The Silent Majority, those Not in the Labor Force: 94,184,000 Adult Americans Not Participating in the Labor Force.

- 0 Comments

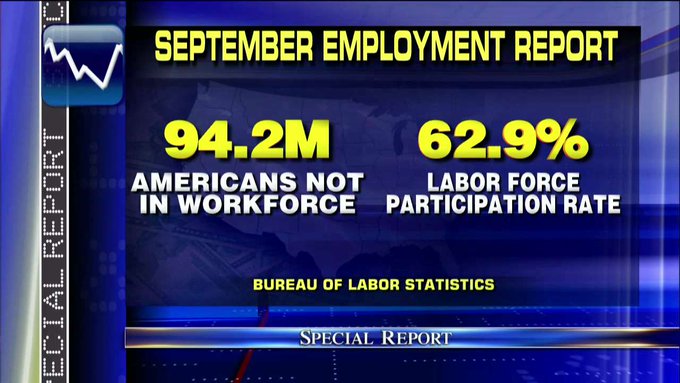

There are roughly 74.9 million baby boomers. Then you have approximately 75.4 million Millennials. Big groups that can sway the election. But how many people are not in the labor force? You have a whopping 94.2 million adult Americans that are not in the labor force. In other words the largest voting bloc of adults is going to be a group that isn’t employed. So think about what issues are going to matter to this group. It is a given that a large part of this cohort comes from older Americans. Those that are concerned with healthcare and Social Security. But you have many in this subsection of America that would like to work but simply cannot find work. We are talking about millions here. So it will be interesting to see how this group will vote one month from now.

The not in the labor force cohort

I still find it hard to believe that so many Americans just don’t know about this giant group of people in our population. It is a hidden majority. These numbers are not some sort of fabrication but come directly from the government’s own data.

Take a look here:

Source:Â BLS

You have a giant group that has largely gone under the radar in this election cycle. There are a couple of reasons for this:

-1. People that are not working are largely not going to announce it

-2. Most are older people and many are retired by choice or by force

-3. Advertisements do not market to this group in large numbers because they simply do not spend as much as younger people

So this group has become a giant silent majority. But all adults have the right to vote. It’ll be telling to see how they will vote in one month. This election cycle has exposed one glaring fact: large money controls our government. It also exposed the media for being sensationalist.

I’m not even sure if pollsters are looking at this group at all. It might be but more likely than not they are flying under the radar. This number is simply going to grow and many are going to be concerned with major deficit spending items like Medicare and Social Security. Both leading presidential candidates have left these items off of the agenda in essence kicking the can down the road.

It is a shame that we don’t have a true third party of independents. I recently saw a poll showing that for the first time ever most American identify as independent versus identifying as Republican or Democrat. That is an important tipping point. However it will be a long-time before we have any viable third party option. Why? There is a machine of money behind both parties. You have to pay to play in this system. In the end middle class Americans get slammed out of the system. It’ll be interesting to see how this silent majority will vote come November.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â