The coming pension crisis: States face a $3 trillion funding gap. Only about 10 percent of Americans now covered by pensions.

- 9 Comment

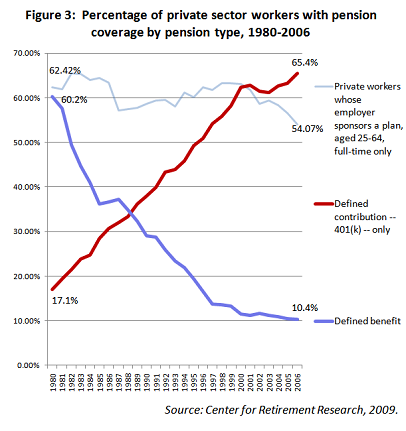

Many Americans look at the crisis in Greece and shake their heads wondering how it is possible for an entire country to derail the future of its younger generation. One big problem in Greece was massive government liabilities funding very generous pensions. Yet this came at an enormous cost. The US is facing a different crisis but the markets have already responded over the last few decades. In the early 1980s, roughly 60 percent of private sector workers had a pension. Today, it is down to 10 percent in the latest data and will likely continue to decrease. For young Americans entering the workforce, the self-funded 401k is likely the only path to having a nest egg and any sort of retirement. This is why so many people get angry when they hear about some in California that retire in their early 50s pulling in annual pensions of $100,000. Over 20 to 30 years this can range from $2 to $3 million of payouts. And we wonder why states face a $3+ trillion funding gap with pensions. Are we simply ignoring another looming crisis?

The shift away from pensions

While the stock market inches closer to a previous peak, the shift with pensions has been rather dramatic:

Only about 10 percent of private sector workers have the opportunity for a pension. This of course is likely lower given the trend above. While many might think this is an issue to deal with in the future the crisis is very real:

“(The Atlantic) In addition, states have funded only about 80 percent of their pension liability, leaving a $3.32 trillion funding gap. Ohio and Rhode Island are in the worst shape, having underfunded their pensions by almost 50 percent of their gross state product. Other liabilities, such as retiree health and dental insurance, also are underfunded. City governments similarly are plagued by underfunded pensions, with Los Angeles underfunding its public pension liabilities by $3.53 billion, with an additional $2.43 billion owed for other employment benefits such as healthcare. As of June 2009, New York City public pension programs had liabilities that exceeded their assets by $39.9 billion with an additional $65.5 billion owed for other benefits.

So both the private and public components of the U.S. pension system are under severe strain, as the Great Recession combined with pre-recession patterns of rising inequality and a diminishing social contract have taken their toll. With fewer workers covered by pensions, this leg of the three-legged stool of retirement security is too short — and growing shorter.â€

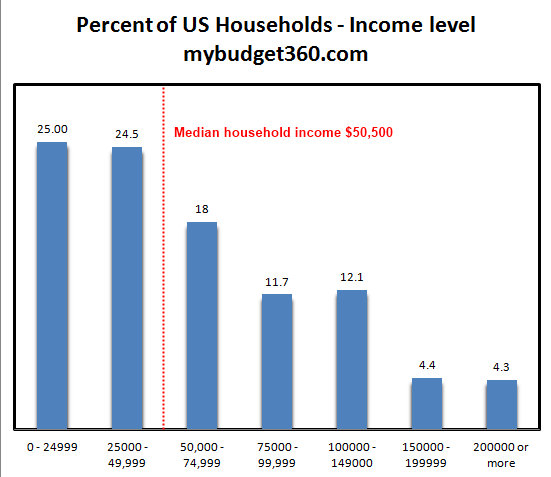

This is incredible. Guess who will cover this gap? The taxpayer. And of course, we are talking about massive payouts for many. In California, over 18,000 people collect pensions of over $100,000. Given that the income figures, this is very generous:

This of course will cause many Americans to become furious at the current situation given that most are left to the whims of the stock market to save up any sort of nest egg. Most will depend on Social Security deep into retirement. Yet for many younger Americans, many realize that the estimated benefits will be cut (we already know that only a 75 percent payout will be had after 2033). For someone in their 20s or 30s, that is reality.

