The sordid details of the employment market – Before recession hit 5,000,000 job openings were available while today there are 3,000,000. 1,000,000 Americans have completely quit looking for work and average duration of unemployment is 40 weeks, twice the amount of the 1980s recession.

- 0 Comments

There is a growing disconnect in America as the middle class is hollowed out. Many Americans hear talks of a recovery that is now going on three years but look at their tight monthly budgets and wonder what recovery is being discussed. The median household income is roughly $50,000 and with rising food, healthcare, energy, and college costs many are left with little each month once the basics are paid for. And that is the core of the issue. The typical American family is seeing their paycheck devoured by items that are used on a daily basis. The employment situation is tenuous at best. We still have a peak in discouraged workers. Roughly 1,000,000 Americans have simply stopped looking for work since the recession hit. These are people willing and able to work but have given up in the current economy. We are adding jobs and many are in the lower paying service sectors. What is meant by a recovery?

The one million discouraged workers

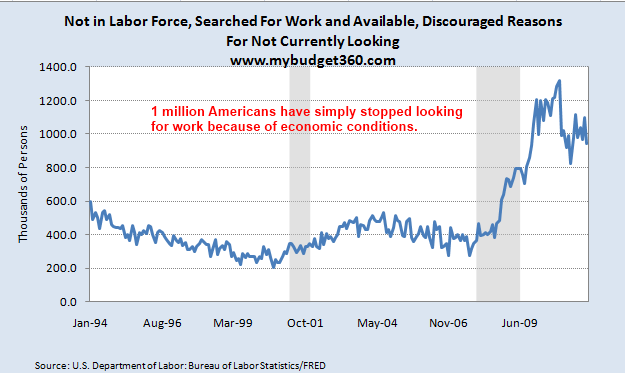

Simply looking at the headline unemployment rate does very little in highlighting the plight of the current economy. Take a look at a chart of discouraged workers:

Almost one million Americans have stopped looking for work because of the weak prospects of finding a job. Keep in mind the economy needs to add roughly 150,000 to 200,000 jobs just to keep pace with demographic changes. Examine the chart above and you realize what we are facing is a structural change to our economy. Many Americans are simply checking out of the workforce. This is why this recovery has added 14,000,000 more Americans to the food assistance programs.

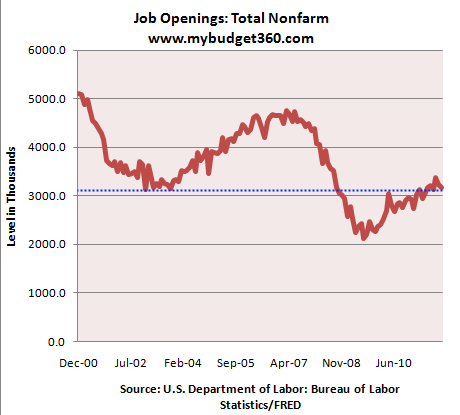

Part of this discouragement comes from current job openings:

Before the recession hit there were roughly 5,000,000 job openings. Today you have approximately 3,000,000 job openings but with a much larger number of unemployed Americans. A very small percentage of Americans derive their income from stock market wealth and this is really where the true recovery has occurred. The stock market has rallied 100 percent from the March 2009 lows. Most Americans feel a recovery via their housing and paycheck. Both of these are still in the doldrums of the recession. Just look at the chart above. We are missing some 2,000,000 job openings and more Americans are looking for work. The result is a painful combination.

The time of unemployment extends

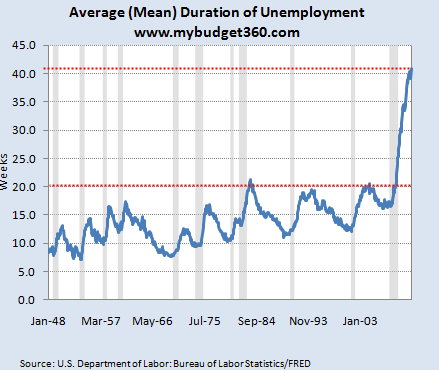

To further highlight the long-term nature of this recession and structural changes simply look at the average duration of unemployment:

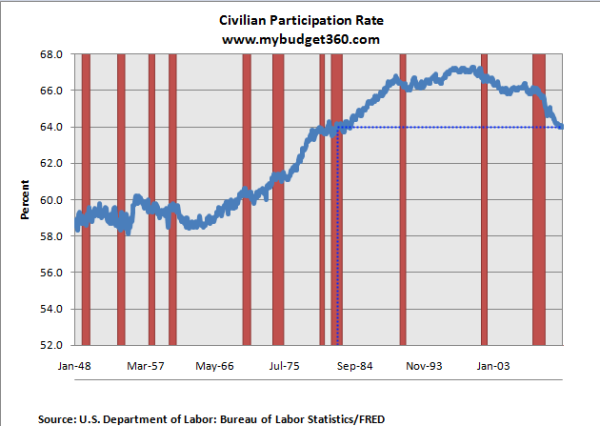

Even in the troubling recession of the early 1980s the average duration of unemployment was 20 weeks. We have doubled that taking it to over 40 weeks. What you are facing is a large group of Americans that simply cannot find work in the current economy and this is with a per capita average wage of $25,000 per worker. For this reason and shifts in our population we still have a near record low participating in the workforce:

This is near the level of what we had in the early 1980s. Keep in mind you also have a massive part-time workforce that is working at places like Wal-Mart for 10 hours a week yet are somehow counted as employed. It is useful to understand what is going on and what we are seeing is an emergence of low wage capitalism and social welfare for the financial industry in this country. What we have is a recovery for the few at the expense of the many. No wonder why Americans are fed up with both political parties and the investment banks on Wall Street. Small protections for working families are largely being stripped away like healthcare or even pensions. For example, in the early 1980s some 60 percent of workers had some sort of pension. Today it is down to 20 percent. While we hear the media railing about this there is little anger toward golden parachutes for financial executives that costs thousands of times more than any pension a worker would receive. And this is given to the same crew that created this financial mess in the first place. If this is a recovery, many Americans are wondering what a contraction would look like.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!