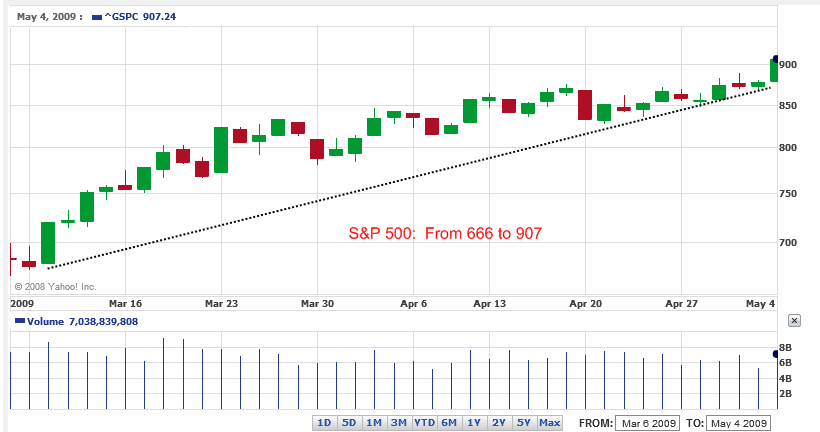

S&P 500 up 34 Percent in Less Than 2 Months: S&P 500 went down 38 Percent for all of 2008. So why are we Still Down 42 Percent from the 2007 Peak?

- 1 Comment

We are witnessing one of the strongest bear market rallies in history. This kind of market volatility only rears its head during extreme environments. One quick fact many market watchers will realize is that if you lose 50 percent of your portfolio, you will need to have a 100 percent gain to break even. How so? Look at it this way. Say you have $100 which falls to $50, a 50 percent decline. A 50 percent increase will only put you up to $75, $25 short of the original $100. That is why even though the market has rallied a stunning 34 percent in 7 weeks, we are still down 42 percent from the peak reached in August of 2007.

Take a close look at some of the rallies during the Great Depression:

Source:Â Alpha Trends

In fact, before hitting the bottom in 1932 the market had 3 sustained rallies over 30%. One of the rallies was for 52% right after the 1929 crash.  An equivalent rally from our March low would put the S&P 500 slightly above 1,000. Yet this entire rally is predicated on weak fundamentals and is occurring because of technical bounces and short covering.

In fact, there have been only a handful of times in history that we have seen a 34% increase in such a short time. The brutal year of 2008 saw the S&P 500 lose 38 percent of its value, for the entire year. Here, in less than two months we have seen a 34 percent jump. This rally has been virtually non-stop:

If you look at the above chart, it is very similar to the 2 bear market rallies during the Great Depression. The 119 to 156 rally and the 85 to 119 rally (both rallies with 30 percent or higher gains). These were short bursts over a few months. Looking at the daily S&P 500 over this rally, it has been a non-stop rally. And you know this is a bear market rally because good or bad news has not swayed the market. This is paramount to negative sentiment bear market rallies and a key to massive market volatility.

First, 24 million Americans are unemployed or underemployed. This is not good. We all know employment is a lagging indicator but when you are losing 600,000 jobs a month, it can lag all it wants. Until employment stabilizes there is no reason for these kind of rallies.

Second, the S&P 500 is still massively over valued. What is the P/E of a negative earnings company? The market is still pricing in a second half recovery. We may stagnate for many years but the current valuations are assuming a short and quick turn around.

The median annual return for the S&P 500 over the past 20 years has been 10.88%. Yet we are doing those kind of moves in a couple of weeks! So things will remain volatile. With the FDIC gearing up to bailout countless banks on special Fridays, we can expect more money to be lost in 2009. Until we see profits across the board and employment stabilizing, there is absolutely no reason for a 2-month 34 percent rally. Tell me, what warranted this kind of movement?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

g. span said:

Why sell any asset?

What do sellers of metals invest in, oil, wine, art?May 6th, 2009 at 1:22 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!