Which state has half of its eligible adults not working? The dismal employment participation rate across the United States.

- 4 Comment

People have a hard time wrapping their minds around the fact that 93 million Americans are not in the labor. In December alone we added over 451,000 to this category. Much of this figure comes from people retiring and those simply not eligible to work but there is a disturbingly large number of people that are eligible for work and are simply lacking a job. There seems to be a perception that all of the people hitting retirement age are somehow prepared to weather the years of older age with a sizable nest egg. Nothing could be further from the truth. Half of older Americans would be out on the streets if it were not for Social Security. The participation rate tells us a different story regarding the economy. It is telling that for the first time in the history of the Labor Department’s tracking of this metric that one state actually has half of its adult population not participating in the labor force.

The state with the notorious distinction of a low labor force participation rate

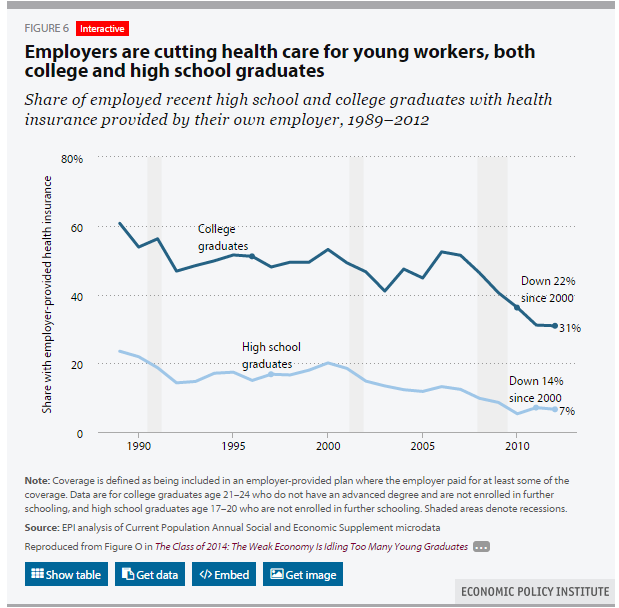

The US has many states that are struggling dramatically even in this so-called recovery. The recovery has not been kind to working class Americans as wages have gone stagnant. More costs are being pushed down onto workers including expenses like paying for healthcare. Lower wages, fewer costs, and you can understand why profits at many firms have been going up on Wall Street.

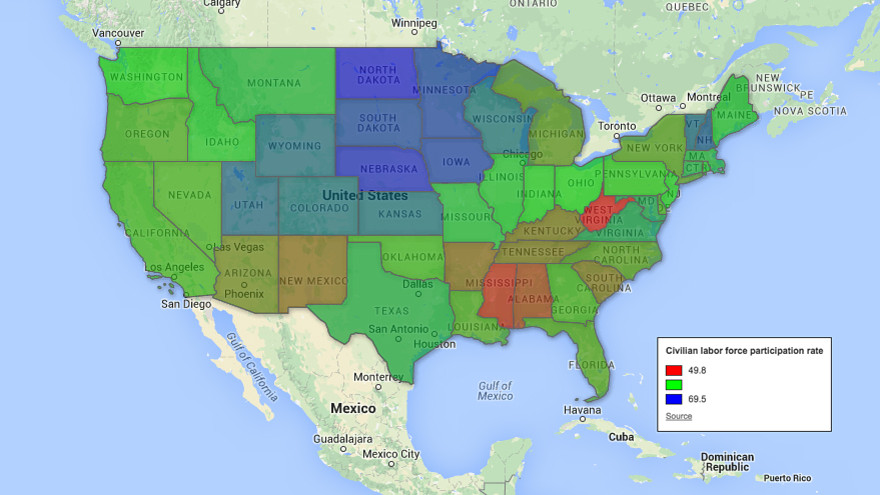

But let us take a look at this map regarding labor force participation rates:

“WASHINGTON (MarketWatch) — West Virginia quietly passed the ignominious milestone of having less than half of its adult, civilian population in the workforce in November.

State data compiled by the Labor Department shows that West Virginia’s civilian labor participation rate has fallen to 49.8%, from 50% in October. The national rate in December was 62.7%.

