Credit Card Monopoly: Top 5 Issuers Hold $550 Billion in Credit Card Debt Taking up over 60 Percent of the Entire Credit Card Market.

- 5 Comment

As Americans rush out to shopping centers around the country on Black Friday many retail outlets have their fingers crossed that consumers will spend money that is clearly not on their balance sheet. The average American is maxed out. In fact, the typical American family has been subsidizing a decade of stagnant wages with credit cards and housing bubble equity. Credit card companies are turning the screws on average Americans even after taking trillions in bailout money that was supposed to be used to increase the flow of credit. Nothing is further from the truth. As we will see credit card companies have willingly taken taxpayer money while upping onerous fees and removing credit from the economy.

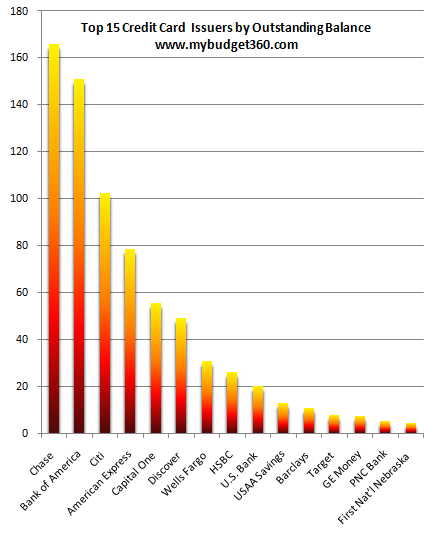

Many card companies use a Proctor and Gamble approach to marketing. That is, many shoppers believe there are many brands of cards out there but in reality, only 5 issuers control 60 percent of all outstanding debt. Similar trends are seen when we look at the 8,000 banks insured by the FDIC. It should come as no surprise who the top 5 credit card debt holders are:

*In Billions of $USD

What a shock that Chase and Bank of America, the two largest banks are also the two biggest players in the credit card game. The top 5 is rounded out with Citi, American Express, and Capital One. These five institutions hold 60 percent of all outstanding credit card debt in the U.S. When you hear that the “credit card industry” is pushing legislation it virtually means that these five are spearheading anything they want. These companies hold $550 billion of the $889 billion in outstanding credit card debt. They are also the biggest recipients of taxpayer funded bailouts. You would think that these banks would be helping the average American who is in economic pain and actually, saved them during their turmoil. Nothing could be further from the truth:

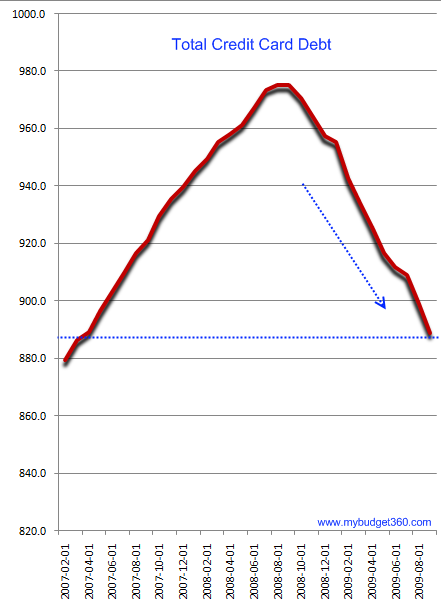

Source:Â Federal Reserve; In Billions of $USD

Since July of last year, some $86 billion in credit card debt has been removed from the system. At the same time, these banks have sucked up trillions in taxpayer money to fix their troubled balance sheets. In a hypocritical twist, the banking lobby is now issuing a threat that credit card rates are spiking and fees increasing because new legislation is now going to get tougher with banks. These institutions have the gall to say this after receiving more money than any institution in the history of humankind. The U.S. Treasury and Federal Reserve issued a massive warning that without bailing out the banking sector all would be lost. What wasn’t specified is that all would be lost for the banks that played on a corrupt structure of crony banking and illicit practices that would make loan sharks blush.

The pretense was bailing out the banks would allow lending to continue. This was the biggest bait and switch in history. In reality, banks needed the money to stay alive and patch up their horrific balance sheets with troubled mortgages and horrific commercial real estate debt.

What is even more astounding is the average credit card interest rate has gone up while the Fed has slashed its funds rate to near zero. Banks claim that this is to make up for the new added risk. How convenient for them now that they have taken the trillions from taxpayers. Are Americans going to stand for this? Many are taking to the streets for bills that will cost a few hundred billion while trillions have already left the bank. Where is the outrage for the biggest wealth transfer in history?

