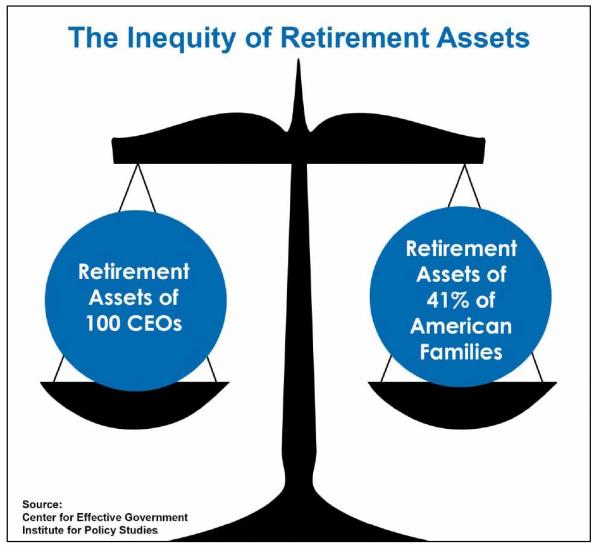

100 American CEOs have more retirement wealth than 116 million Americans. The retirement divide grows larger each year.

- 1 Comment

Most Americans have no retirement strategy. In fact, the new model of retirement appears to be work until you die. It isn’t an uncommon model. In fact, this used to be the status quo for centuries on end. Some tend to believe that having a middle class is the natural order of things. That is simply not true. The middle class needs to have an economic system that favors those that work hard instead of protecting a modern day corporatocracy where politicians simply protect those that pay them off. This is the new system in place. So it is no surprise that 100 American CEOs now have as much retirement wealth as 116 million Americans. It is no surprise then that many older Americans are going to rely on Social Security as their primary source of income into retirement. As you would expect in older age medical costs go up so the burden on Medicare will also rise. The retirement divide simply grows larger in this country.

Top 100 CEOs have as much retirement wealth as 40% of American families

The wealth divide in the US simply grows larger as each year passes. While worker productivity is up not much of this is trickling down to American families. CEOs are making roughly 300 times more than your typical worker.

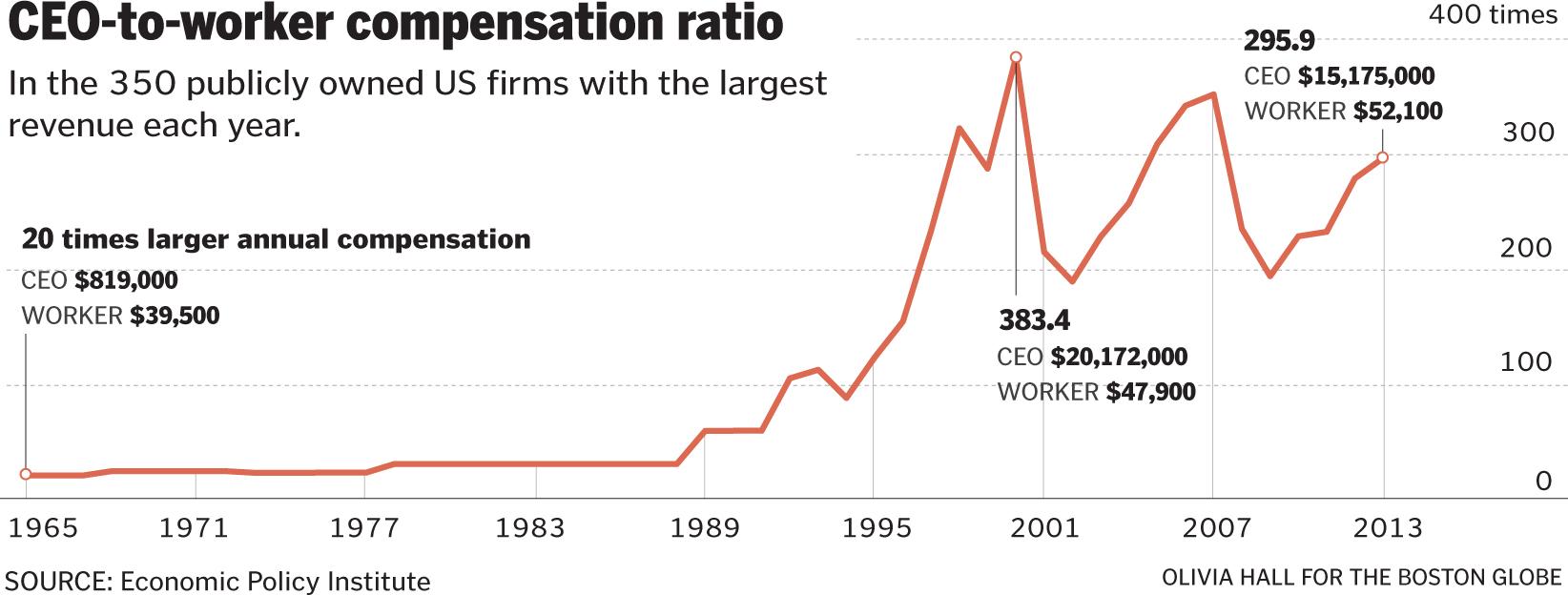

During the heyday of the US middle class, CEOs where making roughly 20 times the income of the typical worker. But look at what has happened since then:

You can see starting in the 1990s that CEO pay went completely haywire. It is also no shock that we’ve had some of the biggest recessions in our country since then with the tech bust and the Great Recession that is still lingering. Many families struggle to get by and most Americans live paycheck to paycheck.

