Monetary Policy: Monetary Policy Slamming on Breaks. What do you do when banks don’t want to lend? Become the consumer. Government getting ready to spend to stimulate the economy.

- 0 Comments

Monetary policy is a delicate game of cat and mouse. You raise rates, you lower rates, or you jawbone a little and normally, the markets respond to the Fed like a conditioned hamster looking for a piece of food. Yet the Fed has lost this power. What happens when the public gets a look behind the curtain and realizes there never was any sort of wizard? What happens is extreme market volatility unlike anything we have seen in nearly a century. Now maybe at this point with consumers closing up their wallets, not buying cars, putting away the American Express credit card, and finally deciding to exercise restraint, flooding the system with credit may be counterproductive.

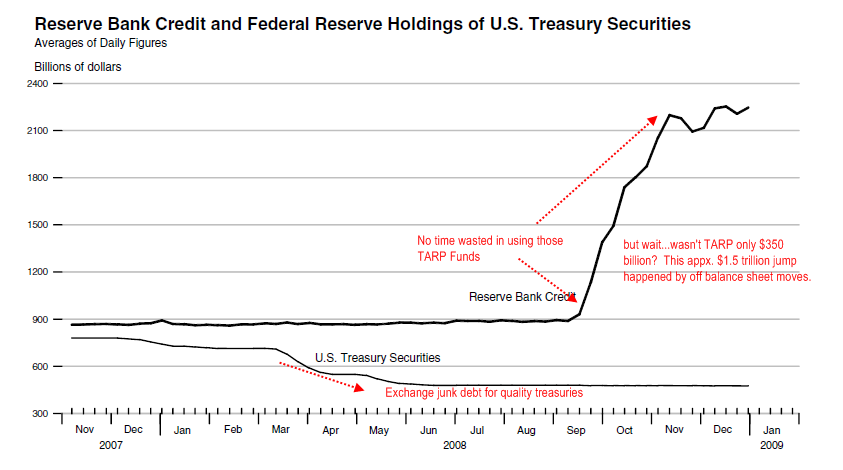

First, let us look at life after TARP and how this has bailed out, I mean helped out banks:

*Click for sharper image

So what we see here is banks hoarding money from various sources including TARP. Yet banks are fearful because the psychology of excessive optimism has now turned to suspicious pessimism. Think for a couple of seconds. If you are bank XYZ you know 100 percent what you have on your books yet you are uncertain of what bank ABC has. ABC knows 100 percent what they have on their books. Yet the problem is, a large part of banking assets are now worth a lot less. Both banks know this. How much less is hard to determine yet you are fearful your buddy bank is holding on to the same toxic sludge as you are. This may not always be the case but that is what is occurring right now. In addition, banks are fearful about lending since they have been burnt so badly and are protecting their capital requirements. After all, some analyst expect one-third of the 8,300+ banks insured by the FDIC to fail by the time this crisis is over.

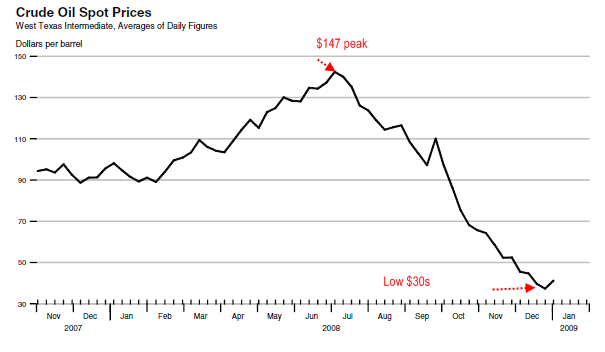

Things have gotten cheaper, at least in the short-term because of deflation yet how long this will last is unknown. First, a large part of this drag down is based on the oil bubble bursting:

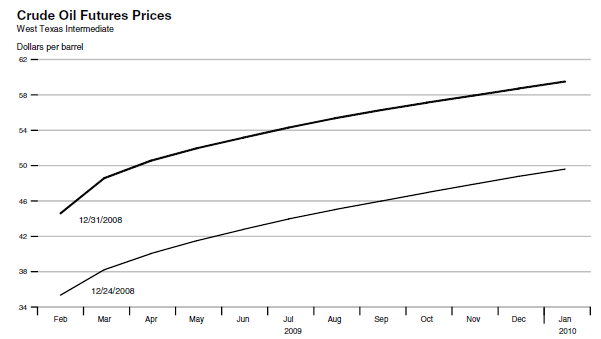

The housing bubble popping was amazing yet looking at the oil bubble pop with such violent speed was also bad for the economy. We went from $147 a barrel to the low $30s in a few months. We’re talking a 79 percent drop! Real estate bubble? Credit bubble? Oil bubble? Commodities bubble? Equities bubble? Bond bubble? How many bubbles can we have!? Yet the oil drop might be short lived given the cut back in production now that many investors may find it pointless to search for new oil at lower prices. The futures market are already pricing in higher oil:

What the above chart tells us is the market sees oil rising steadily in 2009 to close to $60 a barrel. So if we take the low in the $30s to a $60 barrel price, we are talking about a 100 percent increase in one-year. Again, this kind of market volatility speaks more of a very unhealthy market.