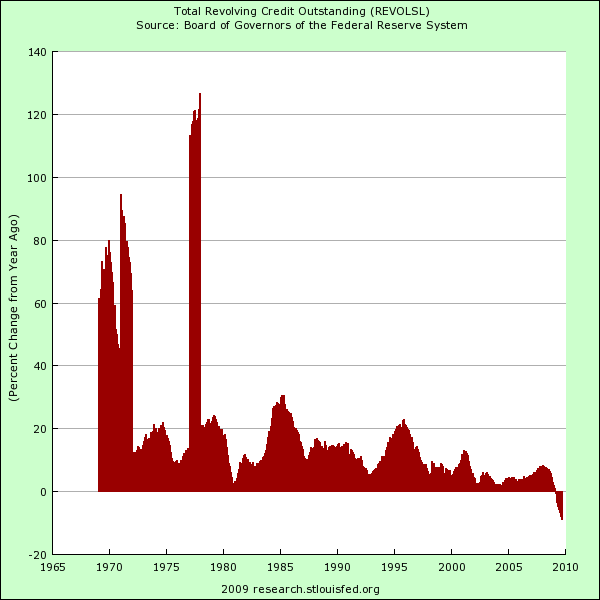

Revolving credit has never contracted on a year over year basis since data started being kept back in the 1960s, until now:

This without the bailouts would make sense. Banks need to protect their balance sheets so they need to tighten up their standards. Yet the bailouts were supposed to provide some access to average Americans who are struggling with 17.5 percent unemployment and underemployment. Otherwise, what was the point of bailing out the banks? To let them charge 79.9 percent interest rates on customers? To allow them to charge $39 overdraft fees raking in billions from those least able to pay for it? To allow banks to set financial fee traps that will make consumers pay fees from every corner? We are now over two years into this crisis and no substantial reform has occurred.

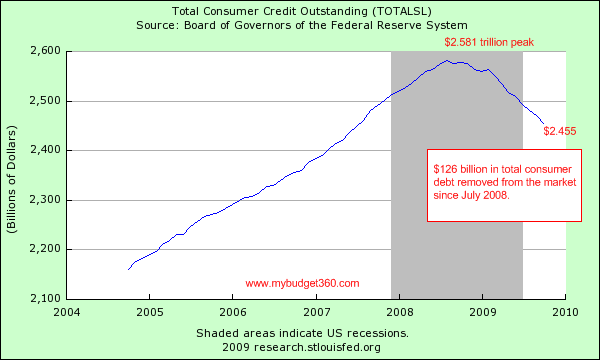

Credit card debt is only one part of consumer debt. We also have non-revolving debt that includes auto loans. Throw that into the mix and the contraction is wider:

$126 billion in consumer debt is now out of the system since July of 2008. Those that can are paying debts down and those that can’t are filing for bankruptcy in larger numbers. As people hit the shops on Friday, many will once again go into deeper debt on credit cards that have more potential pitfalls. Banks realize that they can’t squeeze blood out of a turnip so now they are going after good standing card holders to make up for the difference. Don’t use your credit card? You might get a charge. Not using your credit line? Let us reduce it for you even though this will hurt your credit score. Credit card companies are operating like loan sharks and have no remorse in what they are doing. In fact, many think it is funny. You see the leeches send their representatives to talk to the public. Dressed in tailored suits they tell the public how wonderful it is for them to gouge you financially. It is a game of no risk for them. These people need to be handcuffed and thrown into prison for the robbery they are doing. They laugh at the laws on the books since they were created by their own friendly lobbyist. When will this change?

There might be thousands of credit cards out there, but don’t be fooled. Five big banks hold 60 percent of the market. When they talk about the “industry” it really means the big gatekeepers. When you see people shopping on Black Friday just remember that many are going into debt with the big five credit card pushers.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Al said:

I’m tapped out, so I gave up on most of my cards about a month ago. I’ve been out of work since early Dec ’08, cleaned out my pension and 401ks to keep me afloat and about mid- to late-October, ran out of cash. Unemployment doesn’t come close to paying the bills, so I’m now in a race to see what comes first–foreclosure etc or actually finding a decent job. My mortgage hasn’t been paid for November, but I hope to have that paid within the next couple of days. December’s mortgage? No clue. …and with 5 kids, Christmas is going to really be difficult this year.

And of course, these banks that got bailouts are ringing my phone 8-10+ times/day with the collection calls. So now I can’t even get legit calls because we need to turn off the ringers to keep from going mad.

Happy Holidays!

