Feeling rich through debt: Modern banking has replaced real economic prosperity with massive levels of debt. Housing affordability reaches multi-decade highs while household incomes retreat to 1990s levels.

- 0 Comments

One of the biggest headlines right now is how the housing market is pulling the entire market up. Housing prices are soaring while the stock market is making record highs. Yet a large portion of the housing run-up is being caused by easy money that has been created by the Federal Reserve. Banks are out-bidding regular home buyers so it is dubious how much of this jump in prices is really helping households. Affordability is up because mortgage rates are incredibly and artificially low. Another bubble is brewing in this economic stew yet this time, it doesn’t seem like Americans are feeling all that richer since most of the new access to debt is being given to large banks that are outbidding regular home buyers. In some markets, investors are purchasing 50 percent of all homes. So what use is a low interest rate if investors are going to outbid you? The game is the same this time. Housing is the juice machine once again. Incomes adjusting for inflation are back to levels last seen in 1995 so the easiest way to make Americans feel wealthier is by increasing their access to debt.

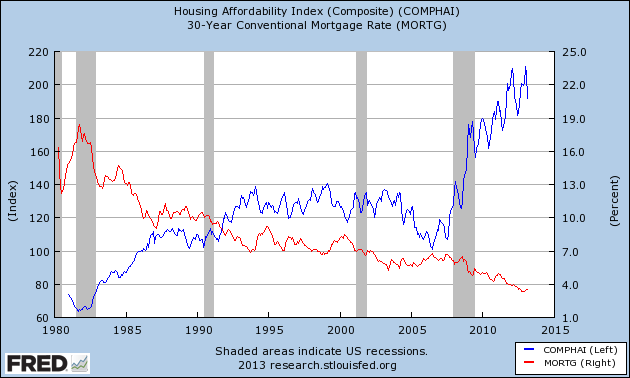

Mortgage rates and affordability

You can see that housing affordability has gone on a moonshot right when the recession started. Two things pushed this up: lower interest rates (courtesy of a $3.3 trillion Fed balance sheet) and falling home prices:

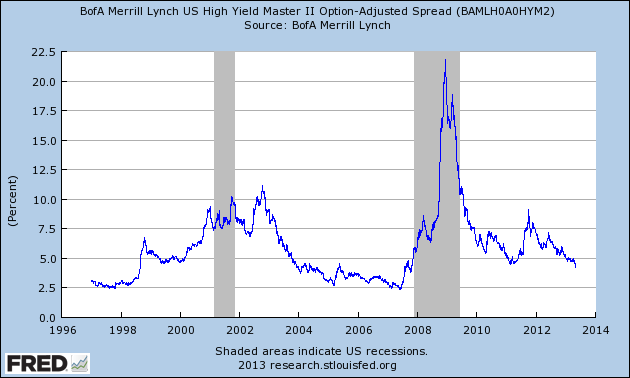

Yet who is really benefitting here? In places like Las Vegas, while rents are down, you have people being outbid on properties from large investors chasing higher yields. How hungry are people for yield? Take a look at some “high yield†investments:

Remember that high yield was nicely rebranded from junk bonds many years ago. These are risky ventures and look at what they are returning. So banks are using easy money from the Fed and are leveraging up on real estate. It is amazing how involved Wall Street has become in the housing market yet again but now as property owners. The bailout kicked out millions of people via foreclosure and now banks, that were bailed out through trillions of dollars from the government and central banking, are now using this money to buy these places and to rent homes back to the same crowd since people need a place to live. This is what happens in a market driven by pure financialization.

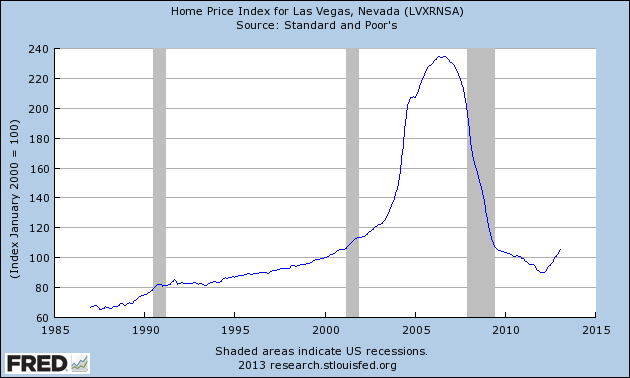

This is definitely happening in markets like Las Vegas:

“(Reuters) Local real-estate broker Fafie Moore says private-equity firms and hedge funds have largely “crowded out” local buyers like Marchillo. That’s because the investment firms have broadened beyond their initial focus – buying homes at foreclosure auctions. Now, they are also bidding for homes listed by private owners and banks. In a sign of how freely the money is flowing, Moore notes around 60 percent of all sales are in cash these days.

Fellow broker Trish Nash says she has seen cases where a home gets listed and quickly draws a dozen bids, many in cash. Realtors are talking about a mini-bubble forming here.

“There is an artificial appreciation in our market,” says Nash. “I know (the big investors) say they aren’t going to be flippers, but for them it is all about the bottom line.”

Home prices are definitely bouncing back in Las Vegas after a wicked crash:

Yet many that are buying for rents are finding the following:

“Cracks are showing in Vegas and beyond. Here, rents on single-family homes were down an average of 1.9 percent in March from a year ago. In other regions targeted by institutional buyers, such as Phoenix, Southern California, Atlanta and Florida, rents are either falling or flat, according to online real estate service Trulia.â€

So essentially you have banks now speculating on further appreciation. Rents absolutely matter if you are speculating on properties for rentals because people can only pay rent from actual earned income. It is amazing that some people think that household incomes simply do not matter. These people fail to acknowledge the cognitive dissonance of our economy where the stock market is peaking at the same time that food stamp usage is peaking. You don’t go on food stamps because you are rolling in gold coins and mounds of greenbacks.

Having access to debt doesn’t make you richer. From all indications, it looks like the recent jump in consumer debt is coming more from student loan debt. We’ve written about that bubble and it is clear that something at some point will have to give. The problems in other markets have allowed the US to hold rates artificially low for a very long time but that is a dangerous bet as Japan has found out. Yet what many are now feeling, even with access to debt is that there is little benefit if the supply of homes is low and you are being pushed out by yield hungry Wall Street. In essence, we are seeing the net effect of the bailouts and realize they were not intended to help the average American.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!