You even have some collecting at much earlier ages:

“(MarketWatch) My two friends on the PATH train would have their blood pressures rise when they hear about stories such as this one from the St. Augustine Record about a 43-year old retired firefighter who will receive a $58,000 pension after 25 years of public service . To achieve this for a private sector worker, they’d have to have nearly $1.5 million dollars in their retirement account. And that doesn’t take into consideration the health benefits that many public service employees will also have.â€

Think about that. Someone at 43 receiving $58,000 a year. Someone working in the private sector would need a nest egg of $1.5 million to make up for this. This is why it is unsustainable. Even at $50,000 payouts given the early age of retirement, these payouts will amount to well over one million dollars. In other words, it is like lottery payouts for many. And this is why the $3 trillion underfunding problem is a big issue.

Keep in mind the pension wasn’t designed to be some sort of lottery winning. The idea that coupled with Social Security, a pension, and your own savings that many retirees would have a modest life after their working years. Yet you have an entire portion of Americans receiving well beyond the median household income into their retirement years for 20, 25, or even 30 full years. Think about that.

$50,000 x 20 years = $1,000,000

$50,000 x 25 years = $1,250,000

$50,000 x 30 years = $1,500,000

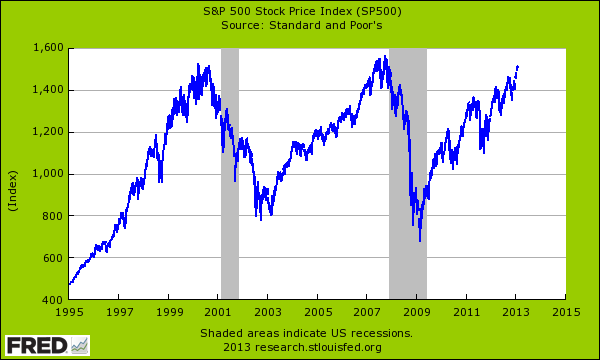

I’m surprised how little coverage is being given to this. Of course, when the assumption was that we were going to be at DOW 30,000 then all of this would have gotten swept under the rug. But instead, we have this:

The stock market is back to where it was in the late 1990s even after the incredible rally from the lows of 2009. So obviously those in the private sector have had a hard time building up their wealth in their 401ks. Yet pensions have always had extremely generous built in assumptions.

A $3 trillion unfunded liability is big. This is baked into the cake. This is going to hit one way or another. Of course, many of those receiving giant pensions right now would probably disagree. Something tells me that they did not pay $1 or $2 million over their working life however. Consider this another big issue we will contend with while many younger Americans are left fighting to stay afloat and are entering a world where the safety net is no longer visible.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

9 Comments on this post

Trackbacks

-

Donovan Moore said:

I live in Illinois where the unfunded pension liability is in the top 10. What they are doing and will continue to do is simply raise taxes and fees to cover this. A perfect example. I own a house in Illinois and in the state of WI. Both the same size. The property taxes on the IL house are DOUBLE of the WI house. The state will take whatever it can to cover this. My advice. Get the hell out of any states with massive unfunded liabilities. It’s only going to get worse. Donovan Moore, Rockford IL and Lone Rock, WI.

February 9th, 2013 at 6:43 pm -

Paul Verchinski said:

It is interesting that you write about the public sector “outlandish pensions” yet you are silent on the “outlandish pensions” of highly paid executives in the private sector and the liability these companies have in the future. Just about all of those executives demand and get a defined benefit pension that is not $58000 per year but millions of dollars annually. The real back story here is some public sector outliers that are highlighted for the mass media and the race to the bottom to abolish pensions. What is interesting when I first started working is the financial communities take on a secure retirement thru the 3 legged stool you mention. Two legs of that stool where to be a reliable source of income with the third, investments, fully recognized as risky and unreliable. This stool is now upside down and most boomers have basically thrown up their hands and are playing hoping poker when it comes to retirement funding. The private sector now basically offloads its pension responsibilities to the public sector (shades of the Great Recession) by going thru restructuring and pseudo bankruptcy and having their pension obligations paid by the Federal Pension Guarantee Corporation. The workers in the US made this country great since WW2. Companies benefitted hugely. Now workers are viewed as throw away cogs in the company machine to be paid the minimum wage and thrown away after years of work. The social compact between labor and corporate management is sadly broken. Who will buy all this stuff when wages have not increased (actually declined) in the past decade? The US is on a downward spiral aided and abetted by corporations. This is the real back story on pensions.

