Bank Charge-off Rate Highest Since 1992 for Commercial Banks: Credit Cards, Revolving Debt, and the Contraction of Credit.

- 0 Comments

Charge-off rates are now at a 17 year high since commercial banks are writing off real estate loans, consumer loans, leases, agricultural loans, and other construction loans. The FDIC is going to be bombarded with hundreds of bank failures in the upcoming years simply because their balance sheet does not have the ability to support such a large banking system with assets that have fallen by tremendous amounts. The most recent data tells us that banks are charging off 1.46 percent of all loans. This may seem miniscule but keep in mind with a system leveraged in some cases 30 to 1, this is all it takes to sink a company into a low capital position.

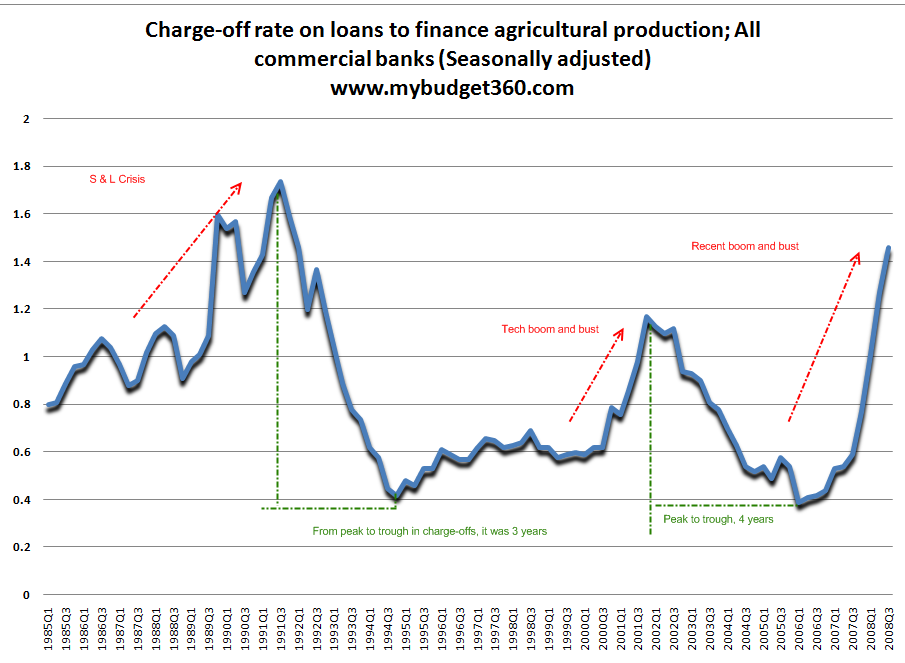

And the rates are misleading for this reason because someone may say that a 1 percent rate is tiny but when you are talking about trillions of dollars, this is a big deal. Let us first look at the rising charge off rate for all commercial bank loans:

It is rather clear to see 3 major episodes in the data provided. We can see the S & L Crisis, the technology bubble, and now our current credit bubble. Of course our current bubble is epic in size and dwarfs any of these and that is why the U.S. Treasury and Fed are trying to throw everything to stop this from getting worse. And by the way, the data above is only available for the third quarter of 2008 which doesn’t even have the fourth quarter which will surely put us near record territory.

Yet let us look at the peak for the S & L Crisis which hit in 1991. The bottom wasn’t hit until Q1 of 1994 nearly 3 years later. Now remember, this is a much deeper and profound credit crisis and our trajectory is still moving to an apex, so we haven’t even topped out. And as you can see from the S & L Crisis, there was a head fake in 1989 but then resumed upward again for 2 more years before hitting a peak. For the tech bust, it took 4 years to hit the bottom in charge-offs. We are spiking up at a near perpendicular angle and have yet to hit the peak. With $49 trillion in assorted debt out there, this number is going to be growing.

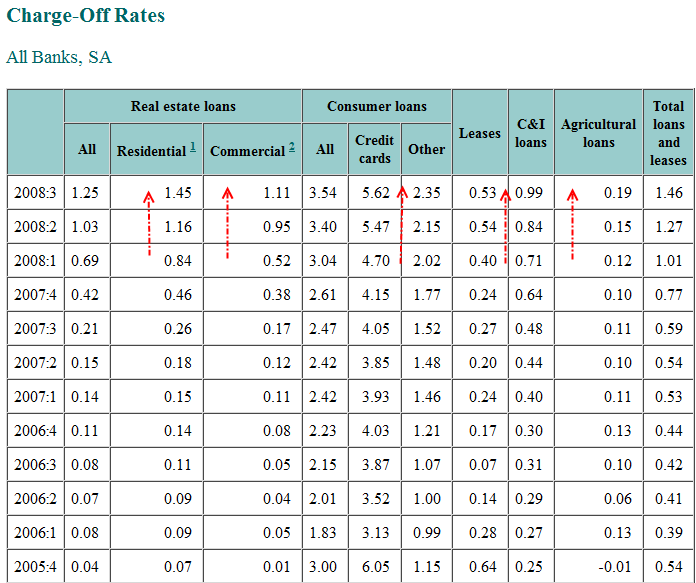

Let us now look at charge offs in different asset classes:

First let us take a few minutes to walk through these assets on the books of commercial banks. Clearly residential loan charge-offs have been spiking since Q3 of 2006 because of the epic housing bubble. Given that there is $10.5 trillion in home mortgages outstanding, you can understand why even a 1% spike is damaging. In terms of consumer credit, there is $2.6 trillion outstanding and credit card companies are now putting on the vice to consumers after a decade of zero down offers and teaser rates. Now, you’ll be lucky to even get a card with a decent rate with good credit.

