Government Employment and Bankrupt City: Federal and State Government were Last Secure Employment Sectors. Financial and Economic Contraction.

- 1 Comment

States across the country are facing unprecedented budget shortfalls. A total of 44 states face budget shortfalls, which for all practical purposes puts the entire country in a uniform crisis. The state of California is in a state of fiscal panic. Currently the state faces a $42 billion budget deficit and the State Controller has decided to hold back on income tax refunds in order to pay for other services. It would appear that furloughs are still on there way starting this Friday for tens of thousands of employees. Yet the state still idles in a weird sort of punch-drunk love.

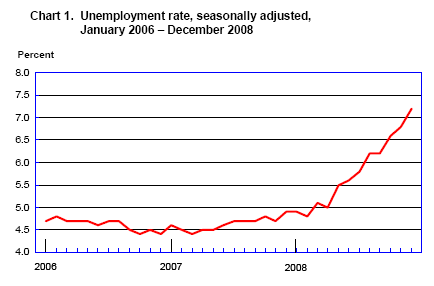

This sort of self induced delusion may come from the velocity of how quickly things have gone from bad to worse. Let us first take a look at the overall employment situation:

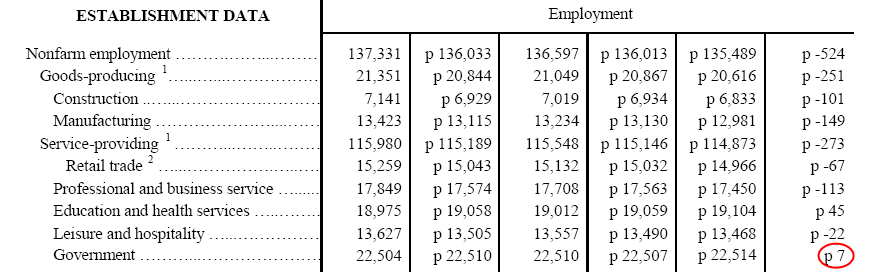

The current unemployment rate completely understates the nature of our problem. We need to realize that through this recession which started in December of 2007, government employment had been expanding. In most recent months, this last bastion of hope has started to sputter out. Let us examine some data:

The only 2 sectors which saw some growth in December were Education/health services and government. Yet the growth in these so-called “recessionary proof” categories is now falling. The government sector makes up 16.6% of all non-farm employment in the United States. When the unemployment report comes out on Friday it will be important for us to see if these numbers are still positive. And with a stimulus plan in the works, we need to keep an eye here to see the actual percentage in employment sector shifts.

We are currently in an awkward state. Our Federal Government through the U.S. Treasury and Fed seem to have an unlimited amount of money to throw at ailing banks, lenders, Wall Street, homeowners, ailing automakers, and every other group you can imagine. Yet on the other side, many state and local governments are expected to balance their budgets and live within their means. Talk about cognitive dissonance here.

Job cuts are coming fast and furious in many companies. We are losing at least half a million jobs a month and more people are simply stuck on unemployment insurance or unable to find other employment in what is the worst economy since World War II. Yet if you want to see an example of the problems in our system let us take a look at the city of Vallejo California.

Vallejo California – A Bankrupt City

Vallejo is a city with 121,099 located in Solano County in Northern California. It is located east of San Francisco so you get a similar dynamic of what is happening in Southern California with the Inland Empire. That is, many people moved outwards from the hyper expensive coastal region to more affordable areas. Yet Vallejo has a unique characteristic. It filed for bankruptcy.

Vallejo has become the largest California city to ever file for bankruptcy. Much of this was buried in the mainstream media because we are having 20 historical events hit every week and this was simply not on the radar of many. Yet this is an important case to follow because the city largely filed for bankruptcy because of high pension and employment costs. Salaries and benefits for public safety workers account for 80 percent of the general fund budget of the city.

Now here in California a case like this would be laden with political maneuvering and ultimately a bluff. You normally hear some jawboning about things going off a cliff and eventually, something gives and nothing really happens in terms of the budget. Well this time politics can’t save a state with a $42 billion shortfall. The bluff was called. What is more important here is that the case is still being hashed out but this can set a precedent for other municipalities that will fail in the upcoming years. Pensions are enormous costs for local and state governments and how this turns out will be indicative of other future cases and may even encourage some areas to actually file for bankruptcy.