February 10th, 2013 at 8:12 am -

jameswvu said:

I think it really depends on how they are calculating what % they are unfunded right now. New York State is close to 40% underfunded, based on 7.5 % returns. So to me an easy solution is to cut pensions by 40% and voila problem fixed.

February 10th, 2013 at 9:41 am -

Stephen said:

You would also need to look at overcompensated CEO’s with $30 K a month for their lifestyle being a bit excessive. Our whole economy is paying for their excessive consumption as well. The other issue with unfunded pensions is that there was a time where some state executives saw pension funds as a piggy bank for ongoing state operations including bending over backwards with corporate largess. New Mexico is one state that a former governor attempted it and now the pension is part and parcel of the state constitution. Fixing this will now take 1) better management of the pension assets 2) definition of actuarial soundness 3) a willingness of the taxpayer to look at costs realistically …if a senior’s pension and savings are continually pilloried and social security insurance and COLA adjustments are also reduced below the historical average you will see a generation of seniors that will eventually become full wards of the state on food stamps, heating assistance and every other type of subsidy. 4) BOTH the employee and the state need to increase contributions during this downturn and maintain the level of benefits not just for existing retirees but for active members and future members.

February 10th, 2013 at 11:42 pm -

Robert said:

Further information is available at

http://www.pensiontsunami.comFebruary 11th, 2013 at 9:38 am -

Steve said:

So what is wrong with cutting pensions? When United airlines whent bankrupt they cut pensions. 401k’s are wonderful pensions are not. Many good companies went belly up because of pensions. Remember Hostess…. Are we going to destroy the working class because of pensions? Are pensions just another Pinzi scheme?

February 11th, 2013 at 10:18 am -

M said:

Chapter nine bankruptcy.

Class dismissed

February 11th, 2013 at 8:47 pm -

westnewton said:

could you please provide some data which indicates the mean and median total savings for retirement for individuals at various ages and per mean and median total net worth ( including primary residence).

thank you and please continue to enlighten us all.

February 12th, 2013 at 4:06 pm -

stephen said:

Steve, we allowed for the airlines all to play the game of dump the pensions on the feds. That system is now underfunded while still other corporate ceo’s are still taking the money on the run and dumping their pensions on the taxpayer as well. As for Hostess, do a bit of reading please. You will find that the company moved for significant increases in pension funding by the workers. The workers agreed to it taking significant cuts in take home. The management then went on to declare bankruptcy and walked away with the pension assets in their own golden parachutes. Incredible brass. Watch what now happens with the Swiss in their corporation referendum the first week in March (if not overshadowed by our sequestration). All this creative theft of labor by corporate management and boards may be coming to a screeching halt. Remember well the trigger for it.. UBS and it’s Wall Street behavior causing a Swiss Air shutdown. Workers after a while will not stand for being shat upon even in one of the richest per capita countries in the world. That Said, Just informed today that a critical co worker of mine will be leaving because of the pension cuts on the government level. His job? Law Enforcement new recruit screening, agency armory, and field training. I will be janked out of field work to cover for him leaving the public a little less secure. Of course if you are a libertarian you can always bring your own rent a cop or wait 30-40 minutes for state police to arrive, maybe if they are in the area. Two years ago I met up with one National Park Service Officer in the Las Vegas area. His patrol area of hundreds of thousands of acres and hundred of miles of roads and recreation sites used to be covered by three full time officers..Now he is it. Its getting worse out there to a tipping point. Hope we solve our move to facism soon.

February 15th, 2013 at 12:39 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!