The Red, White, and Blue Queen’s Race: The Economy Reverts to Historical Inflation Patterns: Stock Market and Real Estate Fall back in Line with Inflation. Working Harder Just to Stay in the Same Spot.

- 0 Comments

The Red Queen’s race is a situation that appears in Lewis Carroll’s Through the Looking-Glass where one has to run faster and faster just to remain in the same spot. Imagine a treadmill that increases in speed every 10 minutes yet you don’t burn calories at the higher rate. Many Americans are feeling as if they are stuck in the Red Queen’s race when it comes to the economy. The challenge many are facing is that with an ever stagnant or shrinking paycheck keeping up with the cost of living is simply getting harder and harder as the weeks go passing by. Much of this has to do with the way our Federal Reserve and U.S. Treasury are managing our currency.

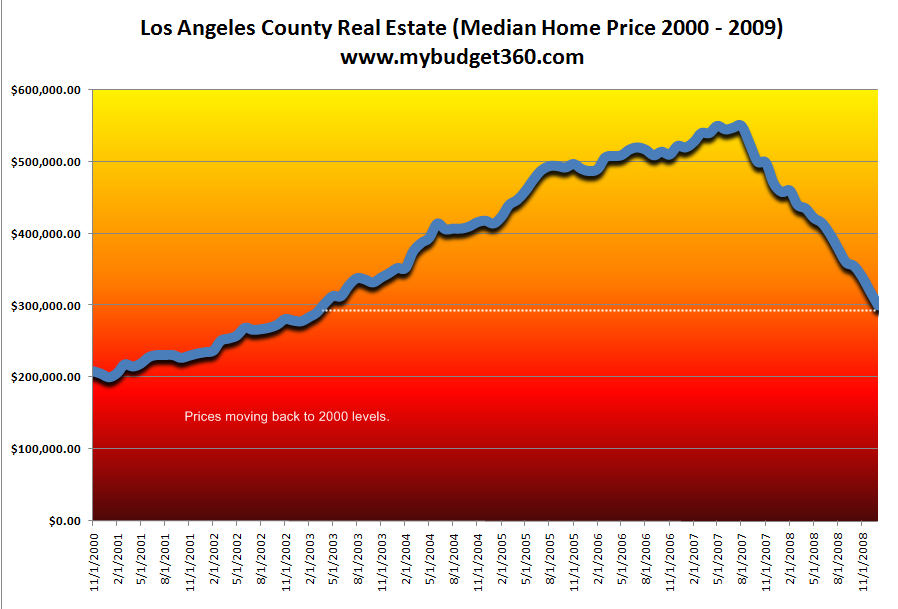

The irony of what is going on is that many items are now reverting back to the inflation adjusted mean now that credit is being sectioned off from the current economy. What this also implicitly tells us is much of the rise in the price of homes, cars, and other debt items was largely inflated by the access to credit. Let us for example look at the price of a Los Angeles home over the past decade:

What this chart shows us is that the median home price in Los Angeles is now back to 2003 price levels and the trend is still moving lower. It is highly likely that once we reach bottom, we will be back to 2000 price levels. This has much to do with the intricacies of the California housing situation but also the fact that over time many systems including those economic, revert back to the historical mean.

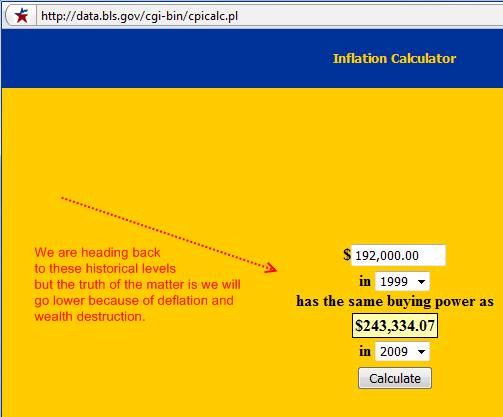

In December of 1999, the median home price in Los Angeles was $192,000. It reached a peak of $550,000 in August of 2007. Currently, the median price is $300,000. Just for the sake of reference, I went to the BLS inflation calculator and put in $192,000 in 1999 and wanted to see what it would by 10 years later:

It is interesting to note that simply by using the data from the BLS, we already see that Los Angeles home prices for example are quickly reverting to the mean. In fact, all this would mean is a further reduction of 19% or allowing inflation to erode the price further. My guess is we will have a combination of both. Currently we are facing massive debt destruction so we are dealing with prices actually decreasing as the money supply contracts. In an economy where debt equals money, debt being destroyed through writedowns or defaults is the actual destruction of money.

