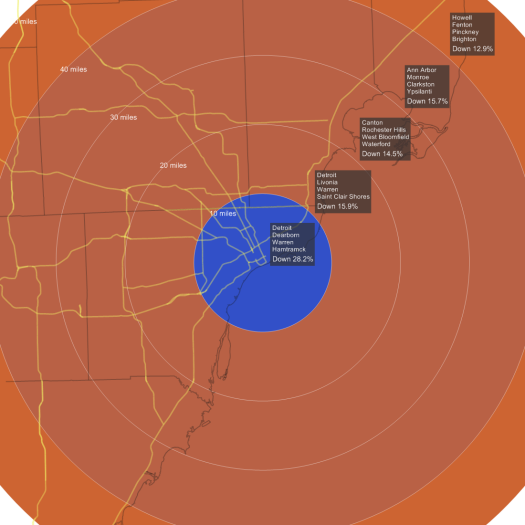

But let us look at another area that actually has an opposite looking circle, that of the Detroit area:

*Source: Zillow.com

With the Detroit market, there is actually a premium to be further away from the city hub. Detroit has had problems for many years stemming from crime and the destruction of the U.S. auto industry. In this case, the model of Los Angeles does not hold true. Less densely populated areas away from the center actually carry a premium whereas Los Angeles, being closer to the city carries a higher value.

Zillow is really offering a novel way of looking at real estate. Combine this with a free online real estate search site like ZipRealty and you have all the information you need to be an educated real estate buyer.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!8 Comments on this post

Trackbacks

-

Tom said:

The problem with Zillow is its Zestimates are often inaccurate by as much as 10 – 20%. I have several examples I am tracking in the Bay Area and So Cal where they list a home for $1.1 million and it is for sale for $895k. Their information should be taken with a grain of salt. I think it’d be a great site if the prices more closely matched what was happening on the front lines.

July 17th, 2008 at 8:12 pm -

Dale said:

No one will need to “justify” an increase in home value by telling buyers what improvements have been made. Home values are determined by current market and nothing else. Other than that example, I like the concept of Zillow.

July 18th, 2008 at 6:44 am -

Ben Benjamin said:

Excellent article!! Zillow provides a needed service. I have been closely watching Zillow prices in my are since it first started. Of course Realtors HATE it with a passion. So do crooked real estate appraisers Loan companies also hate Zillow. These outfits make their money only WHEN THER CONSUMER CLOSES THE DEAL. Thats means dishonesty is the norm. I criticize Zillow for only one reason. I noticed that Zillow Zindex must still rely on comps, which are a snapshot into the past. We must get a way from that old Realtor model. If a jerk paid too much for a house, why should that hurt everyone else in the neighborhood by showing higher comps–as a trend. Two jerks buying makes it worse. That helped fuel the housing bubble. Many buyers were not qualified to buy a can of dog food but bid up the price of houses because they had NO skin in the game. No money down, pick a payment mortgages with CASH BACK at closing. I conducted my own study of Zillow Zindex over time and noticed that a zindex price changed as the house was sold and repurchased. If you want to buy a house to actually live in, rather than to flip, I strongly suggest deducting 50-100K from the Zindex. I tell Realtards and they start screaming. What happened to the so-called buyers agent? They too ONLY get paid when the house closes. The higher the closing price the more they get paid. So if I go back in time to look at OLD Zindex prices, they are still NOT RELIABLE as a firm value since they are using comps of yesteryear. I noticed that some people use Zillow to list their house and select the Zindex as the asking price. They think this is the “real value”. The REAL VALUE is what people with REAL CREDIT and REAL INCOME and REAL ASSETS pay for the house–on the DAY THE HOUSE closes escrow. NOTHING more. Zindex must always be HIGHER in this market, since it is ALWAYS AN OLD FIGURE. HOUSE PRICES DROP DAILY!

July 18th, 2008 at 7:41 am -

Jeff said:

cute…how about a link to the page on zillow? Can’t find it.

July 18th, 2008 at 7:44 am -

Pete said:

Zillow is totally overrated and it amazes me how this article just gushes about it. Do you work for Zillow? Zillow is now one of many, and there are much better real estates sites out there, including Redfin, Trulia, and even Propertyshark. They all scrape from sales records and other data.

The Zillow calculations are notoriously inaccurate, to the point of ridiculousness. I have watched Zillow since it’s launch and during the peak of the bubble it was the worst offender, encouraging houseowners that there house was worth vastly more than it was. And, even allowing people to post information to justify an inflated price. Now, they have adjusted their ‘algorithm’ but the valuations are still totally off the mark and untrustworthy. However, I acknowledge the interface is fairly easy…

July 18th, 2008 at 7:52 am -

Ben Benjamin said:

The bottom line is pay the absolute least that you can, and when the seller starts crying lower your offer by at least 10%. Also, if it is not illegal for Realtors to obfuscate facts, embellish, exaggerate and lie to keep prices high, than you can do the same in the opposite direction. Two principals are involved:

#1) HAVE NO EMOTION about a prospective new house! A house is only wood, nails and a perception. There are millions of empty houses, you can ALWAYS find a better deal especially if you wait — even a month. don’t be in a hurry. During the housing bubble, sellers were requiring “love letters” from buyers to “prove” that they would be the best buyers by “respecting” the house. BALONEY! Its nothing but a house! Now buyers can EXPECT a “Love letter” fron sellers telling the buyer HOW MUCH THEY NEED YOU to buy the house. Turnabout is fair play.

