Not all is well on the housing front. Housing still too expensive for middle class Americans – 9 Years of Housing Inventory and 7 Million Homes 30+ Days Late or in Foreclosure. How the government is keeping and encouraging expensive housing.

- 3 Comment

Since the recession started in December of 2007, over 7 million foreclosures have been initiated. In no other time in history have we seen this magnitude of problems in the housing market. And these problems still persist. It is estimate that another 6 to 9 million homes are at risk of foreclosure in the upcoming years given the current economy and overhang from the housing bubble. If we measure the health of the housing market through foreclosures, we are only half way through this housing calamity. In many ways, the problem still stems from homes being too expensive relative to the income people make.

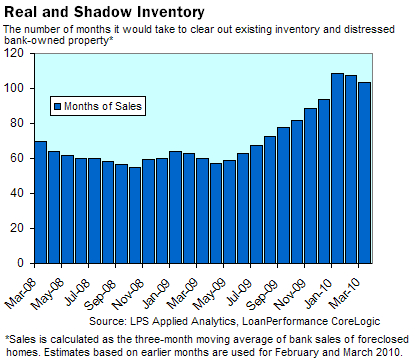

The Wall Street Journal had an interesting chart showing that the current housing market combining non-distress, distress, and shadow inventory would give us nearly 9 years of inventory:

Source:Â WSJ

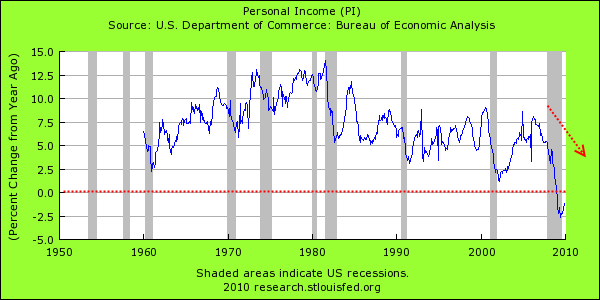

The irony behind most of the government programs in the housing market including the tax credit is they have forced demand forward and have pushed prices up making homes less affordable to millions. And costs are a major factor in today’s economy because many households are dealing with weaker or stagnant wages:

On the one hand you have the government subsidizing housing and actually encouraging banks to hold off inventory artificially to boost up prices. This is the reason the above inventory chart is so high. Yet this is creating a price floor where the actual American middle class is unable to buy a home unless they are subsidized with tax credits and massive interest rate deductions. On the other hand you have wages that have been stagnant and have actually gone down in real terms over the past decade. So why would housing prices go up in this kind of environment?

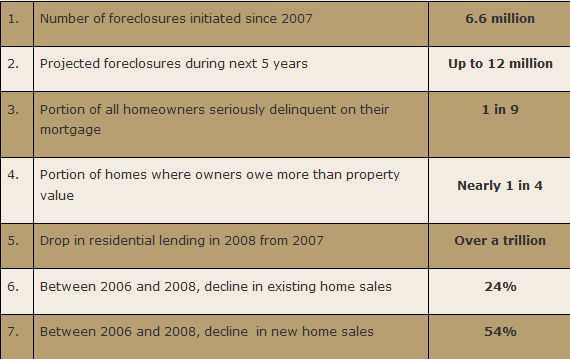

The Center for Responsible Lending has some stunning facts on the housing bust since the recession started:

Source:Â Center for Responsible Lending

Foreclosures initiated are actually over 7 million if we include the damage done in the first quarter of 2010. So things are not necessarily getting any better in the housing market if we measure housing health by foreclosure starts. In March we had 367,000 foreclosures initiated according to RealtyTrac, the largest number ever to be recorded in one month. Yet this is somehow a good sign?

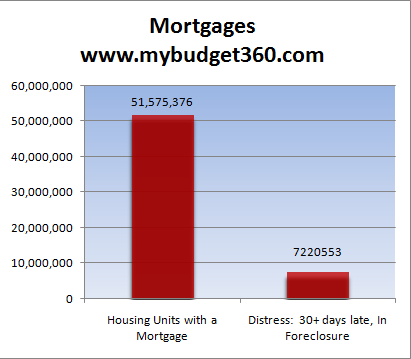

At least 1 out of 4 mortgage holders in the U.S. is underwater on their mortgage. As we have seen through recent studies, being underwater on your mortgage is the number one predictor for future default. Given that the U.S. currently has 51 million mortgages that would mean that 12 million homes are at risk for foreclosure. And this in fact is already showing up in actual distress data:

Source:Â Census, MBA

As of today, over 7 million current mortgage holders are 30+ days late or in some stage of foreclosure. This is at peak levels. And part of the reason why after 27 months of this recession and trillions in bailouts to Wall Street and banks, not much has changed on the housing front. Wall Street and the banks are richer, but in terms of improving the housing market nothing has really changed. And most middle class Americans have their net worth in housing values so is it any wonder why the middle class is questioning this recovery and more importantly, where all those trillions of dollars went?