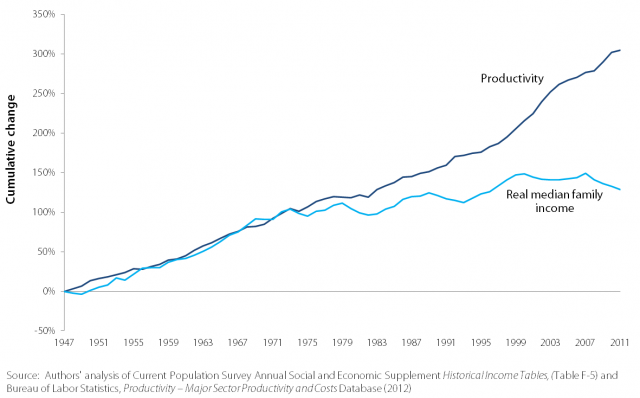

Here is an interesting look at income and productivity. When it comes to a disconnect here, it started in the 1970s as our manufacturing sector was gutted and fully accelerated in the 1990s:

This is why Americans feel like they are working harder but aren’t moving forward. And then we have the wonderful Fed telling us inflation is muted but we have housing prices soaring, college tuition going through the roof, and healthcare costs jumping sky high. Household income is stuck like a stick in the mud.

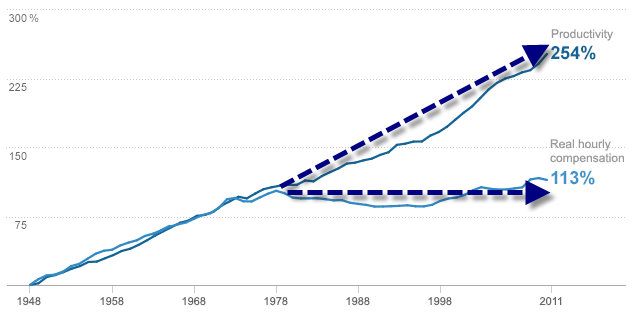

The above chart looks at productivity gains versus household income. You can even measure this against wage compensation:

The same result. Productivity is up but wages are simply not picking up. But it is very clear that CEOs are doing fantastic since 100 CEOs have the same wealth stored in retirement as 40% of American families (116 million Americans):

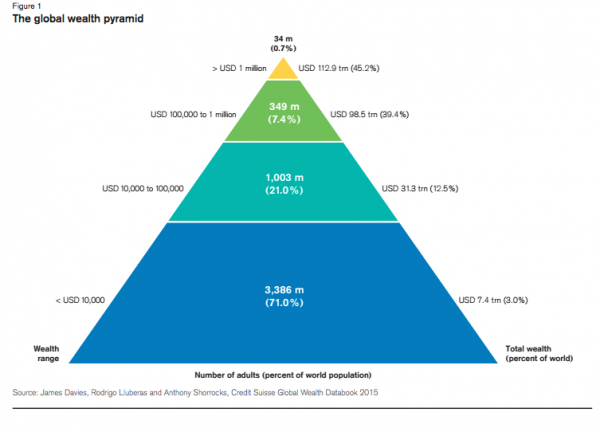

This wealth pyramid can be seen even more pronounced at a global scale:

This is an interesting look at wealth. 71% of the global population has less than $10,000 in wealth. 34 million people at the top (0.7%) of the world’s population holds 45.2% of all global wealth. And when you wonder why so much money is flooding into real estate, art, and other luxury items look no further than here. Yet this has a real impact on regular families across the U.S. that are simply trying to get by. The gains are simply not trickling down and with so much paper wealth for those at the top, many are rushing to buy “real†things in the economy thus pushing prices higher for those trying to purchase a home for example.

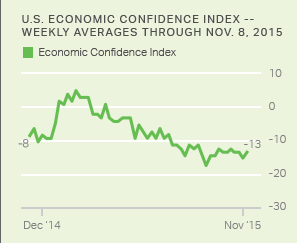

This is why despite rising real estate prices and a stock market near a peak, many Americans are dissatisfied on how things are going:

Source:Â Gallup

The chart above shows Americans are not all that confident in the current economy and they are certainly not happy with politics since the system is perceived as serving an elite corporatocracy. Unfortunately the figures back this up. And if you think this is a meritocracy you are mistaken since the outsized gains of the bailouts went to failed crony banks that brought the economy to the brink. This wasn’t saving good companies that had a bad year. This was about saving entrenched and systematic paper shuffling for the rentier class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Robert said:

This evil system won’t last much longer. Read:

November 19th, 2015 at 11:31 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â