10 FDIC Charts and Graphs Highlighting Bank Problems: FDIC Analysis Examining 2009 Future of over 8,000 Banks Insured by the FDIC.

- 3 Comment

With all the problems occurring in the banking system, it is rather astonishing that so few have failed in 2008. At least that is the perception being put out there for us to digest. Yet the failure of one IndyMac or Washington Mutual is the equivalent of 100 smaller bank failures all at once.

It is true that the composition of bank assets is primarily locked up in mortgages. Yet the true bank failures will be hitting in 2009 with the bust of the commercial real estate market. In this article, we are going to examine the makeup and anatomy of our banking system with data and charts from the FDIC.

Exhibit #1 – Composition of Bank Assets

The above chart should first tell you why the banking system has collapsed with the housing market. Banks rely heavily on mortgages for their asset base. With the housing market collapsing, it isn’t hard to understand why problems rippled through the core of many bank balance sheets. In addition, another large part of the composition of bank assets are secured via credit cards. Bankruptcies are skyrocketing and many people are now relying on credit cards as a last measure. A country with $49 trillion in debt is one that isn’t afraid to take out a loan.

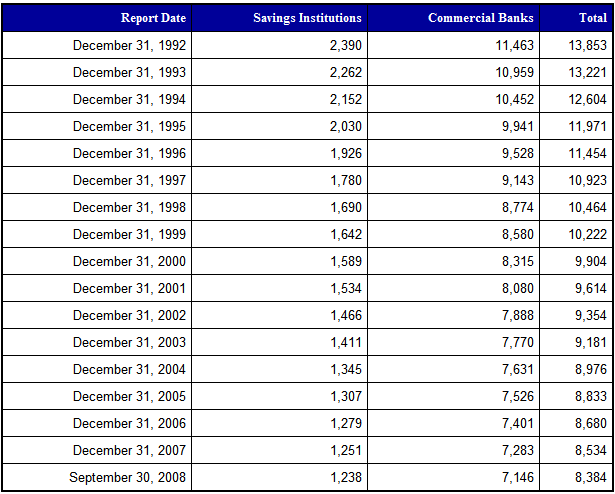

Exhibit #2 – Number of savings institutions and commercial banks

At last count, there are 8,384 savings institutions and commercial banks backed by the FDIC. The FDIC recently upped its insurance for individual depositors to $250,000 through December 31, 2009 from the previous $100,000 limit. On face value, this may sound great but as of August 31, 2008 the FDIC insurance fund is quickly depleting:

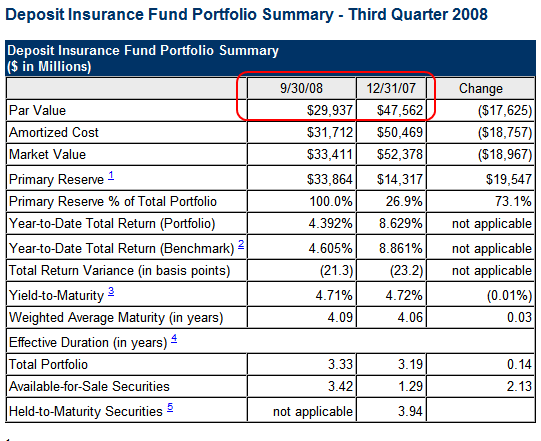

Exhibit # 3 – FDIC Insurance Fund

The fund has depleted over $17.625 billion in less than one year and we have yet to take into account the forth quarter of 2008 which should be out shortly. It is stunning that they can simply increase insurance upwards to $250,000 while the fund is quickly going to zero. Of course the implicit guarantee was made from the U.S. government to back up these funds.

The FDIC has been careful about announcing troubled institutions. In fact, they only have slightly over 100 of those 8,384 institutions on the list which surely will grow. Let us look at the assets of those trouble institutions:

Exhibit # 4 – Assets of FDIC troubled institutions

From last accounting, $115 billion of assets were at risk. These banks are very likely to have problems and without a doubt, we will exhaust that remaining $29 billion in 2009. Meaning, the government is going to have to dish out more money. Money which we don’t have which of course will miraculously appear from helicopters.

Why am I so certain more banks will fail this year? Just look at the composition of banking assets:

Exhibit # 5 – Loan Portfolios

Residential will continue to have problems. Most of the bailouts have been focused here. But what about the large portion of commercial loans? What about the construction loans? What about the consumer loans? Credit cards? Are we going to bailout all these areas. Residential only makes up 26% of the loan composition of banking assets which the FDIC covers. That $29 billion is puny to what is at risk here. The growth in commercial real estate loans is what is going to sink hundreds of banks in the next few years:

Exhibit # 6Â – Construction loans pose biggest problems

As you can see, banks went wild with construction and land development loans. They hit growth peaks at the height of the housing and credit bubble in 2004 through 2006. This is not good. The rate of growth was actually higher than that with residential loans which we are now seeing blow up. These construction loans have very little chance of making it through this crisis. Meaning, many of these loans will default. Many banks simply do not have the balance sheets to survive 2009.

And failures are already rising:

Exhibit # 7 – Bank Failures Rising

What you’ll notice is actual new charters has fallen and mergers and failures have gone up in 2008. Expect more of the same in 2009. The list of problem institutions grows by the day:

Exhibit # 8 – Problem institutions growing

Many of the banks started holding onto adjustable rate mortgages instead of fixed mortgages over the past few years. Now, we are seeing a spike in fixed rate mortgages because this is the only thing the government will now back:

Exhibit # 9 – Growth Rate of ARMs

The derivatives market is such a fantasy game. Take a look at this chart:

Exhibit # 10 – Commercial bank derivatives

This is flat out absurd. The notional value of swaps is approximately the size of 2 times annual global GDP. Don’t expect banks to pay one another. It is now a race between destroying the U.S. dollar and asset value destruction.

What can you expect in 2009? I think the above charts tell you the entire story. Expect commercial and construction real estate loans to bust with less of a safety net than residential loans and expect more bank failures and mergers. There isn’t much that can be done here except to flush the excess out of the system.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Enginerd said:

That last graph is meaningless. The “notional value” of options are the strike price. A put and a call on a stock of strike price 100 have exactly inverse value, but the “notional value” of the two together is 200. This, as you put it, is flat out absurd. Only the absurdity is in the metric being used, not in the actual situation.

I’m not knowledgeable enough about swaps to say for sure, but I’d bet the “notional value” being used above is something equally ridiculous.

January 3rd, 2009 at 6:34 pm -

Bill M said:

If FDIC ever fails which I don’t think it will happed, it is not a very smart economic move, but if it moves into a liquidity crisis, they will just borrow from the “Fed” like every other bank is doing now.

January 3rd, 2009 at 6:48 pm -

John Smith said:

I think the reflection on the numbers coming out of the FDIC and trends moving forward is right on – regardless of how you evaluate the “notional value” as the numbers are big enough that at this point we are left no choice have a back to create some IOUs between the U.S. govenment and Fed to bail out the banks and the economy…and some devaluing of the USD along the way. The question is not if we will come out of this, but rather how long it will take and longer term how many more times we will be permitted to do this with foreign owners of government debt approaching 30% (up from 24% in 2006) and China becoming an ever larger owner. Saving grace continues to be the myth of decoupling…at least for now.

March 20th, 2009 at 7:28 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!