I have discussed this in the menace of deflation since the supply of money is currently being destroyed at a quicker pace than all the debt we are creating. How can this be? Well look at the U.S. equity markets. $11 trillion has evaporated since the crisis started and we have used up $2.1 trillion in multiple bailout programs (although we have allocated nearly $9 trillion). Globally, $50 trillion has been wiped off. So more money (debt) is being destroyed than is being created.

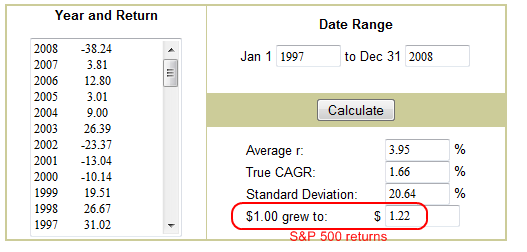

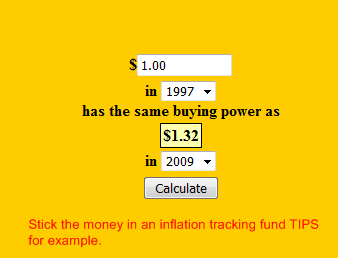

The prospect of what is happening is somewhat stunning and shocking to many. In fact, if we look at the S&P 500 over the past 12 years, you would might want to consider stuffing money into your mattress!

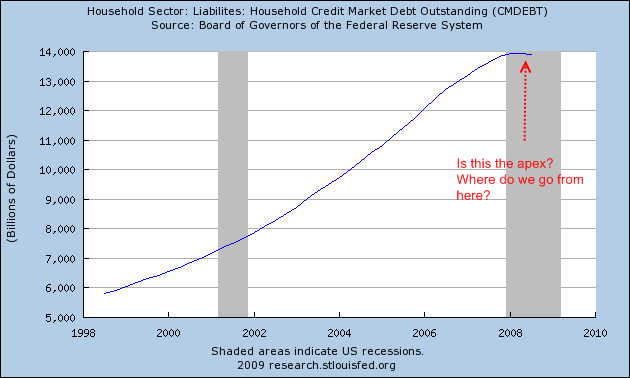

You would have done better by simply sticking your money into an inflation adjusted account like savings bonds or a CD. This is how bad the stock market is performing. But yet again, we see things reverting back to the mean. And the mean we are reverting to is a mean that focuses on stable amounts of debt. Let us take a look at how much debt is floating in the system:

As you can see from the above chart, household debt has topped off. We can expect this to continue to decline especially with all the foreclosures coming online and also, all the revolving debt that is unable to be paid because of the unemployment situation.

So what is happening is more and more Americans are working harder and harder just to stay in the same spot. A story hit the wires about a janitor position in Ohio with 700 applicants. This tells you a lot more of the story than the headline 8% unemployment rate. Many are coming to the realization that the stock market was really a big gamble even though countless advisors kept stating that it was the only game in town.

Just imagine if you had all your money in the S&P 500. Even if you dollar cost average on your way up to 2007, the market has tanked by 57% from that point. So let us assume you had approximately $500,000 at the peak in 2007. You are now looking at sub-$250,000. This on top of your home price falling. That is why many are feeling they are running in the same spot and going nowhere fast. You need to be prepared and ready for tough times. There is no reason to believe the economy will rebound in 2009. Earnings are still pointing lower and until job losses abate, there is very little reason to think that we have hit bottom. The Red Queen knows that the faster you run, the more you will remain in the same place.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!