The Mountain State is the only state in the history of the series, which goes back to 1976, to have fallen below 50%, though Mississippi at 50.8% isn’t far behind.”

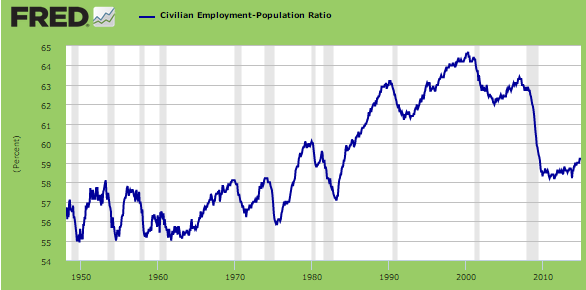

West Virginia has a civilian labor force participation rate of 49.8 percent. Mississippi also has a very low participation rate coming in at 50.8 percent. But to assume that this is an issue for only a few states is actually missing the bigger picture. The labor force participation rate has been falling across the entire nation:

Nationwide we are seeing a generational trend here. Fewer adults in the population are working. Yes, part of this is due to the aging of the country but a large portion is occurring because people are opting out of the workforce. Many younger Americans are going to college and getting deeper into debt to hopefully secure a better financial future.

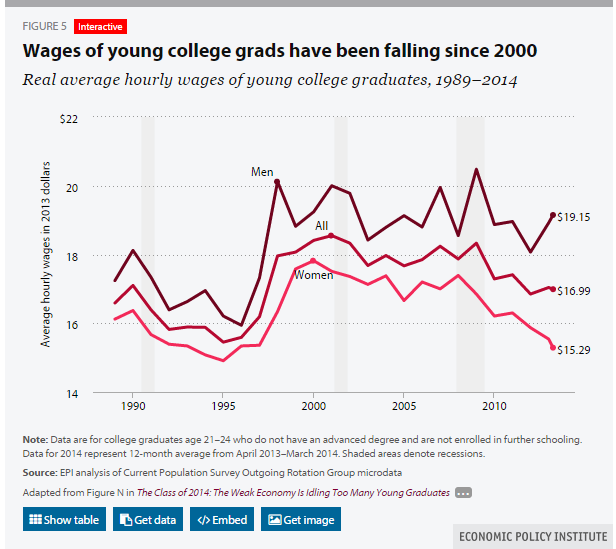

Going to college however does not guarantee wage growth. In fact, wages for college graduates have been falling since 2000:

College students as you know, are not counted in the labor force participation rate since they are in the process of studying. The labor force participation rate has made the unemployment rate appear better than it should be because many are simply opting out of searching for work. This also helps to explain why many in the nation when surveyed don’t truly feel like they are getting ahead financially even though the stock market is up nearly 200 percent from the lows in 2009.

It is hard to imagine one state having half of its adults not working. But many states as the above map highlights are close to this figure as well. You have essentially one-third of working Americans helping to support the other two-thirds. Many costs are also being shifted down to those working while wages are stagnant:

In the end, more money is consumed by daily items like food, healthcare, housing, and at the same time wages remain stagnant. Of course this is for those working and apparently, we have many not even being counted in the labor force.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

welfare.gov said:

got 2 dozen states where almost half the working age population don’t do chit except sit around and watch endless amounts of tv.

so the real unemployment rate conservatively could be close to 40%

damn,no wonder crime and poverty is soaringJanuary 16th, 2015 at 8:27 pm -

Ame said:

I recently heard on some commercial advertising a for-profit college that the U.S. will need 4 million college grads by 2020.

Where did this stat come from, I wonder?

January 17th, 2015 at 12:33 pm -

Jim said:

It would be interesting to compare national historical labor participation rates separately for females and males.

January 20th, 2015 at 5:04 am -

Jim said:

Labor force participation by women in the U.S. rose steadily for 60 years and peaked in 2008. Meanwhile, labor force participation by men has been steadily declining since around 1949. See link to article here:

http://www.slate.com/blogs/moneybox/2013/04/08/labor_force_participation_by_gender.htmlJanuary 20th, 2015 at 8:33 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â