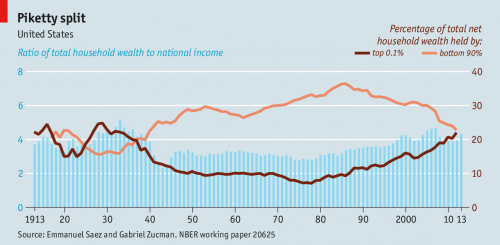

The modern day Gilded Age of wealth: Top 0.1 percent now have more wealth than bottom 90 percent.

- 0 Comments

Wealth inequality is an extremely touchy subject. The main catalyst for “change†in the recent election had to do with most Americans being dissatisfied with the economy. But how can people be unhappy if the stock market is at a peak and housing values are going up? The reason for this is that most Americans don’t own stocks and the push up in housing values is largely driven by investors. That is a big issue. You also have 1 out of 3 Americans living paycheck to paycheck. All of these items combined make for a very unhappy populace. The election was fueled by anger but both political parties play on the notion of change but underlying it all is massive amounts of money keeping the financial powers well in place. The Fed has grown its balance sheet to over $4.4 trillion and much of this has been leveraged into the financial sector. And what has happened? Big banks are even bigger and are funneling their money into real tangible assets in the real economy. This includes single family homes which ironically, is the biggest source of net worth for households. So even this area is now being bought up by the new Gilded Age masters.

Wealth inequality as bad as it was in the years prior to the Great Depression

The top 160,000 families in the US now own as much as the bottom 90 percent of American families. Now if you live in a consumption based economy, this should worry you. The US is heavily a consumption based economy and most people are barely scraping by.

Take a look at the disbursement of wealth over the last century:

This becomes problematic because there are only so many yachts, Ferraris, hedge funds, and other luxury items available to the ultra-wealthy. It becomes a bigger issue when our central bank, the Federal Reserve was used as a lever like the one used by Archimedes to inflate the stock market and housing market. Yet the big winners are not the public. Don’t think that all of this came free of cost:

There is massive risk in the system. Yet the public is largely being pushed out of the market because of economic forces. We hear inflation is low but just look at the cost of housing, college tuition, or healthcare and let us revisit that subject. Incomes are stagnant and people are really struggling to get by in spite of a record in the stock market because the wealth is not filtering down.

Here are two charts showing this artificial boom:

Why are mortgage applications so low if things are great? Well as it turns out big investors don’t need mortgages to push housing values higher. The public is still in a bind financially so they are simply not out in the market buying homes.

Take a look at employment:

We have over 92 million Americans that have dropped out of the labor force. When you run the numbers carefully you will find that we have 1 out of 3 workers supporting two-thirds of the nation. That is not sustainable. It also contributes to a new modern Gilded Age class with lots of capital to dispose of in the economy. It is no surprise that most of the new jobs coming online are in the low wage service sector.

Will things change? It is hard to tell since capital is floating around the world. Large companies are making massive profits abroad and in many cases, can do well in spite of the US economy yet still leverage the infrastructure of this country, including its laws and regulations. They push this vision of austerity for the public but are the biggest recipients of corporate welfare. Corporate welfare impacts the rest of the country because we find debt inflation pushing up the value of housing, college, and auto costs and this is ultimately an outflow of a household budget. Business is a necessary part of our economy. Finance should be viewed as a utility, not as the guiding force. The new Gilded Age is fully in place and the trend doesn’t seem like it will be reversing any time soon unless things radically change. For one, we can start by getting big money out of politics.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â