The New Economic Misery Index: Five Sectors that Show Financial Pain for Americans. Food Stamps, Bankruptcy, Credit Access, Employment, and Housing.

- 1 Comment

Talking with a few colleagues I was reminded about a misery index used in the 1970s to measure the real feel of the stagflation hitting the country. Today, we have a more insidious version of economic crisis because what is good for Wall Street is counter to what is good for the average American. There seemed to be some cheer regarding the latest employment report that unemployment dropped to 10 percent yet overall 11,000 people still lost their jobs. We still have 27,000,000 unemployed and underemployed Americans. At closer examination, it looks like last month’s data is more of a statistical aberration instead of a new trend. Today we are going to look at a few indicators of the new misery index.

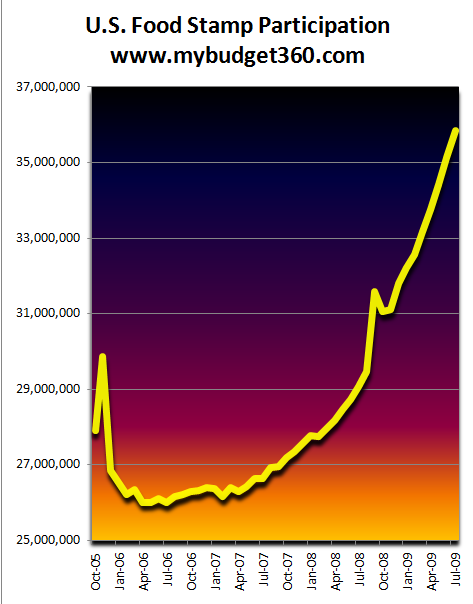

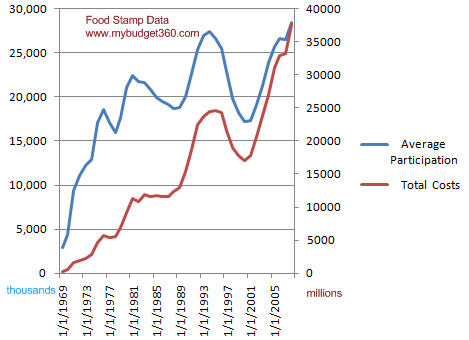

Food Stamps

Nearly 37 million Americans are on some form of food assistance, the largest percentage on record. It is hard to argue with food stamp data since these are usually allocated to Americans who can least afford any bumps in their income. They are simply trying to meet the basic necessities of daily life. That is why we have heard multiple stories of people waiting until the clock strikes midnight so they can begin shopping at Wal-Mart for food. It is also the case that those at the bottom of our economic ladder are usually the first to be let go when recessions hits. The unemployment rate for those with a college degree is 5 percent while those with no college education have a rate of 15 percent. If we dig deeper, only 1 out 4 Americans have a bachelor’s degree so the average American has none to little college education and thus makes it harder to compete in the current troubled workforce.

I’ve seen many reports were schools, companies, and even households have cut back on manual labor positions which are usually very low paying. This is one of the primary reasons why those at the bottom are seeing such crushing blows in this recession. The above data tells us a very different story from what is happening on Wall Street.

There is also a financial cost to this:

Last year $37 billion was spent on food stamps. This year we are going to be solidly over $40 billion (possibly $45 billion).

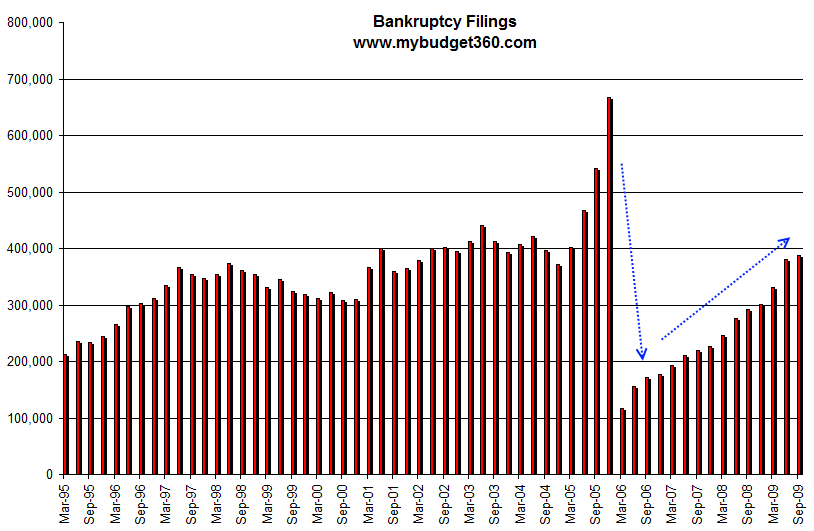

Bankruptcy

There are few things more painful than bankruptcy. Bankruptcy is largely a disappearing middle class phenomenon. Whereas with food stamps, you have to have virtually zero in assets with bankruptcy it is expected that you have something that you are filing bankruptcy against. In many cases this is crushing debt from credit cards and other consumer loans but now, a large number of bankruptcy is now caused by the popping housing bubble. Bankruptcy filings are typically the end of the line for many Americans. They no longer can sustain their payments and have to file. In 85 percent of the cases there is “no-asset” for creditors to go after. This number is very high contrary to what is happening on Wall Street.