So what does oil have to do with monetary policy? A lot. You need to consider oil as a commodity. Another form of money. In 2008 the U.S. dollar rose approximately 5 percent even after all the rate cuts and problems in our economy. This trend may not continue. As I have argued the U.S. Treasury and Federal Reserve would love to see nothing more than the implosion of the U.S. dollar. So when you have oil fall so drastically, this amounts to an immediate stimulus to many Americans in the billions per month. So even though banks aren’t lending per se, saving a few hundred each month serves as a mini stimulus. Yet this may be a small consolation given the extent of damage flowing through the system.

Also, what we see with the oil bubble bursting is how quickly things can change. When oil was at $147, the CPI was going haywire. In June, we had a 1.1 percent jump! So inflation was being talked about. Yet only a few months later in November, the rate came in at -1.7%! Now we are battling deflation. How can you go from worrying about inflation to deflation in 4 or 5 months? You can’t. The average American is feeling deflation; lower or stagnant wages, collapsing home prices, bursting oil, big rebates on cars, and cheaper retail items. Where is the inflation? It hasn’t been here for a long time.

Now this isn’t to say we won’t have inflation. Frankly, given the extraordinary irresponsibility of the Fed flooding the system with credit, I’m not sure how we avoid inflation down the line should that credit make its way into the mom and pop system. Given that historical measures show monetary policy having effects 6 to 18 months later, the TARP and all the other buying and exchanging of treasuries for questionable assets, I would imagine if we were to see any signs of inflation they would appear either in the 3rd or 4th quarter of 2009.

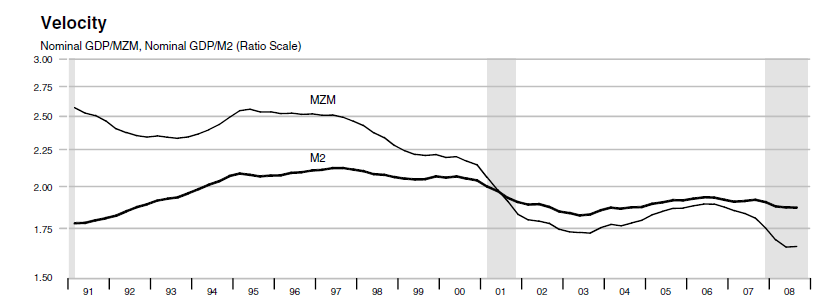

What is probably more disturbing is the velocity of money is slowing down and has been for this entire decade:

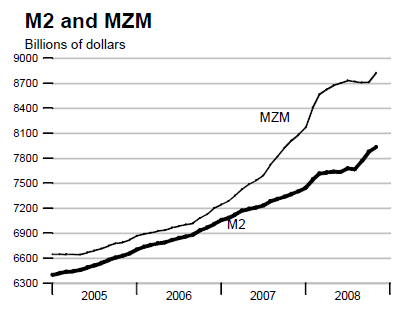

This is fascinating. We are looking at money of zero maturity MZM and also, M2 which is:

M2: M1 + savings deposits, time deposits less than $100,000 and money market deposit accounts for individuals. M2 represents money and close substitutes for money.

M2 is largely looked at to forecast for inflation. So here, it looks like things were all fine and inflation was totally under control. Well, using these measures it is understandable why Greenspan slashed rates in 2001. Yet recently the M3 component has been removed from the public data series (I wonder why); it is no longer measured when short-term repo methods were used to exchange junk for treasuries. Just look at the above chart showing bank reserves. Even though this number isn’t published we know where it is going. I’m no conspiracy person but my guess is this was done systematically to make it difficult for researchers to query any data in a timely fashion. Anyone reconstructing their own data would have to mark it “un-official” and we know how the mainstream media loves unofficial things.

Yet M2 and MZM have been steadily increasing:

So what is happening here? What is happening is money is freezing up in the system. It is no longer traveling as quickly as it once did. Even looking at these two measures, you are left scratching your head. Then what caused the bubble this decade? Credit mostly seen only in the M3 data set. If we would look here, we would virtually see a crashing velocity (heck, banks are hoarding money!) yet a large jump in terms of credit available. In reality, tons of credit is available in the system yet there isn’t enough credit worthy borrowers out there for the amount of available. We just lived through the biggest credit bubble in history and the solution is not more credit. That is ultimately what we are trying to do with this.

Monetary policy has run its course. That is why the next avenue to take is through fiscal stimulus. That is, the Fed and U.S. Treasury have spent all their ammo on banks and lenders yet none of this is making it to the micro economy. So now, the government is going to spend money it doesn’t have. To be fair, the money lent to banks (trillions) was money we didn’t have either. That is why this deflation is more of a shock treatment down yet long-term, we are going through the historical motions that will cause inflation eventually. That is, if history repeats itself.

Keep in mind that the destruction of the U.S. dollar will cause inflation. Oil will cost more. If you travel you certainly will feel it. Exports will all rise. That is, if other currencies don’t implode as well. We are all in a race to a zero interest rate world. We have very few historical measures for what is happening right now since we have so many bubbles bursting, credit flooding the system, a debtor nation who has the reserve currency, and other unique circumstances.

In the end, money has to reflect some intrinsic form of value. The notion of simply printing money out of thin air is by default inflationary. If printing money wasn’t problematic, why don’t we all have individualized printers in our house printing money 24/7? Yet money is simply a medium of exchange. This entire decade money exploded if we measured growth in M3, mortgage equity withdrawals, credit card debt, and other loans. People made the fatal mistake of confusing debt with money.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!