November 27th, 2009 at 4:31 am -

Willow said:

The minute we all stop worrying about our “credit score” is the minute we can free ourselves from this mess. You are not your credit score. From what I understand the FICA score depends on how much money a bank will lend you which seems to be calculated by their own formula. Mr. 360 you explain FICA because you are way better than me on how that is calculated.

Okay, folks, time to break free of this crap. If everyone in the country has 0 for a credit score guess how much that score is going to matter? Zero. Who are they going to lend to? Themselves? The market is driven by value. Value is determined by what someone is willing to pay for a thing. So, as you can see, if nobody is willing to pay $50 for a cheap cotton t-shirt made in China, the price will go down. Just look around at all the sales. They have to move merchandise and in order to do that they have to reduce the price to make it worth buying. Therefore, we have a lot more power than we are led to believe.

Look, just stop buying crap. Honestly. Just stop. Go on strike. Buy food, pay your bills and rent and blow off the credit card companies. They will sell your debt to some collector. Thus, they’ve already been paid. In fact, if those banks accepted TARP money effectively they’ve already been paid by the government who paid them with your Tax money. So, it seems to me that you’ve already paid your bill via your taxes. Why should the banks collect twice? Also, the fact is that much of this debt the banks claim is owed to them probably has already be bundled, securitized and sold to some investor. If that is true then they don’t own the debt anyway and they’ve already been paid.

As for the collectors? Get caller ID. It’s probably no more that $5 a month extra on your bill. Anybody you don’t recognize let it go to voice mail. Then, erase the messages from the collectors. Give your friends your cell phone. Again, any number you don’t know goes to voice mail to be screened. They can’t take us all to court, can they?

Don’t you think it’s time we reconsider exactly who has the power here? Why should we be victims of these scams? There are 300 million Americans in this country. We don’t need to protest out in the streets where the cops will be ready with their tear-gas and rubber bullets. Most of us are just too old to do that. But we can go on strike, can’t we? We can just hunker down and refuse to budge, refuse to spend and refuse to pay. Lock it up and shut them down.

Cut up those credit cards and toss. Go cash only. Use your debit card instead. If we did this for 30 days, the whole Ponzi scheme will crash.We’ve got a lot more power than we think. So, for the love of God…THINK DIFFERENTLY!

November 29th, 2009 at 10:33 am -

steve said:

Brilliant article! Thanks!

November 29th, 2009 at 1:55 pm -

Robert said:

Great Job Willow!

I have often asked, “What if the American people just STOPPED PAYING these companies?” They charge criminal interest rates that no one singed on to initially, accept taxpayer bailout money and then turn around and screw the people who bailed them out in the first place.

Here’s the deal. Wall street, government and the banking cartel are a CRIMINAL enterprise. The American people are finally waking up and realizing this. The sad part is that nothing short of a second American Revolution will stop their criminal behavior, as all branches of government have been corrupted.

Stop playing their game. Willow is right. Hit them in the pocketbook.

Who gives a rat’s ass about your credit score when your family is starving and the very people we elected are bankrupting our nation. The government certainly doesn’t care about their credit rating and continues to mount debt upon debt.

“Do as I say, not as I do” is their motto!

I see our boys dying in a war (non declared) that should be fought to win…not like another Vietnam with these candyass politicians who haven’t worked a real job in their lives, let alone have any military experience to make a qualified decision. We watch the Obamas and all the social elite going to the million dollar parties, yet our children are starving in the streets and we are being thrown out of our homes by the very companies that received our tax dollars as bail out money. This is CRIMINAL and must stop now.

All I can say is if you are tired of being a slave to wall street, the government and the banking cartel, you better had take action now, as this country as you know it is going to change overnight….and in the not too distant future.

Fellow Americans, WE MUST UNITE AGAINST THIS CORRUPTION and take back America from the usurper in chief and his cronies.

November 30th, 2009 at 6:12 am -

Blair said:

Credit card company of which I maintain my largest balance and have been diligently trying to pay off for over 2 years just raised my APR from 11.99% to 17.99%!! Called them up and literally had no negotiating power with them but managed to get them down to charging me 14.99%- gee, thanks for screwing me over just a tad bit less!! Admittedly the debt is my fault and I got myself into this mess but they really have a way of kicking the man when he’s down. They had the gall to say the increase was due to an “economic hardship rate increase”!! Oh really, who’s hardship?? Let’s see, I’ve been unemployed for over a year now, networked & applied to over 1,000 jobs since then with no results and used to work a well paying mid level executive job with great references and experience. 31 years old and broke – great American dream!!

December 1st, 2009 at 9:46 pm