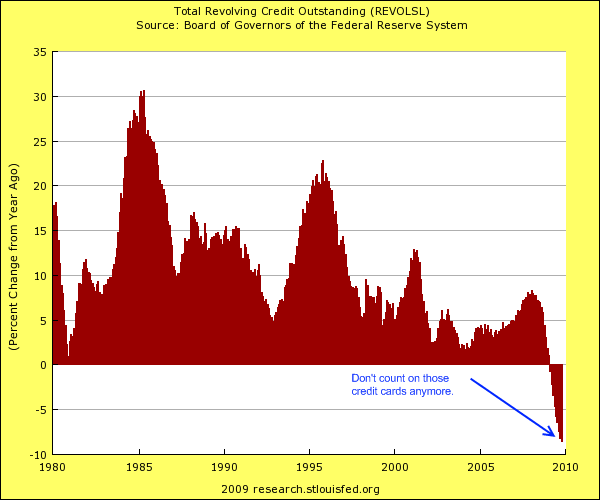

Credit Access

Americans have come to rely on their credit cards as if they were part of their monthly budget. No longer just a convenience product it has become the payment option of choice. It also made it easier for people to spend beyond their means because credit card companies understand human nature. Well that is now coming back to hit many people including credit card companies. But unlike the credit card companies, the average American doesn’t have access to unlimited funds from the U.S. Treasury and Federal Reserve.

During the peak, Americans came close to touching $1 trillion in credit card debt. That number has now fallen to approximately $890 billion due to defaults and credit card companies simply removing access to credit in the marketplace. Yet this pinch is hurting Americans in the short run. Many of us will agree that many spent beyond their means. Yet the hypocrisy that we are seeing is that banks are not needing to cut back because of their taxpayer bailout while they expect customers to tighten their belts. It is the ultimate double standard but it shows who is running the show in D.C.

The fact that credit card companies are now adding onerous terms and traps for good paying customers shows how desperate they are to milk every last penny from the average American.

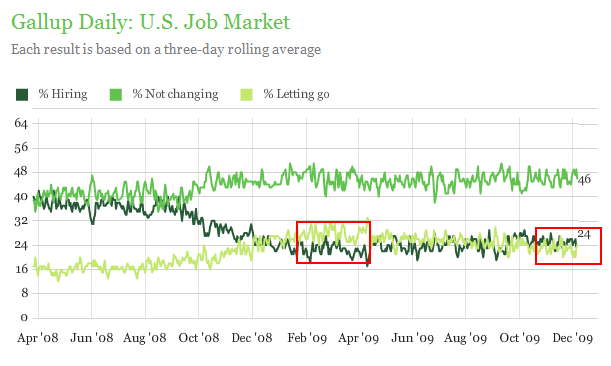

Unemployment and Hiring

If you look at the latest data from Gallup, employers are hiring and firing at the same rate as in March of this year when it seemed the entire world was flying off a cliff. Yet today, we are still seeing the exact same numbers. The fact that there are 6 Americans for every 1 job opening shows that the employment situation is still deep in the hole. Without hiring or job growth, how are we to expect and sustainable recovery. Things have gotten so bad that people cheer simply because the unemployment rate didn’t go up. Too bad they ignore discouraged workers or part-time workers but that is of no consequence to the Wall Street crowd.

Until hiring picks up, the employment situation is still going to feel miserable.

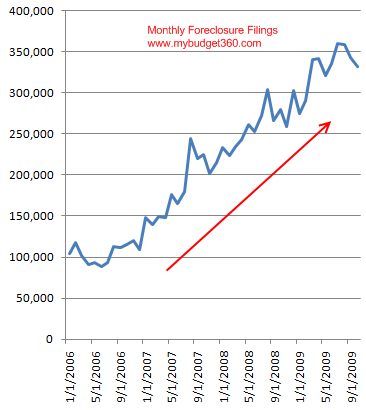

Housing

And finally, the last piece we will look at in our misery index is monthly foreclosure filings. Even with every kind of bailout and government assistance, monthly foreclosure filings are still near their peak. It is hard to make any housing payment without a job, moratorium or no moratorium. And that is largely a problem of how we attacked this problem. It was assumed that if you fixed the banks and housing, all else would be fine. But the banks only wanted to fix housing because that is where their money and leverage was. They didn’t care about job growth. In fact, if employment was solid and wages hadn’t been stagnant for a decade then higher home prices would have made sense. Yet higher home prices merely because of higher bank leverage was the ultimate recipe for disaster. The average American is now paying this bill by losing their home and bailing out Wall Street. A two hit combo.

Until overall foreclosures begin decreasing, many are still going to deal with the burden of too much debt on homes that are worth less than they once were.

When we look at these five sectors most directly linked to Americans, you can see why there is very little to any recovery. Unless you only care about the stock markets we have much to fix before we can issue a recovery statement. The facts are very different from what is coming from Wall Street and D.C.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

JP Merzetti said:

I suspect that a lot of credit card debt comes from making up the monthly deficit: if the replacement job pays less than the old lost one did (another definition of “underemployment”) perhaps that missing 400 or 500 a month is being covered using credit. That adds up to the 5 or 6 thousand annual racked up on a card that’s been babysat with minimum payments.

Quick to judge………too often those aren’t impulsive spending sprees the card is used for – more like covering basic cost of living.

There is only so much a family can cut back on.

Six workers chasing one job…

I don’t know what else has to happen to convince people that there isn’t enough to go around. It’s turned into a shell game.Add to all of this perfect storm the continuing housing meltdown, and I’d say the misery index has yet to be adequately measured – either because it’s too damned depressing, or we have yet to add up all the contributors in their full magnitude.

March 18th, 2010 at 5:17 pm