Federal Reserve ZIRP has essentially destroyed household income growth: Households headed by those 45 to 54 see their real household income growth drop by 16 percent from 1999.

- 0 Comments

The Federal Reserve has pursued a zero interest rate policy as a mechanism for pulling the US out of the financial crisis. Interestingly enough low rates and heavy speculation were part of the cocktail that led us into the crisis in the first place. Ben Bernanke recently mentioned a bit of concern that speculation is once again entering the markets. The Fed of course is always cautious in their wording including saying things like sub-prime loans were no issue in 2007 right before the economy tanked. The Fed is truly in uncharted territory here with a balance sheet of $3.3 trillion and nationwide with incomes stagnating, the ZIRP move by the Fed isn’t exactly helping the middle class. A modest amount of inflation is disastrous when you are seeing your income stuck in neutral or seeing it move in reverse. Even older Americans are seeing tougher challenges (although young Americans have faced the brunt of this recession). What is the aftermath of ZIRP?

ZIRP and Incomes

It is no mystery what the Fed has done with interest rates:

Keep in mind that in 2007, interest rates were brought back up after the insanity that was brought on by the first housing bubble. Yet by the time the Fed raised rates in 2007, it was already too late. Ironically, the Fed decided at this point to fight the current fiscal crisis with what essentially led us into the crisis before. Low rates that encouraged massive speculation were once again introduced into the market.

Today the low rates are creating massive speculation in the real estate market by large banks and hedge funds. Yet this time, the interest is with rental properties. It is clear that overall, many Americans are being edged out either by rising rents, property values, or the inability for a family to even purchase a home. Part of this also comes from the Fed’s balance sheet allowing banks to put naughty loans into perpetual purgatory.

We often read that older Americans have done well in this recession. We even hear a sigh of relief since the student debt problem is one for the youth (assuming you don’t care about the financial future of your kids). Yet looking at income growth it isn’t exactly clear that this group has done well:

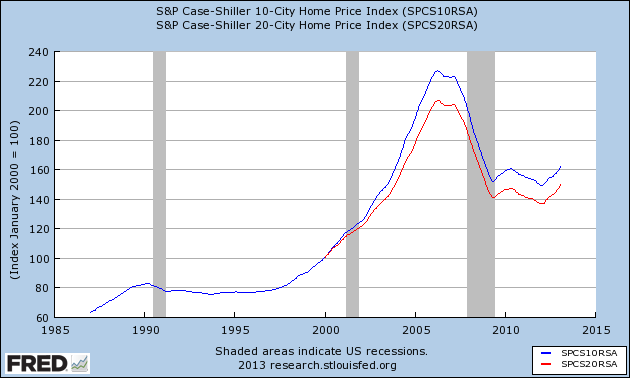

Real household income growth has declined by 16 percent for households in the 45 to 54 age range. This is important because this age group rode two very important periods in our economic life cycle that are important. They had a massive bull market for stocks but also had a chance to get in early on the tech bubble and also, the housing bubble. While a good portion of this wealth has evaporated into thin air, time in the markets is one big way to win. Also, real estate prices were priced within a historically healthy range up until the 2000s:

From the late 1980s to 2000 real estate prices around the country were priced in a very healthy range. It is no coincidence that the low rates of the 2000s led to this housing mania that we lived through. Yet the Fed is recreating a very different real estate bubble in this go-around because ZIRP is basically benefitting only banks and hedge funds here that are now crowding out regular home buyers.

As we have mentioned, regular Americans have seen their incomes stagnant for well over a decade:

Too big to fail led to the crisis and yet nothing has really been done to solve it:

“(USA Today) Asked about these efforts Friday, Bernanke said that the Fed and other banking regulators were working hard to put in place the regulations needed to implement the too-big-to-fail provisions.

“Too big to fail is partly a credibility issue on the part of the government,” Bernanke said. “Will the markets believe the government will go through with its commitment to wind down an institution?”

If you read between the lines, it is ZIRP from here until eternity. I’m sure the Federal Reserve has the concerns of average Americans at heart before those of their banking members.      Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!