FDIC Insures $4.7 Trillion in Deposits with a $13.6 Billion Deposit Insurance Fund. This is Like Going into a Hurricane with a 99 Cent Store Umbrella.

- 12 Comment

On Friday, three banks failed and the FDIC took them over. Now this isn’t the big news necessarily. What it significant is that one of the banks taken over was Silverton Bank of Atlanta, Georgia. Silverton bank has $4.1 billion in assets and will cost the FDIC $1.3 billion from their dwindling insurance fund. This will be the costliest bank takeover since U.S. Bank took over Downey Savings and Loan in November of 2008 for a cost of $1.4 billion to the FDIC Insurance Fund. So how much is left in the fund? Not much. In fact, if we throw in Citigroup and Bank of America, two banks that have failed without government support and massive intervention, the fund would be broke. But let us set those two banks aside and start running the numbers.

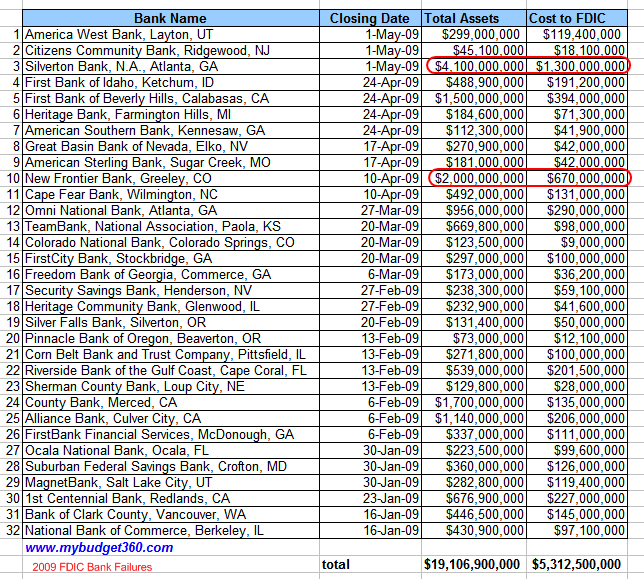

As of December 31, 2008 the FDIC fund had $18.9 billion in it. Already in 2009 we have seen 32 bank failures, above the 25 bank failures for all of 2008. And with commercial real estate and residential real estate still facing record foreclosures, we can expect that more money will be drained from the fund. Now most of the times, you will get bank failures that cost a few million but every once in awhile you’ll get a moderate sized bank like Silverton that will cost the fund $1.3 billion. Let us first take a tally of the 2009 bank failures:

Looking at the list above, you can see that only 2 of 32 bank failures of 2009 actually cost the fund more than $500 million. Silverton by itself took out the same amount from the FDIC fund as the first 11 bank failures of 2009. In the age of mega banks, we are no longer in a depression era local banking system where bank failures impacted the immediate community. Our banking system is now interconnected that a bank failure in Georgia with Silverton 1,400 client banks in 44 states and has six regional offices impacts a larger geographic area. Many people never heard anything about Silverton until this Friday.

Let us refer to the 32 bank failure list I put together from the FDIC again. So far in 2009, the total estimated cost to the FDIC’s fund is going to be $5.3 billion:

$18.9 billion in fund as of (Dec, 31) – $5.3 billion in 2009 bank failures = $13.6 billion left

And many of you may remember the failure of IndyMac bank back in July of 2008. When IndyMac was taken over by the FDIC it had $32 billion in total assets being managed. Initially the FDIC had an estimate that the cost to the fund would be anywhere from $4 to $8 billion. A sizeable number. Well after many months, this information was released on March 19, 2009:

“IndyMac Federal sustained losses of $2.6 billion in the fourth quarter 2008 due to deterioration in the real estate market. The total estimated loss to the Deposit Insurance Fund is $10.7 billion. No further payments on receivership claims for uninsured funds from former IndyMac Bank, F.S.B. will be distributed as a result of this transaction.”

Talk about missing on your estimate. It went from a lower end estimate of $4 billion to a finalized cost to the fund of $10.7 billion. Of course IndyMac was heavily reliant on one of the largest real estate bubble economies here in California. But with only $13.6 billion (estimate, could be lower) the fund would be virtually exhausted with one more IndyMac size failure. The FDIC already has its hands full trying to deal with the public-private investment program that will put them in the business of putting out non-recourse loans for the U.S. Treasury’s toxic asset program. The fund initially will have $500 billion in loans to make available. Of course, this program is still in the works and is a major rip off to taxpayers.  If the majority of the public understood the details of the program, they would be out in the streets protesting right now.

