Debt Apocalypse: US Student and Auto Loans Hit New Record of $2.6 Trillion.

- 8 Comment

American consumers are once again spending beyond their means. Just a few months ago there was a startling headline reporting that US consumers now had over $1 trillion in credit card debt outstanding. That seemed astonishing in itself but now looking at debt levels in other sectors we find that auto loans outstanding are also over $1 trillion. Keep in mind this is for an item that will lose value once it is taken off the lot. You also have student debt over $1.4 trillion which is amazing given many young Americans are working in jobs that really don’t require a college degree. The debt apocalypse is once again upon us and we better hope the economy keeps on running on fumes or we will be confronted with another solvency crisis shortly.

The debt numbers broken down

The figures are stunning to see:

Student debt outstanding: Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1.44 trillion

Auto loans outstanding:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1.12 trillion

It is no surprise that we have so many Americans struggling under the weight of debt and then we wonder why many families are too broke to even afford an entry level home. Many young Americans are entering the workforce with what amounts to a mini-mortgage.

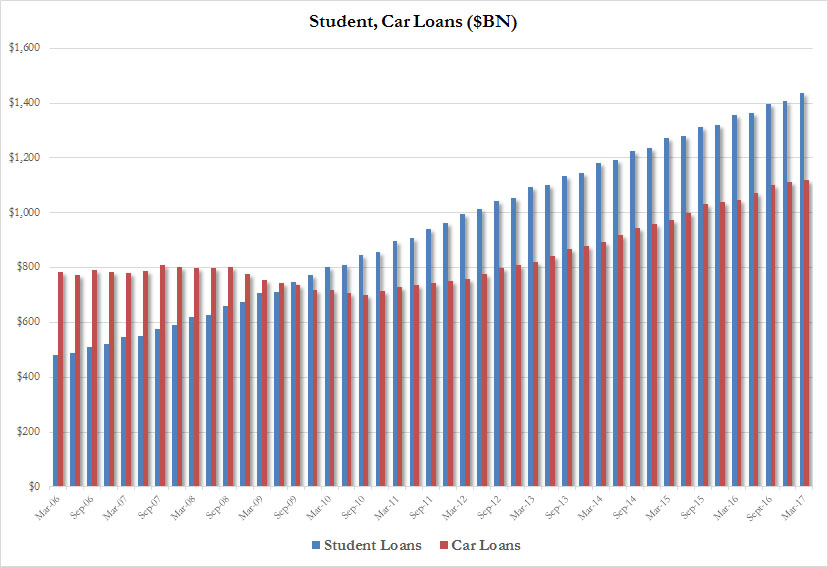

Here is the incredible growth in student debt and auto loans:

The problem of course is that inflation in college tuition continues to move up unabated. The government in collusion with big banks makes a racket out of this. Many students continue to go into debt and really have no idea how much it is going to cost them until they start paying their student loans six months after graduation. In many cases, some are working low wage jobs and have a tough time paying off the debt.

The auto loan market is troubling to look at because this is not a wealth building sector. Sure, we have gorgeous and beautiful cars to choose from but is that worth sacrificing your financial future? Many think so. Or many don’t realize if you took that $300, $400, or $500 car payment and invested it instead of having a rusty beat up car after 15 years you could have a nice nest egg.

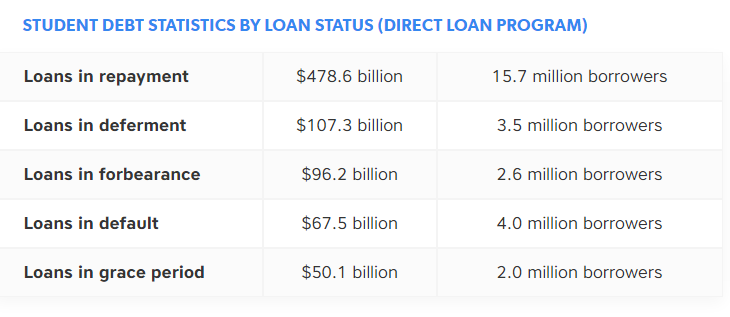

And you don’t think people are having a tough time? You have 4 million people that are in default to their student loans:

But look at the other categories like deferment, forbearance, and loans in their grace period. A large chunk of student loans are not actively being paid. So once these enter into the repayment phase you can expect many will go kaput as well.

I know it is hard to see this as an issue right now with the stock market at a record high, real estate at a record high, and levels of debt at a record high. But this is the siren call of a bull market. Bad investments and financial decisions are being masked by a rising tide of exuberance. Yet we will find out who is financially swimming naked when the tide rolls out.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!8 Comments on this post

Trackbacks

-

Joyce Perkins said:

So why are we still sending money to Terrorist Countries. I just read Article that Donald Trump has increased the money to the PA Terrorist.

And he campaigned on “Putting America First”. Should have know that was a lie.May 7th, 2017 at 6:43 pm -

James Andrew Spruyt said:

I met a young man fresh out of college last week. 5 years to get Marketing degree at a state college in Kali. He has $200,000 in debt! He has defaulted on his private loans and has not filed his federal taxes because he does not want the IRS to know where he works. I am not making this up, he literally lives in his mothers basement.

He was in a panic. It has dawned on him that he will NEVER be able to pay back the loans. I think he was betting on Hillary or Bernie for “debt forgiveness”PS. He sells Solar PV systems for a living. He is clueless when it comes to “Marketing”.

May 7th, 2017 at 7:11 pm -

BKW said:

Exactly what is there to invest in? The markets are also a racket run by criminal government at the direction of criminal banks. After 15 years of investing 300 per month you end up with paper promises backed by exactly nothing. And the protected classes can’t be held accountable for their criminal acts. Wait till they try to make the productive pay for their unearned pensions. There will be blood…

May 7th, 2017 at 8:59 pm -

Mike Ayala said:

It is a G.o.o.d. deal to Get Out Of Debt. One good way to not be in debt is to not get into debt. Incurring debt is effectively making a presumptuous mortgage on one’s own futurre productivity. That might be a viable strategy in a vibrant healthy growing economy, but I suspect it is not too wise of a thing to do in a front-wheels-over-the-cliff economy laden with heavy public and private debt only stabilized and being held up from crashing over the side into the abyss by a bubble machine which is long overdue for a service and is running out of bubble solution.

God bless and protect you all,

Mike Ayala

May 8th, 2017 at 4:04 am -

LOUIS NEMETH said:

This is necessary information.

May 8th, 2017 at 10:12 am -

Michele said:

Same ole, same ole. Nothing new under the sun. The scam that keeps on keeping on.

May 8th, 2017 at 11:07 am -

control p said:

just 2 more for the bailout pile,and the pile is growing,mortgage bailout 2.0,student loan bailout,stock market runnin bailout,obamacaid /trumpcaid bailout,auto bailout,bank bailout2.0,credit card bailout,gov’t bailout 2.0,add it all up ,oh,it’s not so bad,$12 trillion in one key stroke=balance paid!!

May 8th, 2017 at 4:12 pm -

max said:

“If the American people ever allow private banks to control the issue of their money, first by inflation and then by deflation, the banks and corporations that will grow up around them will deprive the people of their property until their children will wake up homeless on the continent their fathers conquered.†–

Thomas JeffersonThe FED is Jewish thats why

May 13th, 2017 at 7:16 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â