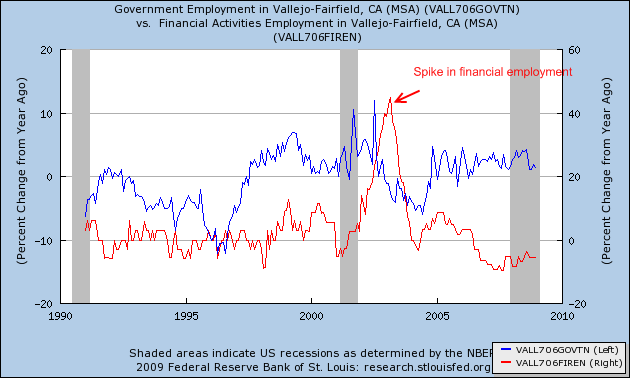

This is simply a microcosm of the world in which we live in. I decided to dig deeper into the city and what we find is similar to the nationwide employment data. That is, government employment is still not adjusting to the current economic reality:

This is a fascinating data point. You can clearly see the spike in financial activity employment due to the massive California real estate bubble in the first half of the decade and now the negative year over year declines. But what is also fascinating is the growth in government during this time for Vallejo. Even as the current crisis unfolded, government employment in this bankrupt city held steady. You show me one bankrupt company that hasn’t had to make massive layoffs.

In a state like California so dependent on sales tax, property tax, and income tax we are facing a triple whammy. Sales are down because employment is down. A 3 decade long housing bubble is exploding at epic proportions. And there is little to tax when your state has 9.3% unemployment.

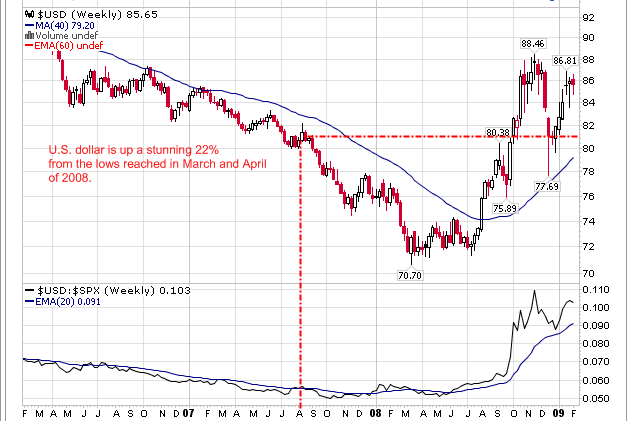

Where do you get the money? The U.S. Treasury and Federal Reserve seem to think that crushing the spirit of the dollar is the ultimate answer yet let us look at their futile attempts:

The U.S. dollar is up a stunning 22% from the lows reached in March and April of 2008. Now why is this significant in the context of government employment? Well you need to realize that we are financing our current spending through foreign investment largely fueled by the sale of U.S. Treasuries. Much of this has driven the yields to practically nothing and the Fed now only has one way to go and that is up. Now keep in mind this U.S. dollar rally is something the Fed and Treasury do not want. Why has this occurred? Well let us look at the basket of foreign currencies that make up the U.S. dollar index:

-Euro

-Japanese yen

-Pound Sterling

-Canadian dollar

-Swedish krona

-Swiss franc

Well guess what? Many of these countries have housing and financial bubbles rivaling the U.S. The Pound has recently fallen off a cliff adding pressure to a higher dollar. Europe is in deep trouble and they have massive government spending. Even places like Sweden are unable to avoid this mess.

The stimulus bill (which it seems will pass) needs to be handled with extreme caution. Take a look at a city like Vallejo. Is it good use to fund the massive pensions of some state employees while newer workers get shafted with no protection? What good will that do? Just look at the charts above. The stimulus will need to have surgical precision but just look at the U.S. Treasury and Fed and tell me if that is the case. With the TARP Hank Paulson basically said, “can I have $350 billion pretty please?” and he basically got it. No wonder why we’re in state of trouble.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Catman said:

In reference to the comment about California being bankrupt, I think it needs to be emphasized that the State Controller refused to to issue IOUs and place state employees on furlough until a court order FORCED him to comply with the governor’s order. In addition to which the State Controller, Mr. Chiang, has spent an estimated $2 million on new furniture for his office while this idiocy that is the budget crisis has continued. The state representatives and senators continue to look for ways to continue their out of control spending on “social programs” and perks for themselves while attempting to find ways to force the state taxpayers to foot the bill through higher “fees” and outright taxation.

Vallejo is a study in failed Liberal policies. That city was dead as soon as the Navy was forced to shut down the Mare Island Naval Shipyard. There is no industry, businesses have fled, attempts at attracting new growth have failed due to the ridiculous restrictions placed on prospective businesses and developers. The biggest “employer” is a hamburger joint on Sonoma Avenue where the prostitutes congregate.

February 5th, 2009 at 7:55 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!