California Loan Modification Scams: Kicking the Financial Can Down the Road. SB 1137 and SBX2 7. Mortgage Cram-Downs Stripped from Rescue Bill. Loan Mods that make your Payment go up.

- 1 Comment

In another chess move to reward banks and fleece the American public, cram-down legislation was stripped out of the new rescue bill. This is significant since this was one of the keystones in the new housing agenda. Yet the banking oligarchy wasn’t pleased with this legislation and applied pressure via lobbying to get this piece out. This isn’t the first time cram-down legislation has failed. Remember the Troubled Asset Relief Program? After the 3 page Paulson memo was voted down in epic fashion, the new legislation actually provided for cram-downs. However, the final version of the bill once again had cram-downs ripped out.

Why would banks fight so adamantly against cram-downs? Because a cram-down gives bankruptcy judges the power to write the principal balance down to more manageable levels. And since bankruptcies are shooting to the moon in our current economic environment, banks are looking at every angle to suck money from the American taxpayer to stay solvent yet have the gall to beg for capital injections, executive compensation, and other perks to keep them afloat. You need to remember that much of the bailouts and credit injections were premised on helping homeowners. Cram-downs would be a big help for homeowners, not so much banks. Banks 19, homeowners 0.

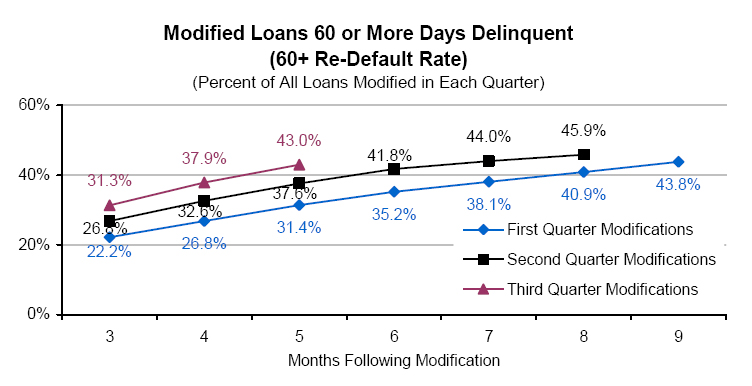

The reason recent loan modifications have been such an utter failure especially here in California is because people simply cannot afford their homes. It is pointless to drop the interest rate or extend the term. Refinancing only works if you are not underwater by more than 5% which virtually eliminates the entire state of California for those that bought in the past 4 or 5 years. Plus, the California housing market is the most toxic in the nation and people are being lured in to a false sense of security when the market is only hitting the eye of the hurricane. Just take a look at how many loan modifications go back into default:

OCC and OTS Mortgage Metrics Report, Fourth Quarter 2008

Now why is the re-default rate so high? Well think of it logistically. People for the most part default because the payment is too high or they lose part or all of their income. That isn’t uncommon with 24 million unemployed or underemployed Americans. Modifying your loan does very little for those that lose their income yet it may help when the payment is too high. Yet from most modifications that occurred in 2008, these were largely refinances and in many cases, the actual payment stayed the same or the amount jumped! How about that for help?

“(LA Times) WASHINGTON — Though lenders are boosting their attempts to curb record-high home foreclosures, fewer than half of loan modifications made at the end of last year actually reduced borrowers’ payments by more than 10 percent, data released today show.

The report, based on an analysis of nearly 35 million loans worth more than $6 trillion, was published by the federal Office of the Comptroller of the Currency and the Office of Thrift Supervision. It provides the most detailed and broad analysis to date of efforts to stem the foreclosure crisis, which President Barack Obama is trying to combat with a $75 billion plan to promote loan modifications.

The report helps explain why many loans are falling back into default after being modified. Many borrowers and consumer groups contend that the modifications offered by the lending industry aren’t very generous, despite more than a year of public prodding from regulators.”

So again, this is why current loan modifications are such a waste of time. They do not address the two main sources of payment shock: (1) Unmanageable payment (2) Loss of income. Now number 2 can only be dealt with via an improving economy and lower unemployment which isn’t likely in 2009. Yet number 1 can be easily managed with cram-downs. We’ve already given banks the opportunity to modify loans and their idea of modifying a loan is making a 30 year loan go to 40 years and saving you $200 bucks a month. How is this going to help someone in a pay option ARM? Let us run a scenario. We have a $500,000 pay option ARM in California given to someone making $50,000 (not uncommon sadly):

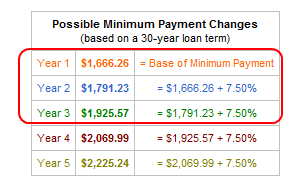

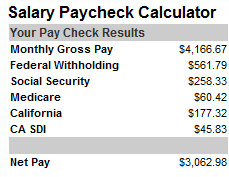

We are being massively optimistic here. We are considering a fully indexed rate of 4.875 percent. For the first year there is no problem. Then the second year things get bad. After the third, it just spirals. Now what is the take home pay of someone making $50,000 in California?