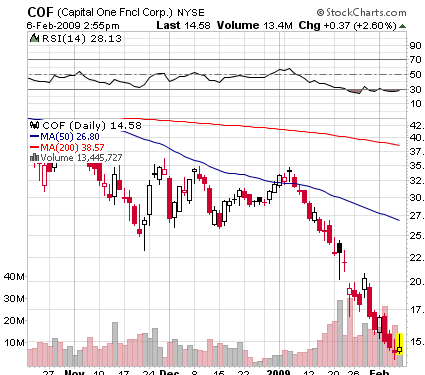

That is the true problem now that credit card companies were playing into the Ponzi scheme that had become our economy. The game was good since everything was going up in tandem in a bubble like symphony. Now that the bubble has burst these highly leverage institutions now have to be more cautious about their loans and their capital reserve ratios are getting hammered. Let us take a look at Capital One for Example:

Capital One has been punished during this credit contraction. And of course this is obvious because charge-offs are going sky high and also, consumers are actually pulling back on spending and trying to repair their balance sheet. This is one of the paradoxes of credit/deflation induced economies. First, during the good times easy money was everywhere yet the need for easy money wasn’t necessary per se. Now, with the unemployment rate spiking and now having our 3rd consecutive month of 500,000+ job losses, people are actually in need of credit yet at the same time, the easy access to credit is now gone. Talk about poor planning but that is the reason why states like California are facing $42 billion budget short-falls.

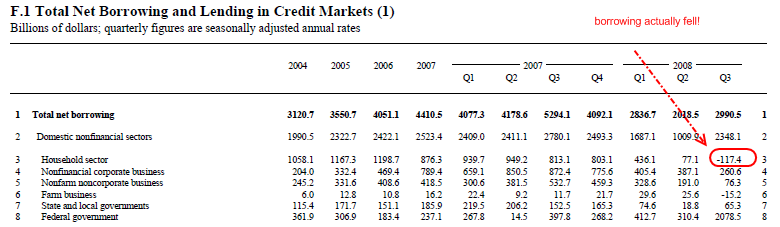

It is amazing that in the third quarter of 2008, the household sector actually borrowed $117 billion less than the previous quarter. This has not been seen for multiple decades:

This is a stunning given that the household sector in 2007 alone, was borrowing approximately $900 billion a quarter! That is the insanity that we were living through. So just imagine going from nearly $1 trillion in borrowing to negative in a few quarters. That is why this recession will be the worst since World War II and frankly, since the Great Depression. We have over built an economy to accommodate a bubble world were consumers were yanking out $900 billion in debt each quarter and now, that money has stopped. Sure, we’ll be kicking down additional funds through stimulus but let us have a few more quarter like Q3 of 2008 (which is assured) and you can see how much of what the government is doing is small relative to the destruction occurring in the markets. As I highlighted in detail before, since the crisis started $40 trillion in wealth has evaporated from only 3 areas.

The problem in solving something like current crisis is that we have to go through the pain since we lived for a decade in a debt induced bubble. Trying to return to those days is not an option. The belief system has been shattered and rightfully so. We tend to blame Bernard Madoff and Art Nadel as the financial minds that broke this system. Yes, they will be tried for what they did but the true crime is what is occurring through our Federal Reserve and U.S. Treasury. If they could destroy the U.S. dollar today they would do it. They want nothing more than high profits for the financial sector and could care very little about how average Americans are coping with this crisis. Have you seen any piece of the trillions in debt, capital injections, TARP, and other forms of programs put into the system? Of course not. You aren’t part of the inner circle and all these charge-offs are going to continue to happen because the money is simply going to a select few while nearly 600,000 are laid off in one month. That is a pace of approximately 20,000 job losses a day!

The fact that the market is rallying today is another sign that horrible markets show signs of massively volatility. In fact, this should tell you everything you need to know. The fact that we just saw 598,000 people get the axe and the market is soaring is indicative have Wall Street views the average American. The market is rallying on the prospect of a bad bank or some aggregator bank where banks can start trashing these charge-offs but push them on to the American taxpayer for a nice little rally like today. So what that we’ve lost 1.5+ million jobs in 3 months so long as we can kick down a few bucks to insolvent banks.

These charge-offs aren’t going away anytime. But remember, before you get to excited about this rally ask yourself how a market can rally on the announcement of 598,000 job losses? Sure, we know the warn out mantras of buy the rumor and sell on the news. Yet there is no rumor here and people are buying on the news of massive job cuts. This is how deeply flawed our system is. It is time we get serious about this before we wake up one day and the U.S. dollar isn’t worth the paper it is printed on. Those Federal Reserve Notes aren’t what they used to be.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!