With approximately $13.6 billion left in the Deposit Insurance Fund (DIF), the FDIC realizes that it will be emptied out in 2009.  That is why they have been lobbying for more money to be allocated to the actual fund. They’ve won concessions such as raising the deposit limit to $250,000 per individual account. Much of this was probably spurred by the failure of IndyMac where many clients had over $100,000 in accounts. The government didn’t want anymore photo ops of people standing in lines outside of banks ala the Great Depression in 2008.

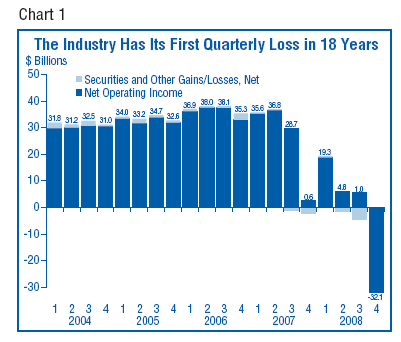

The FDIC with their 4th quarter report of 2008, stated that FDIC-insured institutions reported a net loss of $32.1 billion which was the first quarterly loss since 1990.

Even though we all know that most of the nation’s banking is in a monopoly with the 19 large banks, there is still trillions not owned by these big banks. Â Here is the data:

-The FDIC insures more than $4.7 trillion in deposits

-8,300 U.S. Banks and thrifts

-In 75-year history, not one penny in insured deposits has been lost

-4,900 person staff (and growing)

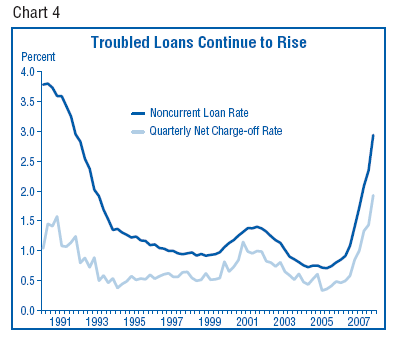

Now of course, the operative word is with insured deposits. So if you put your money in a mutual fund with Bank of America, that money isn’t protected from the shellacking the market took in the last year so make sure you know what is covered and what isn’t. There is all the reason to believe that the 8,300 banks and thrifts are going to see continued pain in 2009. In fact, troubled loans keep on increasing:

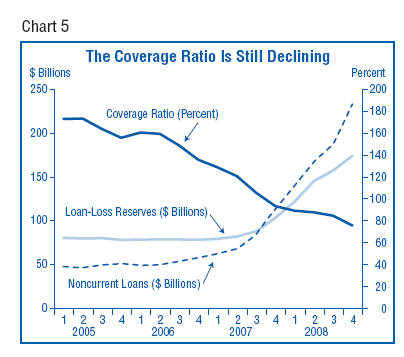

And of course, the DIF is facing a declining amount which is putting pressure on the coverage ratio:

The bottom line with the FDIC is that the Deposit Insurance Fund will be exhausted in 2009. The fact that the FDIC will be intimately involved in making non-recourse loans with the public-private investment program tells us this agency is where much of the money is going to be floating through. It is time for the FDIC to gear up and make sure that one government agency does their due diligence and protects taxpayer’s money. It is our last line of financial defense at this point.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!12 Comments on this post

Trackbacks

-

Erik Johnson said:

I have no money. Why would I worry?

May 2nd, 2009 at 11:44 am -

Troxel said:

Banks are not lending because they want the economy to collapse, they then can use the money lent to them by the Fed to buy up businesses on the cheap. It is the classic boom & bust banker take-over. History is repeating itself because our Federal congress has removed the last depression era banker safe guard, namely (Glass-Steagall) Banking Act of 1933. This legislation forbids banks from creating and trading in securities. How was this safe guard removed? It was removed in the “Gramm-Leach-Bliley†Act of 1999. Many of the congressmen who voted this bill into law are still in our government. This bill was the chief device that destroyed the world economy. I encourage you to visit govtrack.com and find out if your representative was part of this bill.

May 2nd, 2009 at 12:48 pm -

Peter said:

Yeah, this really sucks.

What makes it worse, is everything is going up in price, so we have to spend way more on everything, leaving little to cover bills and committed expenses. We can’t go without eating!

May 3rd, 2009 at 3:55 am -

Bob Hager said:

“No further payments on receivership claims for uninsured funds from former IndyMac Bank, F.S.B. will be distributed as a result of this transaction.â€

Does the above mean that all of the assets of Indy Mac have been sold off and that there is no money left to reimburse those having uninsured deposits? Or does the statement only refer to the transaction and not any residual assets that might be left after the transaction. Hopefully it is the latter.

Well here’s to Schumer the chump..