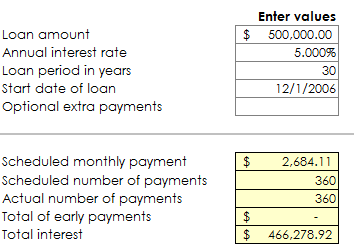

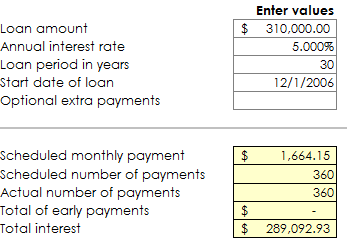

So from the first payment, over 50 percent of net income is going to the house payment. With each year, the payment simply gets larger and larger. Now the problem with refinancing today is we are talking about 30 year conventional fixed mortgages. Let assume he now refinances the home with a 5% 30 year fixed mortgage. We’ll assume this person made the interest only payment yet many actually went negative amortization which means the balance is larger! But let us focus on that $500,000:

The loan jumps by $1,000 with a 5% 30 years fixed mortgage. Without principal reduction loan modifications are an absolute waste of time. When you look at the numbers, you can see why. You cannot shift someone from a loan made in a toxic bubble market to a conventional product. This debt bubble has been building for 30 years so it will not be resolved over night.

“For instance, nearly one in four loan modifications in the fourth quarter actually resulted in increased monthly payments. That situation can happen when lenders add fees or past-due interest to a loan and spread those payments out over the 30- or 40-year period.”

What a shocker that loans are defaulting again. If we already established that payment amount is a major reason for defaults then how in the world does a higher payment help? It doesn’t. More wasted money. But by how much would we need to cram this mortgage down to meet that initial payment of $1,660?

And there is your answer. The bank would need to write the principal down by $190,000 to get this to the initial pay option ARM payment. No wonder why banks are running. Plus, they would need to recognize the loss on their balance sheet which with the new mark to market rules, they can keep claiming that home is worth $500,000. What a sham.

Now the reason I tie this into California is that 60 percent of all toxic pay option ARMs are here in the state. These are the mortgages that need urgent modifications. But the only way to do this is via cram-downs if we really want to keep the initial buyer into the home. In the past you would simply foreclose and that would be that. But banks are getting tons of REOs and are simply being overwhelmed. And without the public-private investment program open, they have no place to dump the loans yet. So right now they are buying time.

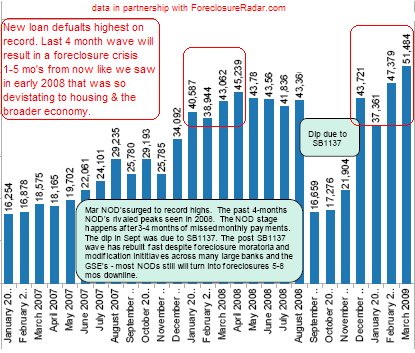

The first buy in California was SB 1137. This program basically stalled foreclosures for a couple of quarters. But now, California is seeing a jump in NOD activity and making up for lost time:

Source:Â Field Check Group

Don’t be stunned. What you first see is a fall in NODs for a few quarters brought on by SB 1137 and various other moratoriums. All that is now done and we are now back in record territory. SBx2 7 is basically a variation of SB 1137. It requires more kicking of the can down the road. The intention of the program is in the right place but there is little use for it without forced cram-downs since lenders have proven to be useless in helping borrowers stay in their home. They have done a great job robbing the taxpayer however and lobbying for massive aid to banks at the expense of taxpayers who are ironically, homeowners as well. Let us look at the legislation:

“The California Foreclosure Prevention Act is designed to force Wall Street to help the citizens of “Main Street.” The Act:

1. Imposes a 90 day foreclosure moratorium to allow distressed homeowners time to work out loan modifications with their lenders.

2. Allows lenders to avoid the moratorium if they have a comprehensive loan modification program based, in part, on criteria set forth by the Federal Deposit Insurance Corporation. Loans may be modified several ways, including interest rate reductions, extension of the loan term, or principal reduction.

3. Provides oversight and accountability by requiring regular reports to the legislature on loan modifications and foreclosure reductions, and coordination with appropriate state regulators.

The California Foreclosure Prevention Act is the first law in the nation to impose a foreclosure moratorium and encourage quality loan modifications.”

Let us address the 3 issues above:

First, why do you need to give lenders another 90 days since they have already proven ineffective? This first point does nothing except causes NODs to go down but that already occurred in the last two quarters. This will largely have no impact aside from kicking the can down the road.

Second, all these solutions of interest rate reductions, extension of loan terms, are a waste of time. Principal reductions will NOT BE DONE on a voluntary basis, hence the forced cram-down. The fact that it is stripped out makes this legislation a toothless tiger.

Third, asking for banks and lenders of toxic assets to be accountable is an absolute joke and the irony is thicker than a ton of bricks. There is no such thing as a quality loan modification. Not with toxic loans. In fact, I have heard of people who pay on time seeing the train coming but unable to modify their loan. Why? Lenders want to milk their paying customers. However, once they miss a payment it is all business and they are willing to work. In this market, failure is rewarded. Those who are prudent are being smacked around. California is going to see a ton of problems hitting the market in the second half of 2009. Anyone thinking otherwise is simply ignoring the facts and is too short sighted on the current market of people jumping in to buy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Jay Scott said:

I have been working in the california loan modification industry for almost two years now and believe that your article has many great points!

Principle loan reduction (cramdown) seems to be the answer, but its just not simple. Specific questions that are difficult to answer:

1. How much principle do you reduce?

2. Where do you stop?

3. How do you decide who gets it?

4. Is this really fair to investors (bond holders)?

5. How soon do you do this again?

People that got help early, need more help as their hardship gets worse (less income, more loss of home value).This isn’t going to be an easy problem to solve.

-Jay

amlgloanmodification.comNovember 7th, 2009 at 2:15 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!