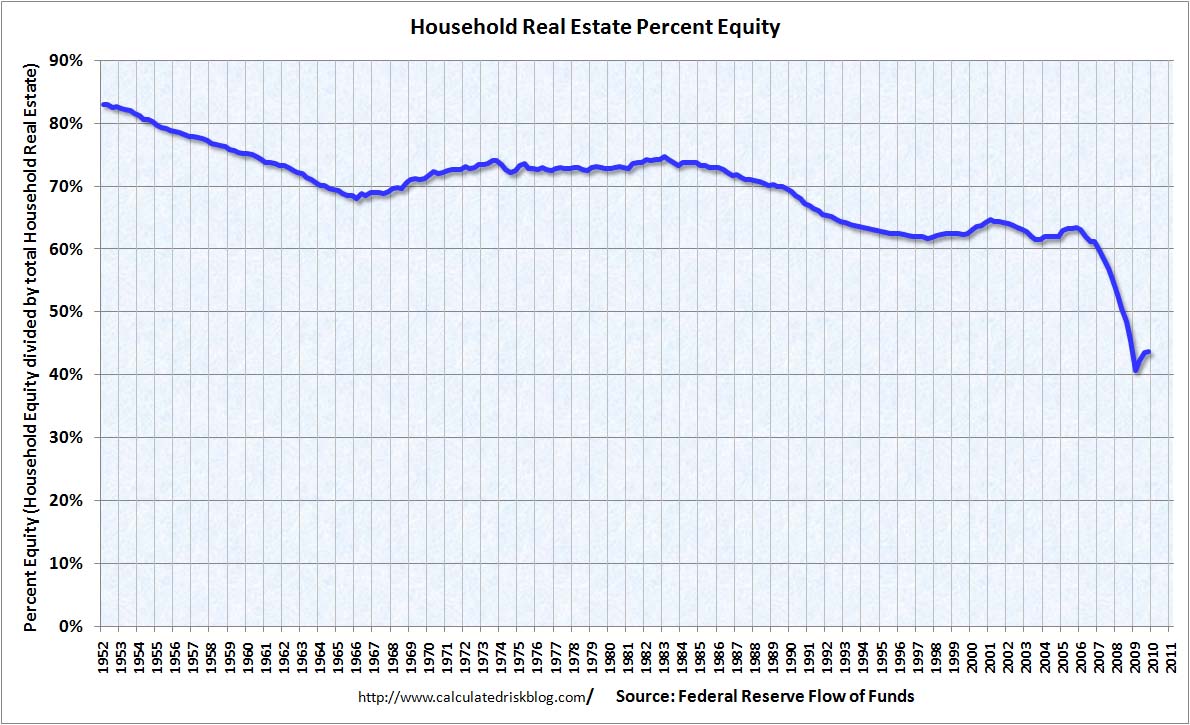

This is why Americans have the lowest level of housing equity in nearly 60 years:

Source:Â Calculated Risk

The government bought into the banks notion that bailout money was needed to support home prices for Americans. Well look at the above charts. The only real bottom line increase has occurred with banks:

Source:Â Stock Charts

The financial sector is up 300%+ since that bottom in March of 2009. Is your bottom line up 300% from last year? Of course the middle class is wondering how in the world much of this could have occurred but part of it is the symbiotic relationship between Wall Street and the government. The only way home prices can go up in a natural environment is if wages actually increase. Tax breaks, easy money to banks, and other gimmicks don’t address the fundamental problem with housing. They are approaching the issue from a perspective that housing values crashed because of a short-term liquidity problem. Instead, they should be approaching it from the angle that home prices are too expensive because of a massive bubble brought on by Wall Street and massive government subsidies to homeownership.

The biggest contradiction is that for the above reasons, housing values have crashed in spite of all the money being thrown at the problem because they don’t focus on jobs or wages (how else do people pay their mortgage?). In trying to support prices at certain levels we have lost focus on the fact that without solid income growth, no amount of government support will help. The middle class is losing ground and housing is at the center of this issue. The fact that we have 9 years of total inventory and have 7 million homes in foreclosure or are 30+ days late should tell you that not all is well on the housing front.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Kevin said:

I couldn’t agree more with you. I read a while back that a lot of people are still in denial about what is happening and just can’t come to terms with how much money they’ve lost and are holding out for a better price. They keep thinking that real estate is going to rebound, but as you point out, the government is simply propping up a dead guy, kind of like that movie, My Weekend at Bernie’s.

April 30th, 2010 at 12:47 am -

hartman.kurt@gmail.com said:

The housing credit was originally supposed to be a no interest loan, repayable over many years, deducted from income taxes.

Unfortunately, buying a home is not a rational endeavor. If it was, very few people would own one.

April 30th, 2010 at 5:12 am -

RH said:

Look at Japan and look at us, the US. Our housing problem is gonna to be worse than Japan, becaue we Americans don’t like to save, but like to build (credit card) debt. If you don’t think so, research Japan first.

May 1st, 2010 at 6:37 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!