#2) Shilling: In Las Vegas, many table games have “gamblers” who are there to entertain and keep real gamblers at the table gambling as much as they can. Keep the game “happy”, and keep the bets increasing. These are shills working hourly jobs for the casinos. Realtors have been playing this game on the up side to keep the bubble expanding by having OTHER REALTORS somtimes in the same office bidding UP the price of a house to keep the number of “offers” high to make the price go up. Of course there is ALWAYS a contingency that prevents these high offers from being accepted. Contingencies about FACTS only known to the listing broker, making the offer look “real”, when it is ONLY a ploy by the Realtors to keep multiple offers coming in at higher and higher prices ABOVE ASKING PRICE. So the bottom line is SHILL SHILL AND SHILL–unless it is illegal in your state. Its legal in California but Realtors pretend it doesn’t exist. Have a friend or friends place a real offer with a refundable down payment with contingencies about financing that can always be used to get out of the deal. After a few rounds of SUPER LOW balling the seller—tne price will come down–but only if the seller is serious about selling. This implies THE MOST IMPORTANT factor!! READ THIS. What is the REAL REASON for the seller to sell the house? This is most important. Death in the family, divorce, disease, loss of job, demotion, job transfer. These D’s are the reasons MOST people sell during a normal Real estate market. A house is NOT A LIQUID INVESTMENT. It can only be turned into money in two ways: REFINANCING and SELLING. So, if you are wise, you will forget about the REO’s and the short sales and focus on ONLY those sellers who bought the house before the bubble started—usually about the fall of 1998. The second factor is that they must not have any seconds, thirds, HELOCS or liens on the house. If any of these are on the property they may want to sell but these other factors will keep the price high.

What to look for in a house to buy:

Location

Cost/sq ft

Zillow history of area and house

House bought by the seller before year 2000.

No seconds or third deeds of trust

No HELOC’s

No liens from taxes or lawsuits.

Motivation to sell:

Death in family

Disease

Divorce

Destitute (lost job–job transfer)

Disaster in their life

Desire to sellWhen and only when you can verify each of these factors, then you know you will be able to negotiate the hosue down to normal levels. To help, you can recruit REAL buyers (family members) with SUPER LOW BALL offers and contingencies to get out of the offer. After repeated cycles of this you will get a lower price. REALTORS do this stuff ALL THE TIME…Don’t tell them you know their tricks. Buyers agents almost NEVER care about buyers. Their most important client is themselves—because they do not get paid until the deal is accepted. Mist don’t have the cajones top low ball rediculous asking prices. They don’t want to “embarrass” a listing agent by showing that the asking price is way out of line with reality.

Personal note: On my next hosue purchase I expect that the seller will be crying and whining to the point of psycohological collapse. When this happens your price is TOO HIGH. keep negotiating becvause as the house value DECREASES….YOU ARE THE ONE WHO HAS TO SELL IT NEXT TIME. BUY LOW—and sell HIGH. If you don’t the mortgage and tax monsters will kill you.

Always remember that most houses, if financed with a mortgage, are DEPRECIATING ASSET when considering the cost of the loan, property taxes, the cost of the transaction (6% to Realtors), HOA fees and the cost of upkeep. Your mortgage interest is PART OF THE COSTS associated with the house. The first ten years of a 30 year mortgage Plus the points and fees is mostly profit fot the loan company. Add insurance and taxes, and you have very little equity in the house. Its all on paper. Good luck!

Caveat Emptor!!

July 18th, 2008 at 10:25 am -

Puget Sound Pizza said:

spot on, Ben. Spot on.

I found myself priced out of the very-overpriced Seattle-Tacoma market years ago. I worried that I’d never be able to afford a house. My sister and bro-in-law bought anyway, as did my parents. I just kept renting and saving.

Now, they’re regretting their decisions to buy and I’ve managed to save almost $100K.

A few more months, probably 12-18 and I’ll have more like $125K. I plan on buying in cash… distressed homeowner or foreclosure, it doesn’t matter.

Who needs a bank if you’re smart and patient?July 18th, 2008 at 9:18 pm -

Damian said:

Yes really…Zillow is completely off the chart. Even when my home was worth 400K Zillow zestimate was 650K unrealistic for my area! And another of my rental properties t came in 150K under the actual amount. Zillow is not a good place to turn to.

July 19th, 2008 at 6:48 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!