The young, educated, and massively in debt college generation: Total student debt outstanding approaches $1.1 trillion. 65 percent of all outstanding student debt held by those 39 and younger.

- 4 Comment

It is interesting to hear older politicians take the podium and wax and wane poetically how young Americans are not working hard enough or need to take responsibility for their actions in the current economy. The reality of the situation is the recent recession has punished the young disproportionately. The young have seen their net worth crushed and job opportunities shrink in the current recession. Most of the student debt outstanding is in the hands of younger Americans simultaneously going up with rising college tuition. The price of going to college can no longer be support by merely working a minimum wage job. I’ve heard some out of touch politicians argue that instead of going into debt, current students should work instead of going into debt. Even with a minimum wage job someone would have to work 40 hours or more just to cover a regular state school tuition in most states in the country. The student debt problem is largely a young American issue.

Total student debt

The amount of student debt outstanding is quickly approaching $1.1 trillion:

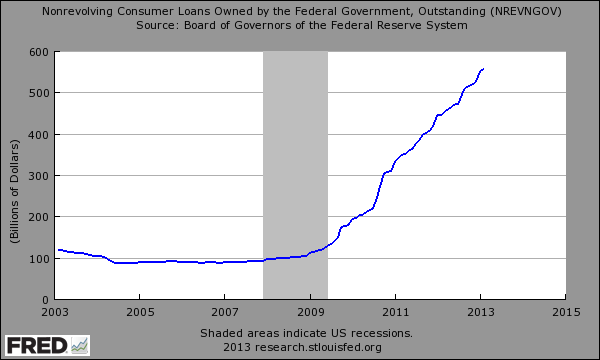

Most of the student debt is now being owned and guaranteed by the Federal government. At this point, most realize that a bulk of this student debt is never going to be paid (similar to our national debt). Why would you continue lending if you knew a large portion of the principal wasn’t going to be paid? The markets understand this and that is why the government owns most of the newly minted student debt:

The amount of student debt directly held by the government has jumped by a factor of six only since 2009 from roughly $100 billion to $600 billion. Keep in mind the government backs hundreds of billions more in student debt but this amount is directly held and will be a responsibility to the government.

The young and in debt

What is even more troubling is the amount of the $1.1 trillion in debt held by the young:

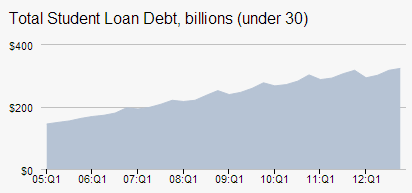

Those under 30:

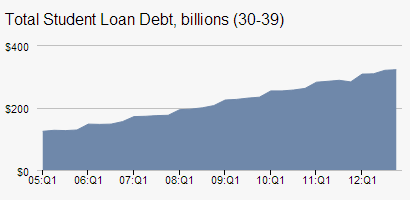

Those 30 to 39:

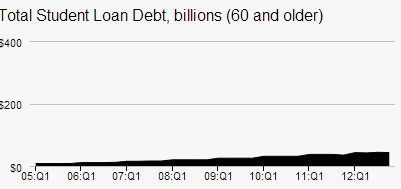

Those over 60:

Roughly 65 percent of all student debt is held by those 39 and younger. The amount of student debt held by those 60 and older is nearly invisible and keep in mind many went to school when prices were reasonable. So Congressmen that are 60 and older lecturing young Americans on buckling up and paying $20,000 or $30,000 a year by working part-time jobs to go to school are disconnected from the real economy. The average per capita wage in the US is $25,000! So even someone working full-time with a high school degree may not even cover the basic amount to attend school.

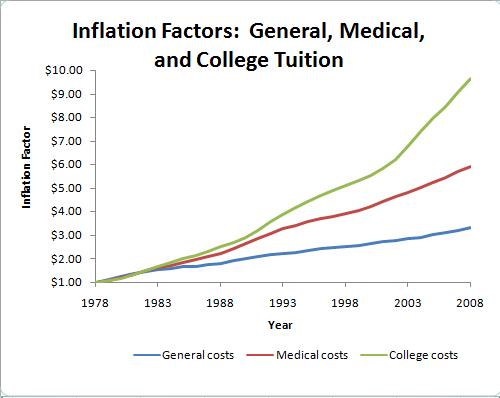

Inflation has had a massive impact on college tuition:

So while wages have gone stagnant since 1995, the cost of going to college has increased many times over. The option for many Americans is to get into debt. Young Americans have the option to struggle in an economy with no jobs for the uneducated or go to college, get into debt, and have a fighting chance at a middle class life. So it isn’t hard to understand why student debt continues to rise. What is hard to understand is why the costs continue to soar while wages have gone stagnant. What is increasing the cost so quickly? The big reason is the amount the government is willing to back and spend. Certainly we can eliminate the subsidy to paper mill for-profits for example that have no track record of success.

The young largely carry the burden of $1.1 trillion in student debt outstanding. With poor job prospects does anyone realistically think that $1.1 trillion is going to be paid back in this lifetime? This is why many young Americans end up broke, educated, and massively in debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

4 Comments on this post

Trackbacks

-

Paul Verchinski said:

While it looks like a lot owed by those 39 and younger, How much of this debt was co-signed by their parents? An educated guess is probably at least 50% which will continue to crush any savings for a parents retirement. Parents in many cases have jeoprodized their own retirement so that their children can compete in a poor jobs environment.

May 6th, 2013 at 1:30 pm -

jim said:

The debt should be cancelled by law, disregarded by the debtor, marked paid-in-full by our congress and simply looked upon as an example of how our Congress looks at debt. With the example our congress gives, is it any wonder that we should all look at debt as nothing to worry about. Cest la vie.

May 6th, 2013 at 7:57 pm -

Nicholas said:

A truly horrendous reflection on a moronic society: both Republicans and Democrats who oversaw, participated and ignored fundamental warnings over many years. How on earth can you have a competitive economy if you enslave the very people who will (eventually) drive that economy? Such a repressive system guarantees than any other nation with normal educational expenses will gain tremendously on this country. I can’t wait to read about the Americans taking cleaning jobs in China, India and Saudi Arabia. Welcome to the dark ages.

May 7th, 2013 at 12:44 pm -

Expat said:

Nicholas – I’ve had to move to Saudi Arabia for work….

May 25th, 2013 at 12:41 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!