Wealth Evaporation of $40 Trillion: 3 Areas: Global Stock Market Capitalization, U.S. Residential Real Estate, and Oil.

- 2 Comment

We have never seen so much global wealth destruction happen at once. Global equity markets are off in the 50 percent range and don’t seem to be letting up. We are seeing wealth destruction at an unprecedented rate. We can debate whether inflation will show up but until the U.S. Treasury bubble pops, we can expect to see deflation in our current forecast. I think it is hard for many to comprehend that $40 trillion has evaporated from a few niche markets.

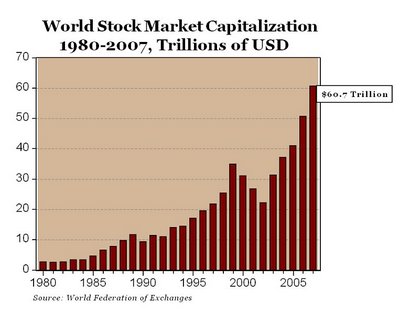

In this article I’m going to focus only on 3 areas and find $40 trillion of wealth that is now gone. Keep in mind that this figure is not all encompassing. Recent estimates put global wealth destruction upwards of $70 trillion. So where is this $40 trillion? Let us first look at global equity markets:

Global Stock Market Cap Value at Peak:Â Â Â Â Â Â Â $60.7 trillion

Current Global Stock Market Cap Value:Â Â Â Â Â Â $30 trillion (approximate)

At the peak the global stock market value in 2007 hit a peak of $60.7 trillion. Of course this was an epic bubble but the market was not reacting that way in 2007. The fact that most markets are off approximately 50 percent, would now put the global equity markets back to $30 trillion, a level unseen since 1999. The world it would seem has just witnessed a lost decade occur over one year.

Now keep in mind this varies. Here are a few baramoteres:

MSCI World Index:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -50.1% from high

MSCI Emerging Markets Index:Â Â Â Â Â Â -60.4% from high

S & P 500:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -47% from high

Hang Seng Index:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -58% from high

Russia Trading System Index:Â Â Â Â Â Â Â Â Â Â Â -67.4% from high

Dublin ISEQ Index:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -76.8% from high

Bombay Sensex Index:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â -54.9% from high

I think you get the picture. So right here alone, we have found our first $30.7 trillion in wealth destruction.

Running total:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $30.7 Trillion

That is merely looking at global stock markets. But what about global real estate? We all know that there were multiple housing bubbles going on at the same time globally as everyone believed in the housing mania that swept the globe. From Dublin, to Sydney, to London, to Madrid, to New York, to Los Angeles, every major city seemed to be engulfed in this same housing delusion.

*Source:Â The Economist

In fact, as it turns out the United States did not have the most outrageous housing prices which is really saying something considering the seed of our bubble was planted way back in the early 1980s.

Countries like Ireland and Britain are in worse shape when it comes to real estate values. But let us only look at U.S. residential real estate values. First, at the peak residential real estate values were estimated to be at $24 trillion. If we look at the Case-Shiller Index we are now off by 25% from the peak. So let us do that math now:

U.S. Residential Real Estate at Peak:Â Â Â Â Â Â Â Â Â Â Â Â $24 trillion

Current U.S. Residential Value:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $18 trillion

We’ve just found another $6 trillion gone but recent estimates are saying that American households have lost $7 trillion in real estate wealth. We’ll be generous and say $6 trillion. Keep in mind that we are only counting U.S. residential real estate. We didn’t even look at U.S. commercial real estate which is now imploding. In fact, I recently argued that the FDIC was ill equipped to handle the oncoming tsunami of horrible commercial real estate loans:

And guess what, just as we utter the above the FDIC is now running out of money:

“WASHINGTON (Reuters) – The Federal Deposit Insurance Corp is seeking to more than triple its credit line with the U.S. Treasury Department to $100 billion, a move to give it more financial power to handle U.S. bank failures, the agency said on Monday.

The FDIC and Congress are working to boost the agency’s current $30 billion borrowing power in legislation being crafted by U.S. Rep. Barney Frank, chairman of the House Financial Services Committee.”

What a shocker. I recommend you read the FDIC article I put together and you can understand why this was only bound to happen. The FDIC is going to be dealing with hundreds of bank problems in the upcoming years.

So back to our tally, we are only counting U.S. residential real estate and now we have found another $6 trillion in evaporated wealth.

Running Total:         $30.7 trillion + $6 trillion = $36.7 trillion

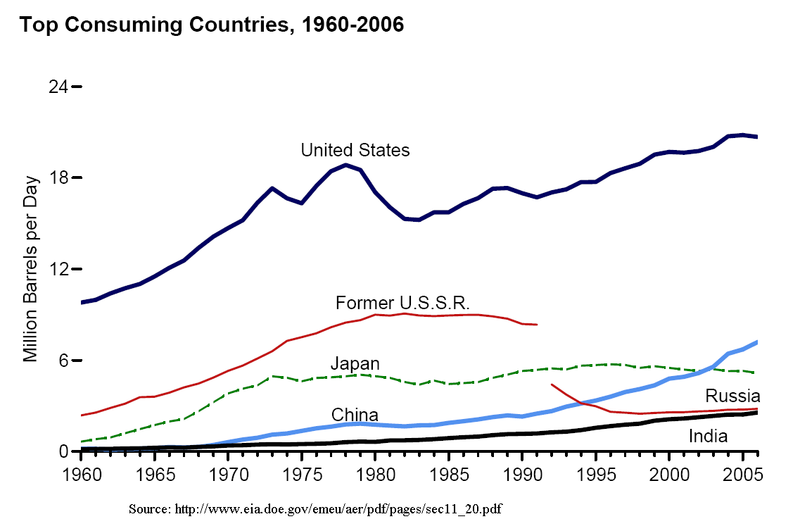

And finally we are going to look at the oil bubble which has now burst. Try if you can, to put yourself back to early 2008. Oil was hovering close to $100 a barrel before making a steady progress to $147 a barrel. At this level, globally we were spending $4.6 trillion annualized at market oil rates. That is simply astounding. Look at oil consumption around the globe:

But in a blink of an eye the oil bubble burst and brought down nations like Russia and Venezuela that were heavily dependent on oil revenues. This was a double hit for many of these countries. The one silver lining for a consumer nation like the U.S. is that the drop in oil prices was a stimulus. Can you imagine how our economy would be right now if oil were at $147? Hard to even imagine. Daily consumption is roughly 86 million barrels globally. Let us run the annual numbers:

$4,614,330,000,000 (annual consumption cost of oil at $147 per barrel)

$1,255,600,000,000 (annual consumption cost of oil at $40 per barrel)

That’s another $3.3 trillion we just saw evaporate mostly to oil exporting countries. Now let us run our grand total so far:

Running Total:         $30.7 trillion + $6 trillion + $3.3 trillion = $40 trillion

$40 trillion on the nose. Now keep in mind we did not look at residential real estate across the globe which is imploding. We did not look at commodities which have collapsed. It is easy to see how we can reach the $70 trillion now making the rounds. This is a stunning number given global annual GDP is approximately $54 trillion.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

margaretta swigert said:

Better to know the horrible truth than to speculate on an early recovery. Better to know we are not even half way through this mess. thanks for having the genius to understand the unfortunate truths

February 4th, 2009 at 3:43 pm -

Hillary said:

Federal Deposit Insurance Corp is seeking to more than triple its credit line with the U.S. Treasury Department. If only we were still ont he gold standard this wouldn’t have happened.

August 6th, 2012 at 8:01 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!