US households are tapped out on debt: While US households are forced to eat austerity measures financial institutions load up on debt and purchase assets at rock bottom prices.

- 1 Comment

US households are tapped out with debt. Debt matters. Contrary to what is being spouted out over the airwaves having too much debt does cause problems. American households tipped over this point when total household debt reached annual GDP. This is a critical juncture and results in massive deleveraging. There doesn’t seem to be answer or really a major priority in trying to figure out ways of maintaining a strong middle class in the US. It is almost assumed that this is now a lost cause. Fewer in the middle and more in the low wage system that is being developed. Half of Americans are living paycheck to paycheck with 1 out of 3 having no savings at all. Another 47 million Americans are struggling on food stamps. Yet we are supposed to believe that this is a recovery. We recently found out that a large jump in the economy has come from housing. Yet curiously, the large purchasing power has come from financial institutions crowding out regular Americans. There is such a thing as too much debt. US households have reached that point.

Reaching peak debt

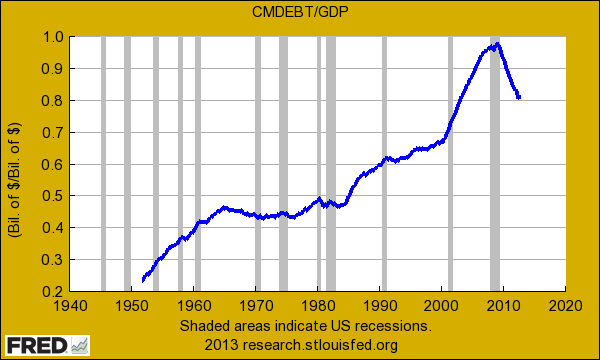

It is clear that US households hit a tipping point in total debt accumulated:

No one has a hard and fast rule on what constitutes too much debt but obviously in the US, that was the point at which total household debt reached annual GDP.  The financial crisis took off after this point. The major reason the figure above has retraced is because of foreclosures. The biggest item of debt for Americans is with mortgage debt so having that taken off via foreclosure is an easy way to get rid of this line item. Over 5 million homes have been lost through foreclosure and countless bankruptcies have occurred as well. Yet other areas of debt like student loan debt are moving up in their unrelenting progression upwards.

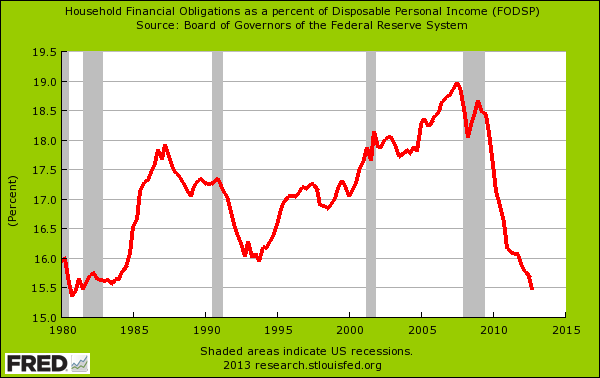

Part of the painful austerity has brought household debt back into more historical standards:

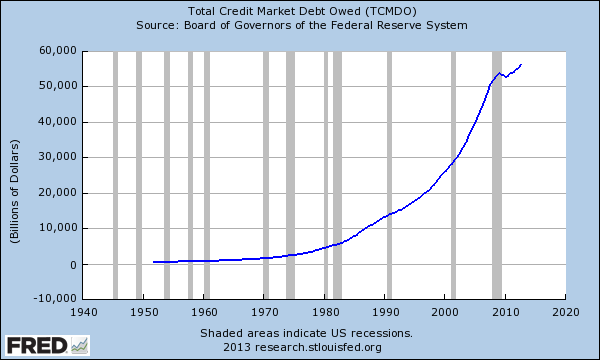

While households are dealing with this challenging landscape, they are now having to compete with financial institutions that are heavily connected and are leveraging the low interest rates provided by the Federal Reserve. While households are more cautious with debt either because they are limited to what they can borrow or are pulling back forced by stagnant income, the overall market in debt is moving in one clear and unmistakable path:

This easy money environment has allowed banks to essentially become the housing market on both fronts. First, the Fed is the only big player buying up mortgage backed securities. Who else in the open market will buy a 30 year mortgage at 3 percent? No one outside of the Fed. Of course, banks lend out this money creating it out of thin air. Larger banks borrow this money and use maximum leverage to now crowd out regular home buyers. This is where we have big hedge funds buying up foreclosures and turning them into rentals and hiking up prices. Given that household incomes are now back to levels last seen in 1995 adjusting for inflation, any little rise in prices is going to hurt.

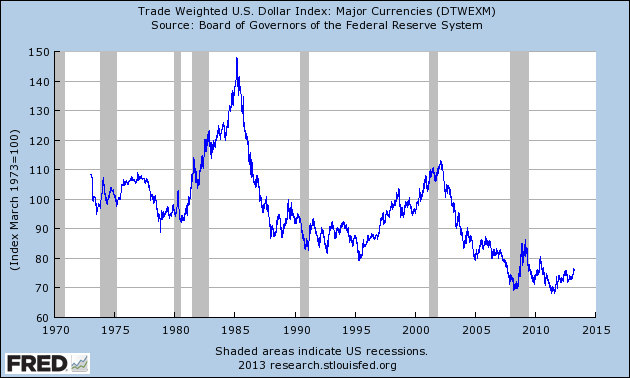

All of these actions have taken their toll on the US dollar over time:

While there is this race to the low wage bottom, there is an issue when certain debt privileges are extended to large financial institutions and regular Americans are locked out. The Fed balance sheet is now at $3.3 trillion and they continue leverage up while US households pull back. Who are we really bailing out here?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Terrance said:

The decrease in energy prices ithe USA may but not assuredly result in increased mnufacturing jobs in the here. China is getting tapped out it will now be on to India as corporates seek low labor costs. After that there is Africa. Mars an Neptune likely would be high labor cost areas, but think of all of the cheap gas at Jupiter. Corporations have been in search of institutional survival and expansion on the back of cheap labor. Henry Ford realized that if his workers could not afford the product there would be no need for the product.

We are the world’s largest consumer culture at this juncture, but that culture is changing as we get poorer.

April 20th, 2013 at 4:34 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!