May 3rd, 2009 at 7:47 am -

DAN HOLLAND said:

SO WHY IS SHEILA BAIR STILL IN CHARGE OF THE FDIC? AS YOU MAY HAVE NOTICED, SHE NEVER SMILES WHEN APPEARING IN PUBLIC. SHE KNOWS THE FATE OF THE BANKS AND HER AGENCY.

I USUALLY LOOK AT BANK NPAs BEING REPORTED AND DISCOUNT THAT FIGURE BY 20%. THEN I DEDUCT THAT FIGURE FROM LOANS AND LOAN LOSS RESERVES. THE RESULTING FIGURE TELLS THE TALE AS TO WHETHER BANKS ARE UNDER OR OVER RESERVED.

IN THE NORTHWEST THE PICTURE LOOKS GRIM, PARTICULARLY IF THE MORTGAGE/CREDIT DECLINE CONTINUES INTO 2010.May 3rd, 2009 at 12:15 pm -

adrift said:

I agree that the banks are deliberately steering the economy into a full fledged depression so that they can be the only ones left holding all the chips. My question is however, why isn’t anyone doing anything about it? It’s clear at this juncture that our representatives don’t care one bit about actually ‘representing’ us.

Congress should be downsized to a skeleton crew to recoup the wasteful spending they’re complaining about. They should give up their limousines, big houses, fat expense accounts and free medical coverage until such time that ‘the people’ are given decent jobs that pay enough money to fulfill our ‘inalienable’ right to life, liberty and the pursuit of happiness. These continual recessions are in violation of the constitution and give the people a valid complaint to sue both the gov’t and corporations in a national class action suit.May 4th, 2009 at 5:30 am -

mikem488 said:

The article should state how many branch banks have closed. Just stating 32 banks does not take in the full disclosure.

If one bank and one branch close what affect. But if IndyMac close with a bunch of branches their is more problem for neighborhood lending.

Plus we could compare it to the 30s. I would guess that most banks that closed were banks with no branches.

May 4th, 2009 at 9:46 am -

Rom said:

also don’t forget to tie in that bankruptcy that was passed two or three years ago, that effectively put another ace in the banksters hand of cards…….isn’t it ironic that all of the law enforcement agencies fed/state/county levels are looking the other way. They sure went after the mafioso’s families with such zest and zeal in the past using the RICO ACT, effectively freezing the assets of the criminals and all of their relatives. With this current derivative fiasco, or should I say Ponzi Scheme, where are all of the phoney law enforcement agencies at??? Are they there solely as the elitist’s thugs and enforcers??? What about that phoney line handed to the Muslims after 911….Why don’t all the moderate law enforcement agencies stand up to the Radical, fundalmentalist agencies???? I’m not going to hold my breath….and please excuse my lack of respect, but an oath is an oath….just quit and let someone else clean up the mess, or do you think your doing right by the law too??? better shine up that Tin Badge Boy!!!!!!

May 5th, 2009 at 1:14 am -

Frankie said:

Your getting your gander up over something that will not happen. FDIC can go to Treasury and get more money if they need it. Considering all the $ handouts that have been given do you for one second think they won’t give her what she needs? I remember reading an article earlier this year where she sort of greased the skid to get another $500B if she needs it. She has been hailed as a queen through all this, they will keep feeding her what she needs to take care of all the other problems- — but don’t dare touch the top 19 too big to fail babies. We got special $ for them!

May 5th, 2009 at 12:35 pm -

SM said:

Adrift,

I understand your anger, but the government shouldn’t “give” everyone a job. The government’s attempts at centrally planning an economy are what have gotten us here. It is time for the government to shrink back to within its constitutionally authorized limits and let the chips fall where they may. It will be painful, but there is no way to avoid the pain now. You should have a right to life, liberty, the pursuit of happiness, and private property. You should be given nothing from government. It can only give what it takes from another. Hopefully you do not wish to deprive someone else of their property otherwise you are just like the bankers and congressman you abhor.

May 11th, 2009 at 12:32 am -

ad man smyth said:

Bank United, Florida, opens, merged, cost FDIC $4 billion,

May 21 , 09May 25th, 2009 at 1:48 pm -

tim said:

And so it goes on:

1. 8th May: Westsound Bank, Washington: the FDIC estimates the cost to its Deposit Insurance Fund will be $108 million

2. 21st May: Bank United Florida: The FDIC estimates that the cost to its Deposit Insurance Fund will be $4.9 billion

3. 22nd May: Strategic Capital Bank, Illinois: The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $173 million

4. 22nd May: Citizens National Bank, Illinois: The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $106 million.

TOTAL in May = $5.29 billion has doubled what the FDIC had covered up to 1st May; and must leave them about $8.3 billion. Maybe that will last into July?June 1st, 2009 at 11:09 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!