Middle class shackled by banking debt chains. 113 million households each owe an average of $113,000 in banking debt for mortgages, student loans, credit cards, and auto loans. $45 trillion in household sector debt, government debt, and domestic financial sector debt.

- 2 Comment

The middle class has been systematically shackled by large amounts of debt, banking debt to be exact in a new form of financial serfdom. Much of this started in the early 1970s on par with the deficits don’t matter policy that engulfed our monetary policy for the next four decades. Like any giant structure built on debt, there is usually a point where a sort of debtor’s spiral will hit. Many middle class Americans have seen this occur with their credit card debt, mortgages, and auto loans. This also comes at a time when we have a record amount of two (or more) income households. More people are working under one roof but earning less and less in low paying service sector jobs. If it wasn’t for the two income trap, we’d see how shackled the public is to the banking debt that is so pervasive in America.

This amount of debt will cripple any recovery. Take a look at the current trap:

Source:Â CNN

You can see how with even two breadwinners, many families are merely running fast enough to stay on the middle class treadmill. Lose one job like many millions of Americans are and the semblance of any middle class lifestyle is now gone. That is why we have 40 million Americans receiving food assistance and stories of people waiting at midnight at Wal-Mart during the end of the month for food purchases as their debit cards are refilled with government funds. You have to ask where these funds come from. The U.S. Treasury and Federal Reserve have bailed out everything in their line of vision including trillions of dollars to the banking system. Is it any wonder why foreclosures and bankruptcies are near peak levels? It is a carte blanche insolvency.

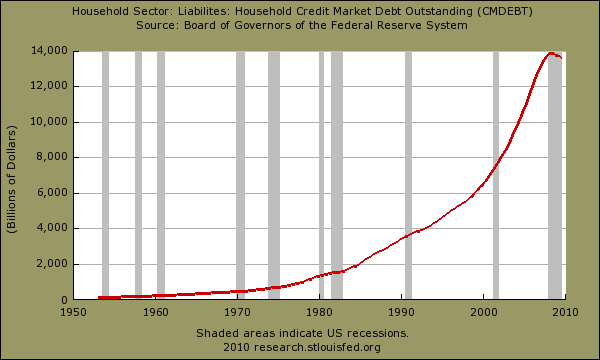

This massive growth in debt can be seen rather clearly starting in the 1970s:

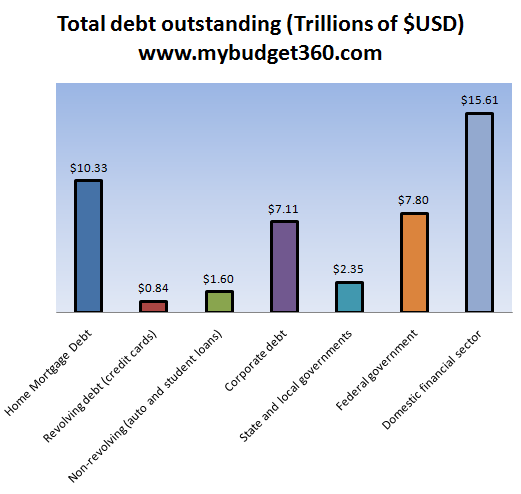

But if we want to break down the debt even further, we can put the debt into smaller categories:

Add up the above sectors and you will find that the U.S. has $45 trillion in total outstanding debt! The household sector carries roughly $13 trillion of this but I think there is a misnomer when delineating between household debt and also, government debt. What is the government if not the aggregate of all the people in the nation? Who will carry the cost of all this debt going forward? If you want to try some troubling hypothetical scenarios try figuring out how long it will take us to pay off $45 trillion. It will never happen.

How heavy are the debt shackles for Americans? Let us simply look at the U.S. household debt sector that includes mortgage debt, student loans, auto loans, and credit cards.

Total U.S. households 113,000,000 /Â $12.77 trillion household debt = $113,000 average debt for each household

Now the above is a stunning figure. The median household income in the U.S. is roughly $52,000 so each household would have to put 100 percent of their gross income for two years to pay off their share of the household sector debt. If we run the numbers for the above $45 trillion the figure is simply daunting:

Total U.S. households 113,000,000 /Â $45.65 trillion in multiple sectors of debt = $403,000 average debt for each household

Now debt in itself isn’t necessarily bad. Yet when you rely on debt for the primary engine to move the economy that is when problems begin to arise. The two income trap for middle class Americans has been softened by the use of debt:

The single-income family in the early 1970s had more financial stability and wealth than the current middle class family that has a large part of their income going to servicing large amounts of debt. This all came to a boiling point with the housing bubble.

Middle class Americans are now taking on the brunt of this current correction while the banking sector seems protected from any outside influence. Banks can still suspend mark to market accounting while any middle class household that tries this will be foreclosed on or see their credit rating slashed. Imagine if you had the ability to value your assets as you saw fit at hyper inflated levels. Also imagine that you had the ability to borrow what would seem like an unlimited amount of money at zero percent from the Federal Reserve. Life would be better but you are no part of the banking elite so you have to operate in a world that is governed by artificial market forces. The debt you pay to banks operates under free market rules while the debt banks take on from the government operates in an oligarchic fashion.

The middle class is quickly disappearing. It doesn’t seem like any political party is willing to take on the battle for what is right for the nation.  Piecemeal type of approaches won’t have any impact on a market that is crying for radical reformation. Instead, this crisis has actually provided a platform for the banking sector to consolidate power and really squeeze every ounce of productivity from the middle class. The chains of debt are being tightened on the hands of the working and middle class. The data we are seeing do not show any reversal of this trend.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

KingofthePaupers said:

“shackled by banking debt chains.”

Jct: That’s the reason I named my political party created to abolish the source of the debt chains, the growth of debt by usury, the Abolitionist Party. Unlike the old Abolitionist movement to Abolish Slavery who focused on the metal chains, we’re here to finish the job and focus on the invisible debt chains.

http://johnturmel.com/abprogs.htm are our programs.June 22nd, 2010 at 4:21 pm -

sharonsj said:

To all you Republicans out there: the Republicans talk about family values, but everything they’ve done has made those values impossible. They want a typical family, with breadwinner dad, homemaker mom, and several kids. But if both parents must work in order to have a middle-class life—or these days, just a basic life– then who is taking care of the kids? And if one of those parents cannot find a decent job, then it’s a quick descent into poverty..or a slow descent using credit cards and loans.

What is equally depressing is the change within the Democrats, who used to stand up for the “little guy.” Both parties are nothing but corporate shills. Their corruption is killing this country.

June 24th, 2010 at 4:17 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!